The following article was written by Jasper Lawler, Senior Market Analyst at FCA regulated broker London Capital Group Holdings plc (LON:LCG).

Jasper Lawler, LCG

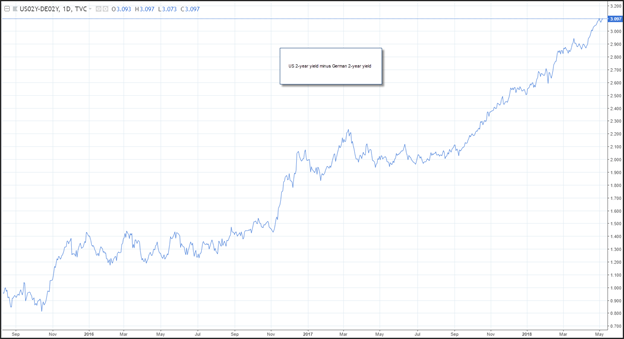

The yield curve is in the process of flattening, where short-term bond yields are rising relative to longer term bond yields. This is sending mixed signals to the forex markets. There are several reasons why the yield curve would contract, but historically the flattening of a yield curve point to a recession. Meanwhile, the forex markets appear to be negatively correlated to a flattening yield curve, which historically appears to be unsustainable. The rise in the U.S. 2-year yield relative to German 2-year yields is driving the EUR/USD currency pair.

What is a Yield Curve?

U.S. sovereign yields are the rate of return on US treasury bonds issued by the Treasury of the United States government. Yields at the country level can have a profound effect on the currency market. The U.S. government borrows money by issuing bonds that are backed by the full credit of the United States government. Generally, the shorter the tenor of the bond, the lower the yield. For example, a 2-year government bond yield will have a lower interest rate than a 10-year government bond. This is because there is more unknown over a longer period requiring additional yield to attract investors. The difference between the 2-year yield and the 10-year yield is referred to as the yield curve.

Changes to the Yield Curve

The yield curve will change for several reasons, but in general the curve will steepen (expand), when interest rates are falling and flatten (contract) when interest rates are rising. When the Federal Reserve enters a tightening or easing cycle they are either trying to cap inflation or stimulate the economy.

Additionally, when investors believe that the Fed will continue to tighten interest rates, short-term yields will generally rise relative to long term interest rates. Conversely, when the Fed eases rates, short term yields will fall relative to long-term rates.

How Does a Flattening Curve Affect the Forex Market

What is important about a flattening curve is that short-term rates are accelerating relative to long term rates. Since the Fed is currently in the midst of a normalization cycle (increasing interest rates back to historical norms following the financial crisis), the 2-year yield is outpacing the 10-year yield, causing the yield curve to flatten. This can be seen in the lower right corner of the chart. The rate line is accelerating lower, yield on the 10-year narrows relative to the yield on the 2-year yield. With inflation rate at the Feds target rate, the normalization process is not to knock out inflation, but instead to get rates back to historical norms. This means that lenders of money for 10-years are not demanding a yield that is much higher than short-term yields since the additional time is not expected to be eroded by inflation.

How is the Dollar Affected by the Yield Curve?

A 30-year chart of the U.S. 10-year yield minus the U.S. 2-year yield relative to the dollar index shows that most of the time the curve and the dollar are negatively correlated. At some instances the negative correlation is as low at negative 73%, but the average is closer to -25% over the 30-year period. The strong negative correlation we are experiencing now is not likely to last based on the historical changes to the yield curve and the dollar index.

What is Driving the Dollar Index

The rise in the dollar index appears to be driven by the weakness in the Euro, which is a major component of the dollar index. With 2-year yields rising to elevated levels, the yield differential between U.S. 2-year yields and German 2-year yields is rising. Since the yield differential makes up the forward curve used in the currency markets, traders who own the dollar relative to the Euro can lock in approximately 3.01% return by holding dollars relative to the Euro for the next 2-years (excluding the fluctuations in the spot rate). If the spot rate did not move over a 2-year period, this is the rate you would earn which makes the dollar an attractive assets to hold relative to the Euro.

Summary

The U.S. yield curve is flattening pushing the 2-year yield to elevated levels relative to the 10-year yield and compared to German 2-year yields. Historically a flattening yield curve foreshadows an oncoming recession as the Fed is hampering growth with higher interest rates. The flattening yield curve tells us that the U.S. 2-year yield is rising, and the differential relative to German yields foreshadows a stronger dollar.