Nasdaq Nordic and Baltic Exchanges launch voluntary ESG Reporting Guide

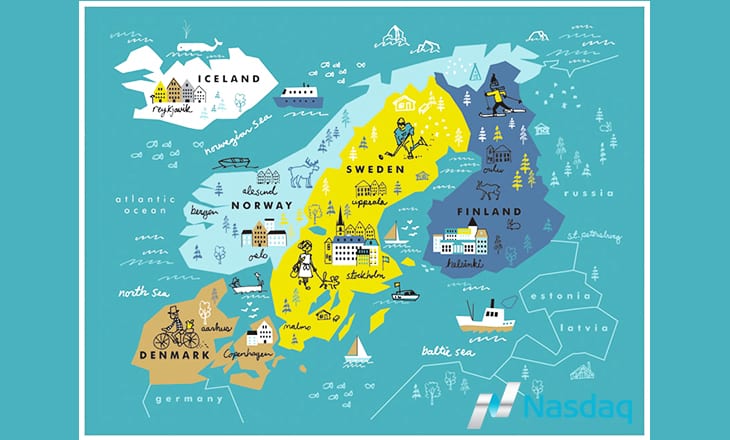

Nasdaq (Nasdaq: NDAQ) today announced that its Nordic and Baltic exchanges in Stockholm, Helsinki, Copenhagen, Iceland, Tallinn, Riga and Vilnius have issued a voluntary support program on environmental, social and governance (ESG) disclosure to support their listed companies. Many of the companies listed on the Nasdaq Nordic and Baltic exchanges are already global leaders in…

Read more