The following article was written by Adinah Brown, content manager at Leverate.

The success of your brokerage, no matter how good your marketing and acquisition funnel is, will be pinned to the quality of your trading platform. But with their being so many platforms on the market, choosing the right one is not an easy task. After all how do you know that the platform you just assumed was good, will be an ideal fit for your clients? Will offer a whole variety of trading styles? But should also be easy, if not enjoyable to use!

Ido Golan, Leverate

To provide some elucidation on this dilemma I sat down with Ido Golan, Technical Account Manager at Leverate, who confirmed that while there are many differences between platforms, from simple to advanced offerings along with copy and social options, that in themselves all vary in their different capabilities, the key is to provide variety.

Let’s start with breaking down the main categories of options;

1. Simple platforms – Intended for the novice trader, the signals are straight forward and easy to use. With no prior knowledge or expertise required in order to execute a trade.

2. Advanced platforms – Intended for the experienced trader, who is looking to apply technical or fundamental indicators.

3. Social – Somewhat of a bridge platform for beginner to advanced traders. It allows traders to copy signals from a master trader, or a guru, if you will. The signals can be derived automatically from a robot or by a human master trading manually.

Ok, so let’s dig a bit deeper on what each of these platforms have to offer.

Simple trading platforms creates an easy way for traders to open signals without using many, if not any, indicators. The target audience are novice traders, who are not applying any expertise to their trading and are going just off their instinct, or worse still, their “lucky stars”. If they wish, traders can just shoot off a trade using the default volume, but there is the flexibility to adjust the trading volume, the stop loss, the take profit and put in a pending order. The key factor about simple platforms is that they just need to be easy to operate, however you would be surprised by how many that aren’t. Due to the simplicity of these platforms they tend to be developed in-house and display the broker’s branding.

Advanced trading platforms, such as MT4, MT5, IB and Ninja Trader, allow you to apply different indicators and test the viability of a strategy. They usually come in two different forms of code and manual. In the manual version, traders execute each and every individual trade using a range of indicators, time frames, styles and strategies. These traders will tend to know what they’re doing and what metrics and patterns they’re looking for.

The code versions of advanced platforms allow traders to create an algorithm or ‘code a robot’ with parameters, once the market hits the parameters of the code, the trade will be triggered to either open or close. To address the interests of this trader the advanced platform will require a variety of statistics, the shape ratio, the average take profit, the average win & loss, the ROI, the average of closed positions, the average drawdown and the ratio of win to loss. The trader should be able to apply these stats to back test and forward test strategies to help them identify if they work.

Many brokers perceive their social platform as having a similar role to that of an account manager. Just as an investment account manager determines a certain position and then correspondingly adjusts the account of all his/her clients, social traders are also simply following the trading activity of a master, who chooses the positions for them. Such platforms on the market include Etoro, Zulu Trade, Mirror Trader and Collective 2.

Social trading platforms have the ability to implement manual executions or to configure a robot. Both will provide signals, but manual is going to allow for traders to apply a fundamental analysis. Most robots are configured by technical indicators for which it is impossible to expect the unexpected of real world events and their impact on the markets. While robots can be configured according to pre-planned events, they are unlikely to work for breaking news events that take the market by surprise, such as the referendum results of Brexit.

Yet this works both in favor of robots and against them. On the one hand, it means that robots are immune to human emotion and will not deter from a trading strategy by reacting to unexpected events. On the other hand, many argue that market movements are not a pure reflection of trading algorithms, but rather positions can move significantly away from any one strategy’s trajectory as the market responds to hype and sentiment. To address this tension professional traders are adapting their trading strategy so that it incorporates and is responsive to market developments, sentiment and global events.

So, how do you identify the right platform?

While it would be easy to collectively evaluate your client group as being suitable for any one type of platform, be it simple, advanced or social trading, the reality is that very few brokers have an audience of traders that is ever this homogenous. For this reason most brokers tend to have more than one platform integrated into their offering and thereby keep their appeal broad and relevant to the full variety of traders, however it’s a solution that’s not without a number of hurdles. To start with every integrated platform will require its own login credentials, so as the trader may wish to switch between trading strategies, they will need to enter new credentials every time. The various accounts will each require their own margin and traders will be charged fees and spreads from each account. While some brokers have managed to achieve some integration between the different trading accounts, there is still the need for traders to download, operate and continually update each of the platforms.

Next, assess target.

Each platform has its target audience with their own unique trading objectives. A simple platform tends to hold the greatest marketing appeal to the largest audience and therefore attracts many traders, however these traders, are often just “dabbling in the markets” and will make relatively small deposits. A social trading platform is a great tool for extending the LTV of simple traders, as a more dynamic platform, it will engage them for a longer period of time and will also increase the volume and frequency of their deposits. The advanced platform, by nature of it being far more complex in its offerings will attract fewer traders, but these traders will be more serious, will have particular strategies that they want to apply and will deposit much larger sums of money.

Variety is the spice of life

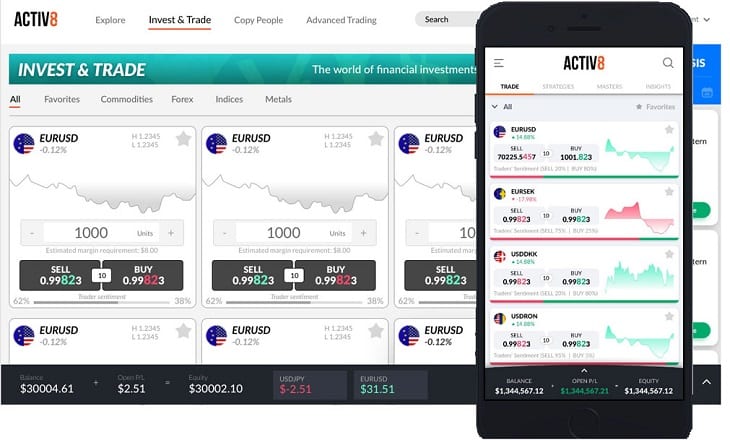

When it comes to your brokerage’s appeal variety is a must. You don’t want to be perceived as only suitable for only one type of trader and nor do you want to lose traders as they develop skills and escalate to advanced trading levels. One trading platform available in the market that is fully integrated between the various styles of trading is Activ8. For the trader, Activ8 is incredibly easy to use, requires just one log-in and allows for easy transitions between trading models. For the broker, Activ8 has the strong added appeal of being integrated to business intelligence and marketing automation features that enable the broker to send intelligent notifications to traders that address their interest right at precise moments. For example, emails can be synchronized with the appearance of the platform so that a trader will receive an email regarding a news update about the value of gold, then the next time they go on the platform, gold will be placed at the top of the page, in direct view. It allows the broker to manage their engagement and performs metrics and pursue tactics that are proven to be more effective.

To guarantee that you do not make the wrong choice, for Golan, the solution is to just choose them all. A platform such as Activ8 is a case of one-size-fits-all, no more expensive than your standard advanced platform, it has the added benefit of giving all your traders exactly what they are looking for.