The following article was written by Capital.com. Traders can understand themselves better by trading with Capital.com.

The human brain tends to follow various simplifications, or biases, that often divert us from rational thinking. This is true for any number of activities – from standing in crowded lines to paying more for things when cheaper options are available – but is also especially true of trading on the stock market. In the world of investing, the decisions you make will ultimately impact the financial outcome, and so it is important to understand how behaviors and biases can impact your trades and investments.

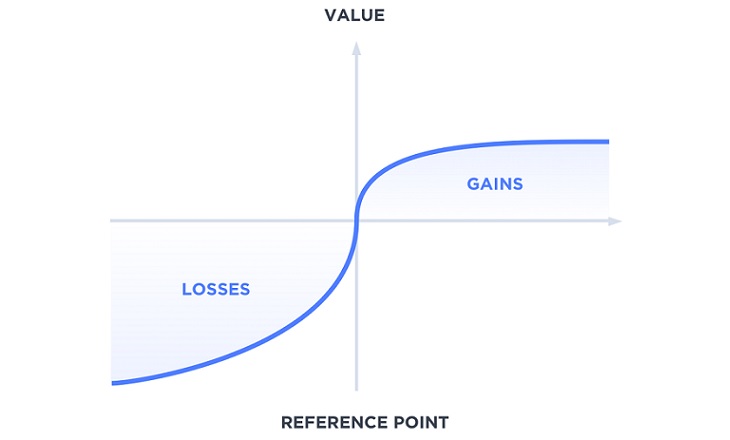

Bias in trading is a psychological phenomenon, in which an investor makes a decision based on their pre-conceived ideas of what will or won’t work without considering all the evidence. A common trading bias is the “overconfidence bias”, often traders are overly confident that one good trade will lead to another good trade (and so on…) causing them to take excessive risk, which could lead to losses. For example, say an investor purchases one Apple share, it grows, he sells it and earns some money – then he purchases another Apple share, it grows and he makes money selling it, then he purchases a Facebook share and makes even more money. He will start to think that he understands how markets work and will take excessive risks by leveraging himself, and risk to lose large amounts of money by making an unsuccessful trade. Another example of a behavioral bias is the “disposition effect”, which relates to the tendency of investors to sell shares whose price has increased, while keeping assets that have dropped in value. The disposition effect is not a rational sort of conduct because of the reality of stock market momentum, meaning that data shows that stocks that have recently done well tend to keep doing well in the short term; and that stocks that have done poorly tend to keep doing poorly in the short term. This being the case, the rational act would be to hold on to stocks that have recently risen in value; and to sell stocks that have recently fallen in value – but the evidence shows that individual investors tend to do exactly the opposite.

At Capital.com we have developed technologies powered by fast-learning artificial intelligence, which are catered to identify and correct these types of human biases. Capital.com’s patent pending “Smart Feed” technology uses machine learning to predict the likelihood that a trader will fall into a behavioral bias and provides investors with appropriate educational content to learn how to avoid those mistakes. For example, if a trader makes five small successful trades and then all of a sudden makes one larger trade, the app will automatically show the user a video about the overconfidence bias to make sure he keeps himself in check. The goal of our technology is to help reduce irrational decision making and thereby encourage traders to make better and more responsible choices.

The “Smart Feed” technology is scheduled to be released in the Capital.com mobile app in November this year.

Additional reading:

- Predictably Irrational: the Hidden Forces That Shape Our Decisions by Dan Ariely

- Hooked: How to Build Habit-Forming products by Nir Eyal

- Thinking Fast and Slow by Daniel Kahneman

- Switch by Chip Heath and Dan Heath

- Nudge: Improving Decisions About Health, Wealth, and Happiness by Richard Thaler and Cass Sunstein

Risk Warning: By its very nature, any investment in shares, stock options and similar and assimilated products is characterised by a certain degree of uncertainty and that, consequently, any investment of this nature involves risks for which the user is solely responsible and liable. The company is regulated by CySEC, license #319/17.