Bitcoin’s recent display of stable pricing behavior has given way in the past week to turbulent times, once again. Investors are witnessing the volatility to which they had become very accustomed, but just as violent swings in value became the norm, the world’s favorite cryptocurrency has slowly but surely regained its dominance in the crypto world. Bitcoin roughly equates to $200 billion in market capitalization, and, when you do the math, Bitcoin’s share of the total system today is 61.6%.

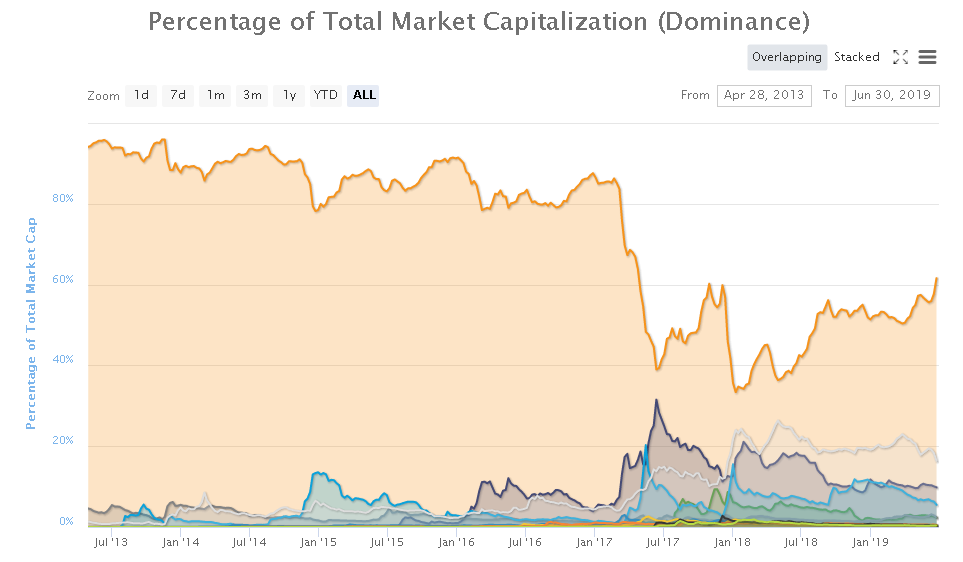

Gone are the days of old when Bitcoin dominance topped 80%, a position that was eroded somewhat with the advent of development token programs in 2017. By January of 2018, BTC’s share was nearly 35%, but it slowly recovered from that low point. Once a bottom had formed and Crypto Winter was declared a thing of the past, Bitcoin had regained its majority position and began 2019 at approximately 53%. The chart below depicts the historical record since 2013 (Bitcoin is in “Orange”):

The trend of Bitcoin dominance has actually become an invaluable indicator for traders in and of itself. If BTC surges and dominance remains flat, it means that capital is flowing into the system across all token systems. If, on the other hand, Bitcoin’s share increases, too, then it may be a “risk-off” situation for other altcoins, a situation, which confirms that Bitcoin may be acting as a “safe haven” for other cryptos. Lately, the same has been true when equities fell across the board, as sign that Bitcoin’s “safe haven” status has expanded into other arenas, as well.

News reports have also documented that recent run ups in BTC value have also correlated very well with declines in the value of the Chinese Yuan, suggesting that Chinese investors have sought out Bitcoin positions to protect their interests during the advent of renewed turmoil in China-U.S. trade negotiations. The one truism about “safe havens”, however, is that they can be a two-edged sword, so to speak. As soon as the “risk-on” light turns to green, capital can just as easily shift way from what was thought to be a safe and secure landing place to another investment medium.

Traders also follow this dominance trend to determine when to shift allegiances to altcoins, as well. History has shown that upward trends in Bitcoin market share are typically followed by a complementary surge in riskier altcoin system valuations. From the end of January through March, there was a period where altcoins played catch up, but Bitcoin surprised the investment world by launching a parabolic move up the scale soon thereafter. It was not until mid-May that BTC took a breath to, once again, allow its altcoin brethren to make up lost ground.

The fact that Bitcoin has regained its dominance over the field of cryptos was actually forecasted by the analysts at A.T. Kearney, a top global management consulting firm with over $1 billion in annual billings. As we reported last December, A.T. Kearney published a report that asserted that:

By the end of 2019, Bitcoin will reclaim nearly two-thirds of the crypto-market capitalization as altcoins lose their luster because of growing risk aversion among cryptocurrency investors. More broadly financial regulators will soften their stance towards the sector.

At that time, Courtney Rickert McCaffrey, manager of thought leadership in A.T. Kearney’s Global Business Policy Council, went on to say:

Our prediction that Bitcoin will regain its dominance is supported by the ever-growing complexity among altcoins, most recently demonstrated by the “hash war” that occurred in the Bitcoin Cash ecosystem. Additional “hard forks” and the continued lack of consensus among developers about a path forward will further widen the chasm between Bitcoin, as the most accessible and widely recognized cryptocurrency, and the altcoin community.

Bitcoin’s crossing of the 60% share mark was also the first time that has happened in 17 months. Its closest competitors, Ethereum and Ripple, remain a good bit back at 9.8% and 5.5%, respectively. While these three programs control over three quarters of the crypto space, analysts expect this figure to rise over time, after a shake out of development token programs. Many observers have contented that there were far too many Initial Coin Offerings (ICOs) in far too short a time period for a great number of these to be successful. Investors are now more discerning before jumping on an ICO “train”, and as many fall by the wayside, the “Big Three” will only gain share, as a result.