TechFinancials Inc (LON:TECH) has announced that the ICO pre-sale of its Blockchain based online diamond exchange unit CEDEX was successfully completed.

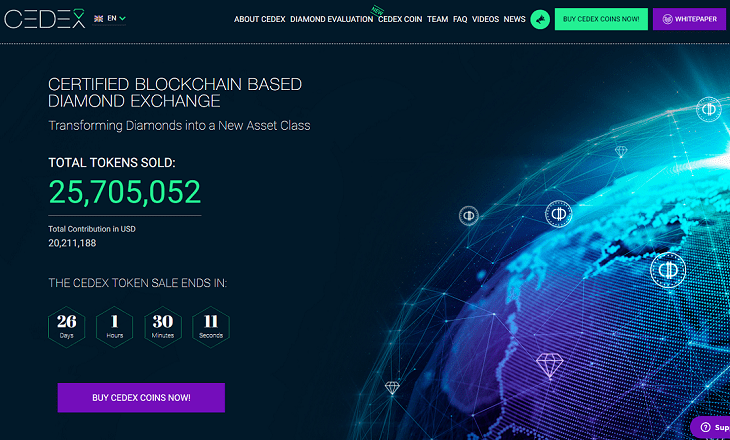

CEDEX hit its target of selling 25 million CEDEX tokens, at a price of 1 Ethereum = 900 CEDEX tokens. At Ethereum’s current price of USD $544, that adds up to a $15 million ICO pre-sale take for CEDEX.

With the completion of the pre-sale event, the ICO main sale started as planned March 17 at 10:00 GMT, and will continue to run until April 17 2018, or until the hard cap of 50 million CEDEX tokens sold is achieved.

The token sale utilises TechFinancials’ proprietary technology of crypto payment processing and crypto feed products, which enables the crypto currency processing of Bitcoin, Ethereum and Bitcoin cash throughout. In addition, the company stated that it has facilitated all other technological aspects of the token sale such as smart contract development, website development, and back office management.

Asaf Lahav

Asaf Lahav, CEO of TechFinancials commented:

We are excited to announce that the CEDEX pre-sale event has completed, using TechFinancials’ technology, which has been developed over the past six months since we entered the blockchain market. Whilst offering CEDEX our proprietary technology, we are pleased to have been able to provide the company with a 360° solution in order to meet its operational needs.

The Cedex Exchange will be powered by the Cedex Coin, and will allow users to purchase diamonds on Cedex, transforming their assets into diamonds. Use of the Cedex Coin will be driven by trading volumes generated on the Cedex Exchange and the demand of the diamond ecosystem. The company plans to have the Cedex Coin listed on major exchanges (to be announced) and will be transferable to other cryptocurrencies and fiat currencies. The Cedex Coin will be the only means of payment used on the Cedex Exchange.

The ICO marks TechFinancials transformation from a Binary Options platform company to a Blochchain technology provider. The company recently shut its OptionFair binary options brokerage business, and gave up its CySEC CIF license. The company still receives cash flow from its China binary options JV DragonFinancials, but seems to be pouring that cash into CEDEX and other Blockchain related projects.