The following article was written by Alex Nekritin, Managing Director of liquidity and technology consulting company Nekstream Global.

Parabolic growth of Bitcoin

With bitcoin experiencing parabolic growth, managing risk for brokers is becoming more and more challenging.

Most clients are buying and holding while the underlying is pretty much going straight up in price.

Not only are brokers carrying this risk on their balance sheet, they are not really earning commission on active two way flow.

Initially, FX brokers all swarmed to offer crypto CFDs and now many brokers are either modifying their offering or pausing their expansion into this lucrative asset class.

Cryptos are not just another CFD

Many brokers fail to realize that cryptos are a game changing instrument rather than just another CFD.

Because of current conditions, certain brokers are either suspending their crypto offering or creating unfavorable conditions for their clients. For example many brokers charge obscene overnight rollover rates, as high as 50% per year on BTC/USD. These actions can deter new clients from coming on board and cause existing clients to look for other venues to trade cryptos.

Brokers must realize that the potential of cryptos is significantly higher than FX, Futures, CFD’s and even stocks.

Cryptos can change the world’s entire monetary system. Current challenges on managing risk and liquidity on cryptos are just a speed bump that must be dealt with rather than a massive problem for brokers.

Smarter brokers will find ways to withstand the current high volatility and one sided flow. And they will use their current marketing and business infrastructure to take advantage of the crypto-craze that is going on in the world.

For those brokers that are up for the challenge, this article will address how to deal with the speed bump of current parabolic growth. We will talk about proper risk managing and mitigating risks of high volatility with bitcoin.

How BROKERS HANDLE CRYPTO FLOW

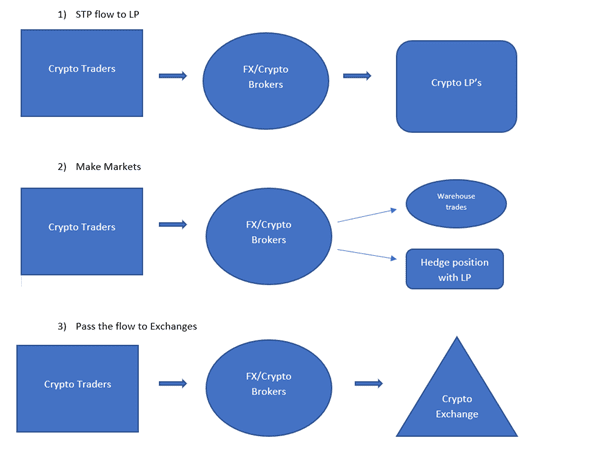

Currently Brokers handle crypto flow in one of three ways.

They either pass the flow through to an LP, make markets themselves, or pass the flow off to crypto exchanges. Each of the approaches has its benefits and challenges when it comes to risk management. Let’s look at each one individually and how to mitigate your risks with them during the current volatile time.

STP

When passing flow to an LP a broker is hedging all client trades with it’s crypto LP. This can be a less risky than acting as a market maker.

The problem is that when bitcoin moves so fast, a mini SNB crisis-like event could happen any day.

For example, let’s assume your clients are long BTC/USD, then you are long BTC/USD with your LP to hedge that position. If BTC/USD shoots up, you can find yourself in a situation where you owe your client a lot of money.

It is imperative to make sure that your LP can and will make good on the money they owe to to cover those trades to your clients. Otherwise you can be stuck paying the bill.

Here are a few things you can do with an STP setup in order to mitigate your risks during current volatility.

- Use multiple LP’s and spread your flow out.

- Limit exposure to each LP.

- Make sure that your LP’s have significant enough balance sheets in order to cover their trading losing trades.

- Expect your LP’s not to be perfect. Cryptos are pretty new. And your LP’s have to match you internally or hedge of their positions just like you do. This can take time and be challenging. You should take this into account. Don’t place massive entry stops and limits and expect perfect fills. Think of FX back in 2002. This is where the crypto market is now. For this reason, limit your exposure to each LP so that you are not sending huge orders.

- Make sure you are capturing significant commission/spread revenue on each trade. Many brokers are looking at cryptos as just another CFD and are instantly worried about competing on price. What they fail to realize is that clients are very eager to trade cryptos. And dealing with a broker is much better than dealing with a crypto exchange. Therefore adding a typical commission of 20-30 basis points ($2000-$3000 per million) will not deter clients at all. This commission provides brokers with revenue.

Market Makers

Market making brokers are accumulating positions from their traders with the expectation to make money on their trading activities. They can also use their LP relationships to hedge of their net positions. Some bigger brokers are taking advantage of their large balance sheet to try to manage risk on cryptos.

