Binary options platform and broker turned Blockchain company TechFinancials Inc (LON:TECH) has announced its financial results for the first half of 2018, indicating (not too surprisingly) that Revenues were down by 46% from 1H-2017, to $3.78 million.

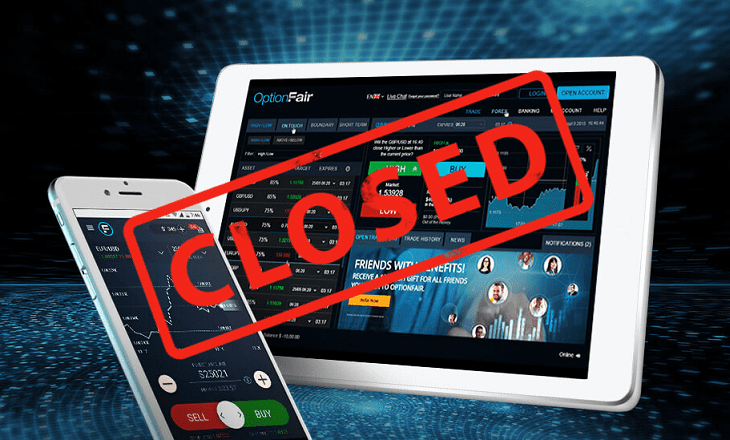

TechFinancials earlier this year shut down its OptionFair binary options brokerage brand, gave up its CySEC license, and shuttered most of its other binary options related activity other than its DragonFinancials joint venture.

Most of the company’s revenues now derive from its DragonFinancials binary options joint venture in the Far East, although TechFinancials said that even that business saw a sharp decline in both revenue and profit, primarily due to the tightening of regulations.

TechFinancials booked “new segment” blockchain trading technology revenues of $1.3 million, with $1.23 million of that from development services provided to Cedex.com, which is developing a blockchain based online diamond exchange. Cedex is effectively controlled by TechFinancials, so those aren’t exactly “real” third party revenues. TechFinancials owns 2% of Cedex, but has an option to acquire up to an additional 90% of Cedex at a (basically symbolic) exercise price of $62,000, giving it up to 87.4% of Cedex on a fully diluted basis.

And given that structure, TechFinancials booked an accounting gain of $9.49 million in the first half of 2018 from the fair value of the option after an independent expert valued Cedex $10.6 million. That “gain” turned TechFinancial’s first half 2018 Operating Loss of $853,000 into a Net Profit of $8.49 million.

Asaf Lahav

Asaf Lahav, Group Chief Executive Officer of TechFinancials, commented:

The first half of the year has been a period of transformation for TechFinancials. With a new focus on blockchain related technologies, the Company has continued to see an increase in the new revenue stream and has maintained profitability in the blockchain segment throughout the Company’s significant shift in strategy.

Importantly, the Company’s balance sheet remains strong at a time when it seeks opportunities to invest in technological innovation related to blockchain, with its technical support for the successful completion of the CEDEX ICO marking an important milestone for the Company. TechFinancials continues to deepen its experience in blockchain-related projects, whilst providing the infrastructure and some of the key software components to the CEDEX exchange. The Company will be using this knowledge and infrastructure in new products that it intends to introduce to the market in 2019.

The Board is encouraged with the progress made over the past six months as the Group builds on its offering, and this gives us confidence for future prospects.”

TechFinancials’ full press release on its 2018 first half results can be seen here.