The following article was written by Anya Aratovskaya, VP of Institutional Sales at Advanced Markets.

Anya Aratovskaya, Advanced Markets

Yesterday, I got an email from one of my old contacts thanking me for persuading him not to go into the retail FX brokerage business last year. The email was sent from the corporate domain of his new business venture, one that is apparently doing well with only a 30% involvement with the FX industry.

His experience has inspired me to write a short article that can serve as a wake-up call to anyone contemplating starting their own FX Brokerage.

It is extremely important to have a water-tight business plan and to be prepared for, and fully aware of, what is entailed in operating a standard retail FX Brokerage. It goes without saying that the calculation of start-up and operating expenses is a priority.

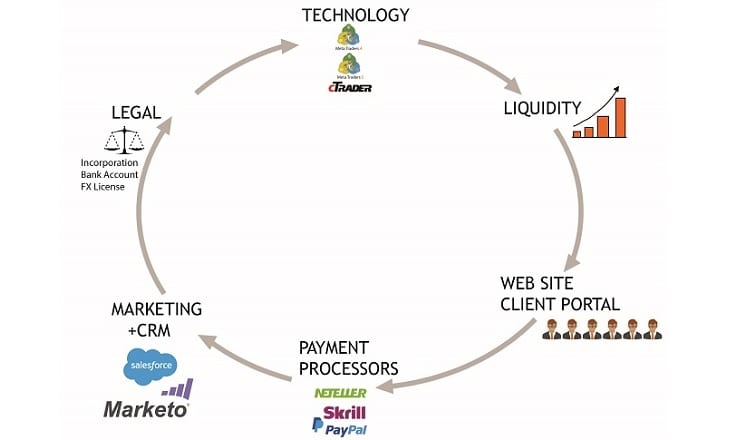

1) Legal (Incorporation, License, Bank Account, Payment Processors).

Cost: Anywhere from $1k for St. Marshall registration to over $60k for an FCA one. In addition, let’s not forget the $100k minimum account balance to apply for a simple FX License.

Challenges:

- Opening a bank account for non-licensed Entity (to be honest, even licensed entities are having issues with bank accounts in the FX industry these days);

- Time to set up (always underestimated by agents);

- Scalability (The presence of the license will not guarantee you clients).

Suggestions: Realistically estimate how many clients/what type of volume you will get at the start; open the bank account with a few different venues; work with payment processors while you are waiting for a full bank set up.

2) Technology (Hosting, Trading Platform, Bridge or Gateway, Aggregator, Plugins).

Cost: As low as $3k and as high as $100k upfront cash expenses plus some monthly volume /license fees.

Challenges: Platform choice should reflect the demands of your particular geographical region; make sure your technology provider has good reviews from industry veterans.

Suggestions: Add in the cost of some essential Plugins: Bridge, Multi Account Manager, Social Trading, Swap update logic, and so on.

3) Liquidity for the STP Model or a reliable Price Feed for a B-book model.

Cost: Usually the Liquidity Provider will not ask for a setup fee, just trading commission with some monthly minimum.

Challenges: Be aware of “quasi” Liquidity Providers, those who have no real Prime Broker relationship, no license, or no technology behind them.

Suggestions: Be ready to deposit at least $50k for PoP provider and less for the regular LP.

4) Your Web Site + Client Portal (Or Traders Room).

Cost: From $3k to set up and $1k monthly (depends on functionality).

Challenges: Don’t underestimate the importance of this element. End clients can easily spot a WordPress free template or a lousy made client portal.

5) Marketing

Cost: Anywhere from 0 to $100k and up.

Challenges: Understanding the specifics of FX-related marketing.

I have to mention that it is a common practice these days for companies, offering an All-in-One deal, to offer you some clients at the start. Don’t be surprised that these 5-10k client databases have also been distributed to your competitors and serve no use in real life.

Tips: Find your own uniqueness. Focus on developing and promoting it. Add value. One of my clients embraced his local presence by organizing Friday FX parties.

I also have to mention that “Package Deals of all 5 elements” are somewhat challenging; do a proper evaluation. You will be locked in to one liquidity provider, one technology provider, and one CRM/Trader Portal company. Since one company physically can’t manage all of this, you will end up dealing with the reseller and all of the problems associated with that. For example, if at some point, you become unhappy with the Bridge provider, you cannot just switch.

From my experience, the most successful brokerages are founded by ex-employees of bigger brands or existing IBs that are aware of the challenges and can easily navigate through the competitive FX space. Unfortunately, some in this industry portray the SYOB business as a low-cost, fast return, money-making machine, resulting in many failed attempts and costly disappointment. Don’t be misled.

Download “Must-read articles for a future SYOB” here.