To some degree, Bitcoin trading has made no sense this year.

As country regulator after regulator continued to warn against the dangers of buying cryptocurrencies, the price of Bitcoin and its crypto cousins Ethereum, Dash, Ripple et al continued to rise. The more that establishment types such as JP Morgan’s Jamie Dimon chimed in to call Bitcoin a fraud or to just warn against a potential sharp fall in Bitcoin prices, the more buyers seemed interested and continued to bid up prices.

And now, over the past few weeks, Bitcoin finally seems to be making inroads in the “real” finance world. Derivatives exchange operators CBOE and CME have launched Bitcoin futures trading. Goldman Sachs, the wise Yoda of the financial world, is preparing to open a Bitcoin trading operation in 2018. The establishment is finally buying in, giving Bitcoin real credibility and acceptance.

So what has happened?

The largest Bitcoin selloff in several months.

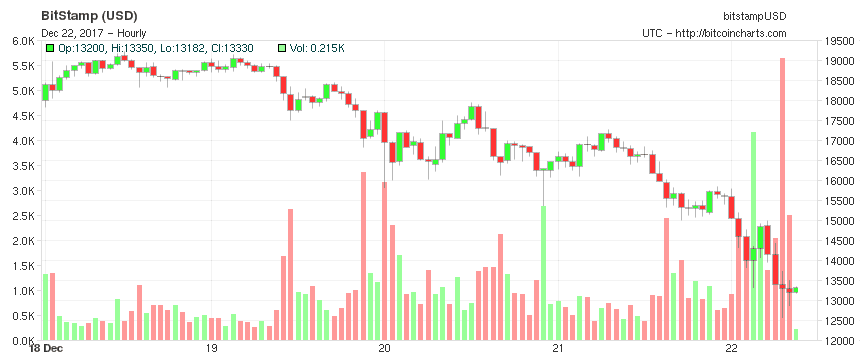

After bouncing around and testing new high after new high in the $20,000 range earlier this week, Bitcoin prices have inexplicably plunged on Friday, down nearly 30%. As of the time of writing, Bitcoin was changing hands at just above $13,200.

The rapid decline triggered a trading halt in Bitcoin futures at both the CBOE and CME.

Is this just some pre-Christmas profit taking by those who have made a lot of money holding Bitcoin the past few months. Just some near-term panic selling? Or are we on the precipice of a real, more serious crash in Bitcoin prices?

Bitcoin price chart past five days. Source: Bitstamp.net.