Just as investors though the cryptocurrency market is up and running with full speed ahead, Monday proved to be a difficult day for the crypto “maniacs” with most alt coins well in the red. Bitcoin is down with 9% for the day up until now, trading at $10,337, according to CoinMarketCap.

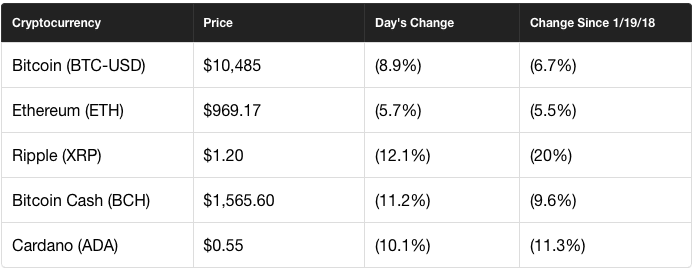

The table below gives more information on the some of the largest cryptocurrencies by market cap, as taken from The Motley Fool database:

Source: Motley Fool, 2018

All of these five crypto assets are now trading at a decrease, with Cardano and Ripple noting the largest percentage decrease in prices. Ripple was recently performing excellently in comparison to other alt coins and the general “bloodbath” of the cryptos.

One major reason for the drop may again South Korea. Last week, the country announced the possible ban of cryptocurrency trading and domestic exchanges. Given the price inflation of cryptos and the growing fear of regulations, South Korea may well be the reason for “red” points in the crypto market today.

While South Korea was not definitive about an immediate ban, they just announced that the South Korean government will impose a tax of 24.2% on all domestic cryptocurrency exchanges in the next 12 months. In addition, it was reported that the government will require these exchanges to share information about investors to financial institutions. This may lower the decentralization and “anonymity” of crypto investors.

In more detail, as reported by Yonhap News Agency, South Korean cryptocurrency exchanges will be required to pay 22 percent of corporate and 2.2 percent of local income taxes if they had an annual income of over 20 billion won ($18.7 million) on last year’s earnings.

This new reform will impose a huge hit on cryptocurrency exchanges such as Bithumb, one of South Korea’s biggest crypto exchanges. The new tax is expected to come into power as early as in February 2018. This tax can probably taper off the heat that cryptos have accumulated recently. Regulators are now “attacking” digital currencies from all sides and it seems that the imposition of tax may do the job.