Mining businesses are in trouble with bitcoin being low and companies like GigaWatt filing for bankruptcy. Bitcoin prices jumped as much as 16% Wednesday after hitting a new 14-month low over the weekend. The cryptocurrency was trading around $4,300 as of 3:55 p.m. ET.

Below is Node Haven’s commentary on the current mining situation:

Michael Bazzi, Co-founder of Node Haven

What this exposed is how brutal market cycles can be. If your business model doesn’t account for any sort of hedge against a bear market, then you will be hurting badly, as seen with companies like GigaWatt. It’s unfortunate because much of this infrastructure built up by crypto miners is capable of many options of revenue generation – such as hosting cloud services. It’s been a wake-up call to many to diversify their infrastructure so they may weather the storm more effectively. Although, many miners operate at a loss because they believe in the future – miners have been through this before and will prosper. As far as blockchain companies, that bring real value to the world by solving current-day needs, they will absolutely weather any downturn. These downturns typically expose weaknesses in projects while allowing others to rise to the top – as seen in the internet bubble. Ultimately, this can be viewed as a filtration process and each time the market cycle turns bigger and better companies will emerge. Blockchain is here to stay.”, commented Michael Bazzi, Co-founder of Node Haven.

Idon Liu, Director of Operations at Node Haven

Idon Liu, Director of Operations at Node Haven, said:

First in crypto, always plan your expansion organically, so a short negative profit cycle doesn’t shut you down. With the fast rise in BTC value in 2017, it comes as no shock many new players were enticed by the 1-2 month ROI and failed to structure their operations to account for sustained downturns. I don’t think this downcycle is any different from prior downcycles. For those able to sustain the losses, this bear market should provide a great time to look at ways to improve operational efficiencies, improve cash flow, and run a leaner operation. More importantly, startups should really look at their hardware investment portfolio and move toward future deployment that has flexibility, to weather future single market segment downturns.

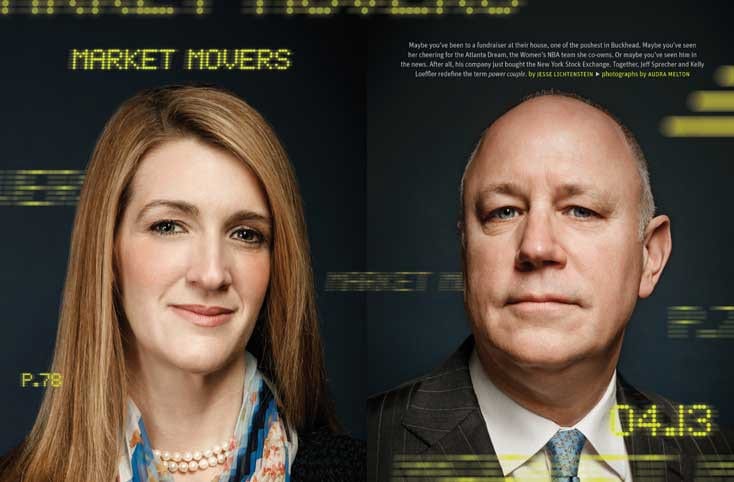

Jeffrey Sprecher, chairman of the NYSE and CEO of its parent company, Intercontinental Exchange (NYSE:ICE), on the other hand, explained that despite all the headlines, digital assets have a future in regulated markets, as reported by CNBC earlier today.

When asked about the current situation, Sprecher brought up another question posed by critics: “Will digital assets survive?”

The unequivocal answer is yes,” he said on stage at the Consensus: Invest conference on Tuesday. “As an exchange operator it’s not our objective to opine on prices.

Sprecher’s ICE, along with Starbucks, Microsoft and BCG, is backing a new company called Bakkt that will facilitate bitcoin futures trading by the first quarter of next year. The launch was planned for November 2018, but the company decided to postpone it for the beginning of next year.

Kelly Loeffler and Jeffrey Sprecher

Kelly Loeffler, CEO of Bakkt, gave some details on the decision:

To give it the best chance for success we pushed it back to the holidays to give people more time to get on board,” Loeffler said. “It’s a positive indication of the interest and it gives people time to learn. We have a responsibility to do that so we’re taking that extra time.

We’re creating that infrastructure that doesn’t exist today, which we think is a big opportunity for institutional investors to come in,” Loeffler added.

Bakkt is starting with bitcoin, which is regulated by the Commody Futures Trading Commission (CFTC). The company’s role is to provide custody and price discovery for bitcoin that’s free from fraud and manipulation. Prices now tend to fluctuate depending on the exchange, which in many cases are unregulated.

A very important detail is how the futures contracts will settle.

Bakkt’s bitcoin futures will settle in bitcoin. Existing bitcoin futures on the CME and CBOE settle in cash. Those futures contracts this week hit their lowest prices since they began trading last year.

Nasdaq and VanEck also plan to launch bitcoin futures in the first quarter of 2019.