The following article was written by Jeff Broth, a business writer and personal finance advisor. Consulting for SMB owners and entrepreneurs for more than 7 years.

2018 is the year of big banks in the United States. Truth be told, this reality has been a long time coming. The Federal Reserve Bank officially reversed course in December 2015 when it started raising the federal funds rate (FFR) from historic lows. At that point, banks were gearing up for bigger profits owing to higher interest rates on borrowed money. For several banks, profitability has been slow in coming. However, a multitude of factors is now in play to ensure that banks will be profitable in 2018.

For example, the Trump administration has been working feverishly to deregulate the financial sector. Trump campaigned on a promise of making it easier for businesses to operate in the United States. To date, he has fulfilled that obligation and his mandate to voters. According to White House reports, Trump has removed 22 rules and regulations for every new rule created. This is an extraordinary achievement in Washington DC which is burdened with bureaucratic gobbledygook.

How Does Deregulation Assist Banks?

Without understanding the mechanics of regulatory constraints, it is safe to say that regulation adds additional layers of compliance to corporations. When banks and corporate entities are no longer beholden to various federal statutes, they can operate with greater freedom. The costs of compliance are extortionary, and these are typically passed on to bank clients. One of the most obvious ways that banks will benefit from current deregulation is the Dodd Frank repeal which is currently in process. Olsson Capital trading expert, Peter Blithely believes that Trump’s lack of mainstream appeal is not reflected by the wealth holders of the US economy.

It is absolutely clear that corporate America is satisfied with President Donald Trump. There is no reason that banks and major financial entities, bar a few, are not excited about tax reform and the current monetary policy tightening currently underway with the Fed. Interest rates are rising, US bourses have never seen such levels, and investor confidence is bullish. This bodes well for the banking sector.

According to these rules, initiated during the Obama era to combat the 2007 global financial crisis and the failure of Lehman Brothers, banks must have a capital cushion. In other words, banks are required to keep a sizable percentage of their holdings in cash to protect against a market downturn. There are many other failsafe measures incorporated in the Dodd Frank rules. These cover bank reinvestments, dividends, exposure, credit lending facilities and so forth.

How Will Tax Considerations Affects Bank Stock Prices?

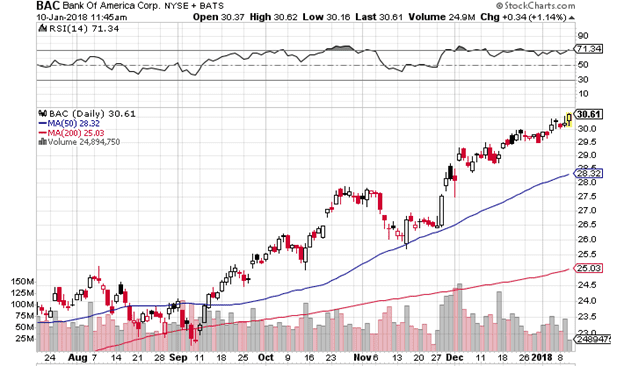

Now that banks have carte blanche to determine how they wish to invest their money, or loan their money, it is safe to assume that they will strive for profit maximization. This will reflect in the price of bank stocks such as Bank of America (BAC) which can be seen in the above chart at $30.61 per share. A great way to analyze the performance of bank stocks is by evaluating the 50-day moving average and the 200-day moving average figures. In the above case, the 50-day MA is $28.32, and the 200-day MA is $25.03. The current price of BAC is well above both of these averages, indicating a rising trend.

Perhaps the biggest driver of bank stock prices is neither deregulation nor the Fed funds rate – it’s the recently approved House and Senate tax overhaul. Now that corporate taxes have been sharply reduced to 20%/21%, banks will benefit immeasurably from this change. It remains to be seen whether US corporations like big banks who have parked trillions of dollars overseas will repatriate these funds to the US and reinvest them for domestic growth. However, the tax overhaul alone will see sharply higher prices for bank stocks such as Wells Fargo & Company, Citibank, Morgan Stanley, Goldman Sachs, JPMorgan and the like.