The following article was written by Adinah Brown, content manager at Leverate.

Leverate, an industry leader in software trading technology, celebrated a second year of operations in China. The anniversary was marked with the recognition of numerous accomplishments; an ever growing pool of 50 clients, a team of 13 highly qualified staff and two offices from which our team operates out of, one based in Hong Kong, the other in Shanghai.

Severe competition and tightening regulation standards has made an eastward expansion a very attractive option to both financial trading brokers and Fintech companies alike. Indeed, China and the wider APAC region appears to be going through a golden era in financial trading. However, setting up shop in China and APAC is not without its challenges. There are major structural differences between doing business in the East, compared to the West. While these differences are all resolvable, if you are not aware of them from the outset, it may cost you your entire expansion effort.

Marketing – Perhaps the first thing that will make itself apparent to you, the day you arrive in China is the widespread adoption and multifaceted integration of WeChat. From the moment you land on the mainland, almost every point of interaction is through Wechat, whether that is to buy yourself a train ticket to your hotel, make a reservation at that hotel, make friends during your stay or organize a night out with those newly found friends – yes, WeChat is that pervasive.

For marketing your brokerage in China this has significant implications. A large part of your marketing efforts will need to take place over WeChat because that is where your audience is. The key factor here is frequency and engagement of your posts. People use WeChat largely for entertainment purposes, so therefore it’s about making some noise in the moment in which events are unfolding, sharing posts along the lines of “check out our new product launch”, “join us at our seminar in Shanghai”, jokes and games. The point is to entertain in those moments where your audience is bored at work and is glancing at their WeChat feed to fill the time, this is your brokerage’s chance to be seen. Then at some later stage when they want to hear more about investment trading, your brokerage may the first one that comes to mind.

Execution – Execution is fundamental to the success of a brokerage in China and APAC so getting this one right is critical. Let’s preface with two facts: 1. The People’s Republic of China is not the liberal democracy that you may be more familiar with, rather the Chinese government has very strict controls about the exchange of data and information that comes through its national borders. 2. China, and by the same token the entire APAC region, is located far from the major data centers of Europe and London. This geographical distance takes its toll in associated latency issues in the transfer of data. The combination of these two factors means that you can’t have a dedicated server in China, because FX trading is not a legalized activity, but nor can you have standard connection to a server outside of China, because the flow of data is likely to be slow, if not entirely unreliable and unpredictable. Consistent trading execution that is of a professional standard, therefore requires a dedicated cable that is connected outside of China to either a trading broker in the case of a money maker, or to a server in the case of a liquidity provider.

Leverate houses data servers for trading execution in London and uses dedicated lines that accelerate the transfer of liquidity and price feed data to Asia, with the cycle going in reverse once the trader has placed a position. This results in ping times of 3ms, with an internet speed of 100 to 300 mps.

Payment processing – One of the many limitations imposed by the Chinese government is that of currency exchange restrictions. Individuals in China are limited to transferring a maximum of $5,000 USD annually into another currency. This limitation becomes a significant issue when trading forex. In order to circumvent this issue, brokers need to contract a professional third party payment service provider in order to accept customer deposits and withdrawals.

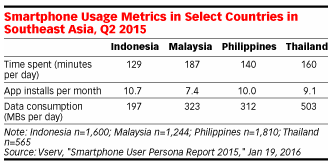

Likewise, different parts of Asia have their own currency transfer restrictions that also necessitate the use of a professional third party payment service. Vietnam and Thailand for example, both have strict capital outflow requirements, especially in relation to the forex industry. As the regulation varies from one jurisdiction to the next, with some being a lot tighter and others looser, brokers will need to adopt the respective payment solution that best addresses the regulation context in which they find themselves.

Culture – There is no underestimating the value of culture and the cultural differences at play, whilst setting up shop in either China or APAC. One factor you may have already noticed about Asia is that it’s a rather big place. The population of Asia is more than half of the world’s population. China alone is 5 times the population of Europe. The diversity across the region is enormous and to succeed, it is imperative to investigate the distinct region or province that you are considering entering into. For example, if you are considering venturing into the Philippines and Indonesia you will need to use Facebook as it has very high penetration in those markets. If you go to Malaysia, people are more skeptical of digital contact and rely on personal interaction to build trust with a brand, because of this IBs are more common in Malaysia and to market a campaign they will hold an educational training event for example.

That being said, an overriding similarity across the region is the significance given to personal relationships, and because of that, trust and reputation are paramount. To achieve this, Leverate has worked hard to promote an image of being decent and professional. In response, people know us as a high class and well respected company who provide a one-stop-solution for brokers. To support this endeavor, Leverate has fostered numerous partnership and media connections that have helped to provide a good flow of leads.

Leverate’s experience of venturing into China and APAC has not been easily won, on the contrary it involved numerous setbacks which were overcome through the hard work and sharp observation of its pioneers Itay Damti and Andy Zhang. The ability to address each of these hurdles is possible with a strategy that is flexible and directly responsive to market needs, strong support from headquarters and the ability to preserve the positive branding of your company. Having won two awards, the first in 2016 as the “Most Trustworthy FinTech Company” by YOCAR and then in 2017 as the “Most Influential FinTech Company” by the China Finance Summit, both of which are two good indicators that we must be getting a few things right!