The advantage here is that if they can do this right they can become a crypto CFD LP and attract many brokers as clients. The disadvantage is that have to make markets on a completely new asset class which does not behave like anything they have ever dealt with.

Obviously they are now running into a problem of dealing with the fact that most of their clients are long and Bitcoin is going up exponentially.

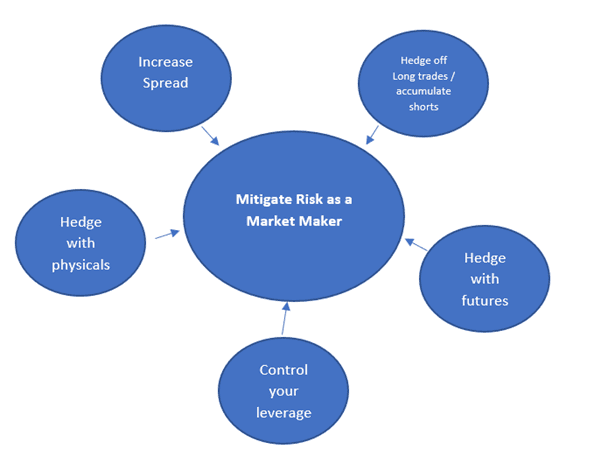

Here are some ways that these types of brokers can mitigate risk during the current volatile times:

- Increase spread to make sure that you are properly compensated for the risk that you are taking on.

- Hedge off all long trades with physicals or other LP’s while only accumulating short trades.

- Consider hedging with CBOE or CME crypto futures. These products will eventually have a lot more liquidity and bigger market depth. They can be a great tool to hedge your net positions.

- Control the leverage offered. There is no need to get crazy and increase your exposure by offering super high leverage from the start. Most crypto exchanges have no leverage. So offering something like 3:1 or 5:1 leverage is more than enough.

- Hedge with physical cryptos. There are large crypto LP’s such as mining operations that will have no problem selling large amounts of cryptos to qualified counterparties. If hedging large short positions is a problem for brokers use these types of LP’s to hedge the net positions.

Working with Exchanges

Some brokers connect directly to physical crypto exchanges and offer the aggregated feed to their clients.

Connecting to these exchanges can be challenging as you are not dealing with counterparties that are familiar with FX trading.

Some of the benefits of working with these exchanges is that you can offer your clients a great deal of various coins.

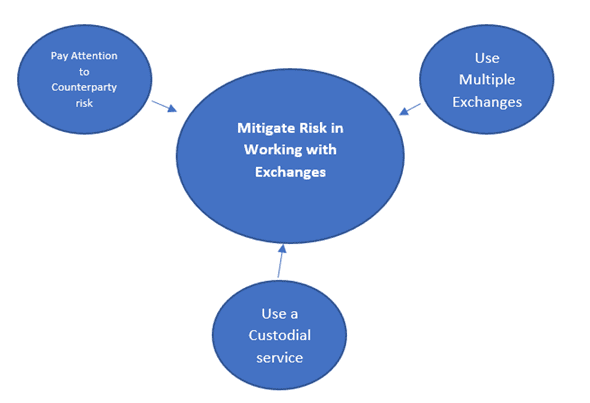

Here are some things that you can do to mitigate the risks of working with crypto exchanges:

- Pay attention to counterparty risk. Most exchanges are not regulated and are at risk for hacking and other types of security problems. Your margin will be held in cryptos in many cases. Make sure to work with large reputable exchanges and take the time to find out how they handle security.

- Use multiple exchanges instead of one. Most of the exchanges don’t have huge market depth. Therefore it’s hard to rely on one and if you have large clients it will be hard for you to fill large orders at the top of the book causing you to have to re quote and slip your clients. It is ideal to find a way to aggregate and multiple exchanges or split up your flow between them.

- Use a custodial service to connect to exchanges. There are services that essentially act as a PB with crypto exchanges. They allow you to hold your money in a bank or large broker and trade and settle with exchanges for a small fee. This tremendously mitigates your counterparty risk and allows you to access multiple exchanges while holding funds in at one entity this can substantially mitigate your risks when trading with exchanges.

Conclusion

At Nekstream we believe that cryptos will be a paradigm shift to the global monetary system. We think that it’s a safe assumption to make that at least 20% of the world is going to be using some sort of cryptocurrency within the next 20 years!

If you manage a broker and share this belief that you can clearly see that stepping away from this exciting product because of high volatility and upward bias is not a good idea.

Instead, you should find ways to better manage your risk when offering cryptos and position yourself to grow your business because of all of the the hype associated with the product.

Hopefully you can use some of the suggestions in this article to improve your crypto offering. And if you need any assistance with the topics discussed you can always reach out to us at [email protected]. We can connect you with CFD and physical LP’s and crypto custodial providers.