ActivTrades’ Market Analysts have prepared for Leaprate their daily commentary on traditional markets for June 27, 2019. See details below:

EUROPEAN SHARES

Stocks from Tokyo to London are edging slightly higher today, alongside U.S. Futures. Market sentiment has improved on general optimism towards the upcoming U.S. – China meeting, during which the two super powers are expected to calm things down by placing on hold any further tariffs hikes. Saturday’s sit-down between the two blocs is a key event for markets after talks broke down last month. Seeing Washington and Beijing get back to the negotiating table in an attempt to solve the commercial dispute and witnessing them adopt a nicer tone towards each other would already be a step forward. However, some warn that investors should not expect much from the meeting or risk getting disappointed.

Stocks are on the rise everywhere in Europe today after the Stoxx-50 index registered a 12-points bullish gap at the opening. The market is now trading towards 3,435.0pts with a strong intraday support above 3,427.0pts while prices are being driven up by Health Care and Financials.

The situation is slightly less optimistic in Geneva where the SMI-20 has already filled its bullish opening gap as prices now trades around 9,840.0pts now. However, bulls seem to still be preventing the market from going below the 9,815.0pts / 9,800.0pts zone. Top Swiss equity movers this morning are Swatch Group AG and Geberit AG while the worst performances are being registered by SGS SA and Givaudan SA.

Pierre Veyret– Technical analyst, ActivTrades

OIL

Oil is slowing down a little this morning, after another positive impulse yesterday, which pushed the price close to $60. The main reasons behind the price rally are expectations for a dovish Fed (which could sustain demand in the next few years) and tensions between the US and Iran, a market driver which could have a strong impact in the short-term but less so in the medium/long term.

Carlo Alberto De Casa – Chief Analyst, ActivTrades

GOLD

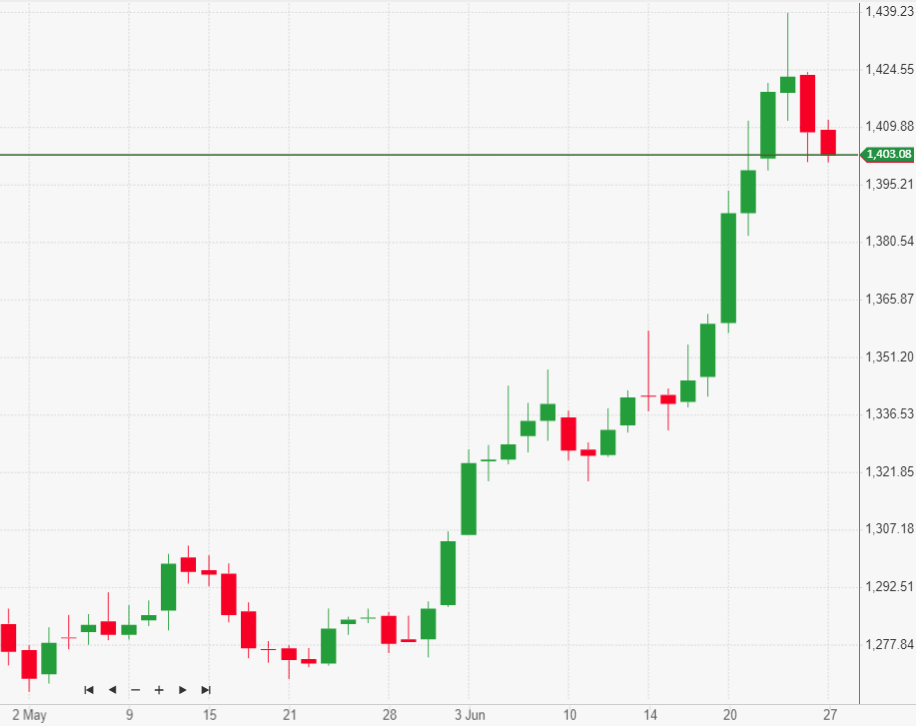

Gold lost a little ground and is now hovering around $1,400. This move could be seen as a natural correction due to some profit taking after the impressive rally of the past few sessions. In other words, bullion seems to be consolidating, in conjunction with the modest recovery of greenback seen in the last 48h. The medium-term scenario remains positive for the precious metal.

Carlo Alberto De Casa – Chief Analyst, ActivTrades