Latoex, the development company that introduces the financial industry of Latin America to the crypto space, just announced its trading platform for digital assets.

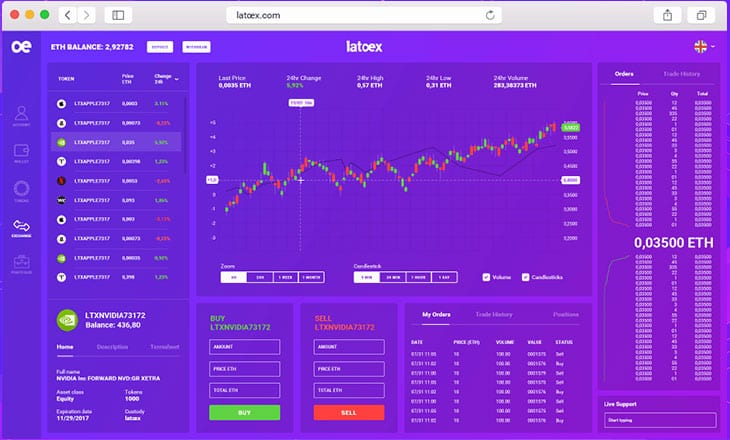

The trading platform, named Andes, provides ready-to-use tools to implement the strengths of blockchain into traditional assets. From comprehensive technical analysis to descriptive components – the platform grants its financial institutions and investors enhanced safety and shortened exchange fees. By operating the system on the Ethereum blockchain and using smart contracts, it eliminates the known third-parties who match and enforce financial standards that many times lead to Ponzi-schemes and rigging.

Latin America’s financial markets are composed of assets like stocks, real estate, gold, commodities, carbon credits, and oil. Many of these assets are difficult to physically transfer, so buyers and sellers use a piece of paper that represents this tangible equity as an alternative to the trading process. This paper contains complex legal agreements that are nearly impossible to track. One solution that Latoex offers is to switch to a digital system that overcomes the industry’s status quo.

These kinds of strict regulations placed on the financial market have led merchants to search for other currencies alternatives other than fiat, and consequently, have found it within the cryptocurrency market. As soon as businesses began seeing that this market lets them not only enter but also withdraw freely, the liquidity surged. The platform that Latoex has developed offers its investors and businesses to gain a higher liquidity and ensure the legal adequacy by using a unique wallet.

The Latin spiced hub which is maintained by its token issuers, financial institutions and companies heading to an ICO, carries in its infrastructure benefits such as:

- The smart contracts allow companies to automatize liquidation and simplify reconciliation and back-office processes

- The company runs multi-layer security protocols that prevent hacking attempts and increase the protection of funds

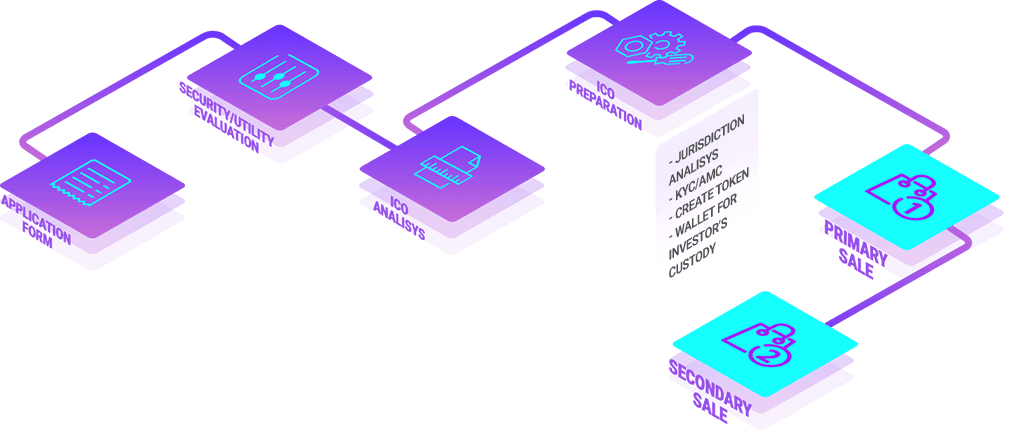

- The company offers ICO toolkit by which companies could launch their ICOs and token creation

- The company offers a 24/7 availability and accessibility to its digital-assets issuers

Latoex has lined up with the legal model of asset trading by realizing the need for the most acclaimed assets of Latin America to be reoriented to crypto”, said Fabio Silva, CEO of Latoex. “The company’s future project is to decentralize the negotiations for all investors who are interested in tokenization. By storing the ownership of each asset in the blockchain technology, we’re creating an investment cockpit where investors could visualize their digital assets from a single screen and with just a few clicks.