Binance is one of the largest cryptocurrency exchange platforms in the world. The platform has just announced their launch of subsidiary accounts feature for institutional and high net worth investors. The request for such an option has been long awaited, as institutional investors have had a large impact on the cryptocurrency industry in the last several months.

The cryptocurrency exchange will essentially be offering institutional investors better managerial control and a variety of audit tools.

As announced by Binance:

This upgrade will serve entities looking to set up multiple trading accounts within one organization and control access on an account level. The original/main account has sole control over the movement of assets within the accounts as well as the ability to set permissions and grant different access levels for up to 200 sub accounts.

Every sub-account has its own API limits, which will allow institutional traders to benefit from improved trading experience and better flexibility. The security levels of the new sub-accounts feature 2FA, passwords and other levels of encryption to ensure maximum security for institutional accounts.

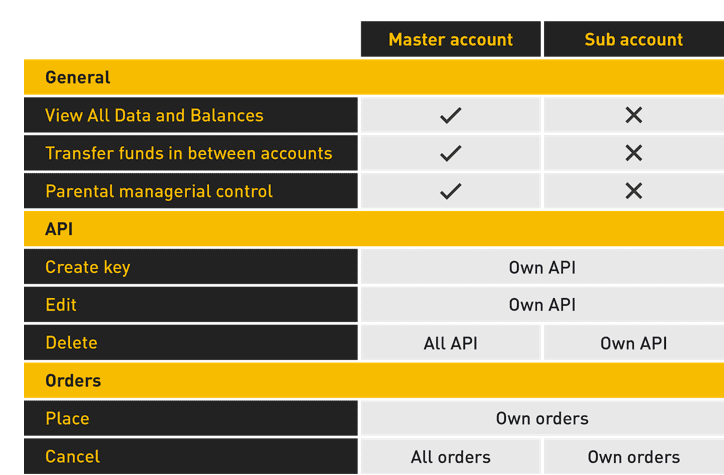

The differences between the master account and the sub-account are given in the following table:

Source: https://medium.com/binanceexchange/binance-introduces-sub-account-support-d7bf2f95e28c

Institutional investors and high net worth individuals are having some major impact on the cryptocurrency industry and their role is expected to continue to grow. Crypto exchanges are on the lookout of introducing “perks” and special features to cater to the growing institutional market and needs. In addition to the sub-account feature, Binance has been growing in terms of offered assets and presence around the world.