After hitting several all-time highs in December and January, Ripple has now plunged with 50%, which has essentially put a stop to the token’s rally. But what could be the reasons for such a quick drop, especially when Ripple currently enjoys “Asian appetites” and is considered “on fire”?

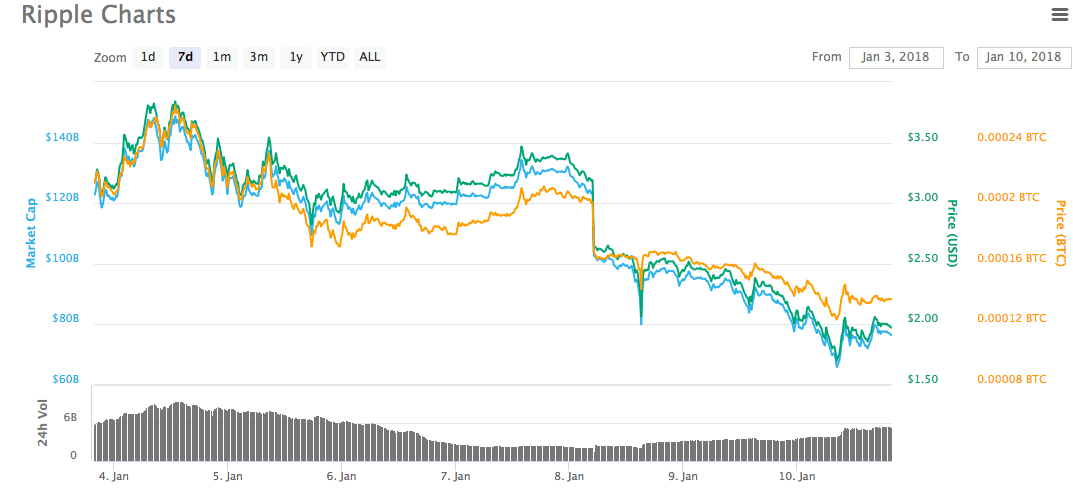

According to CoinMarketCap, the surging price of Ripple hit $3.23. However, it hit a major low trading at just around $2.14. The January high for now was $3.83, according to international exchanges. This drop is half the value of the digital currency that has occurred in less than two days.

Source: CoinMarketCap.com

One interesting suggestion for this phenomenon comes from a “misleading” information that CoinMarketCap is to blame for. The exchange excludes some data from South Korean digital currency exchanges in the display of Ripple’s price, so without the big portion of South Korean activity, the price appeared lower than actual. This triggered a major sell-off from worried investors.

As reported by Express Magazine, David Schwartz, a chief cryptographer at Ripple, commented:

“CoinMarketCap’s decision to exclude Korean prices from the displayed XRP price made the price appear to drop, likely triggering some panic selling. Look closely at the data and don’t be mislead. Prices definitely started falling after CMC made the change. My guess is that the appearance of a sudden drop triggered panic selling and profit taking. But that’s a guess.”

One of the explanations provided by CoinMarketCap was the fact that it is “unfair” to customers to see the South Korean-influenced Ripple, which trades at a premium of almost 30% on their exchanges. The company took to Twitter to respond to Ripple’s accusations:

“We excluded some Korean exchanges in price calculations due to the extreme divergence in prices from the rest of the world and limited arbitrage opportunity. We are working on better tools to provide users with the averages that are most relevant to them.”

While this may seem plausible, it is true that when Bitcoin was trading at $13,500 in Zimbabwe, the average price on international exchanges was around $9,000. All cryptocurrencies are “deflated” from the premiums they receive in different countries. Those swings are considered “outliers” and that is why some crypto exchanges believe it’s just fair to exclude such variations in prices.

Right now, the whole crypto market experiences huge swings and volatility is extremely high. Ripple appears to be one of the several cryptos that is most volatile and investors quickly sell their tokens once there is a downward movement in the price.