Bats Europe, a CBOE Holdings, Inc. (NASDAQ: CBOE) company, today announced it has launched the Bats Brexit 50/50 Indices, two new benchmark indices designed to reflect the impact of Brexit on UK companies.

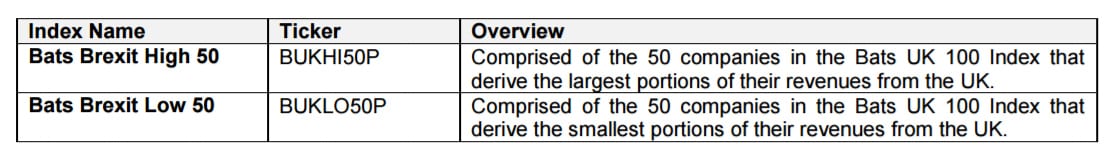

The two indices – the Bats Brexit High 50 and Bats Brexit Low 50 – are designed to act as barometers for assessing how Brexit is impacting UK companies by analysing the difference in performance between those companies that generate a large portion of their revenues from the UK compared to those that have less revenue exposure to the UK.

Bats partnered with FactSet, a global provider of integrated financial information, analytical applications, and industry services, to create the new Brexit 50/50 indices. The indices, which are calculated in real-time, utilise FactSet’s Geographic Revenue Exposure (GeoRev™) data to normalise and geographically analyse where UK-listed companies generate their revenues. To create the indices, the constituents of the Bats UK 100 Index (BUK 100), which tracks the top 100 UK-listed companies based on market capitalisation, were split into two groups – those with the largest and smallest proportion of GBP revenues.

Mark Hemsley, Bats

Mark Hemsley, President of Europe for CBOE, said:

The UK’s triggering of Article 50 is expected to lead to fundamental changes in the way businesses and capital markets behave prior to and subsequent to the UK’s separation from the European Union. We are pleased to provide the marketplace with benchmark indices that are designed to gauge investor sentiment towards UK companies during this critical time. We are providing these bellwethers of the British economy through our network of vendors free of charge so that they are readily available to all as we navigate the complexities of Brexit.

Since the UK EU referendum on 23 June 2016, the Bats 100 UK Index is up over 16% in price performance alone, driven by the significant near 17% and 13% decreases in the value of sterling over the period against the U.S. dollar and Euro, respectively. In comparison, the Bats Brexit High 50 Index is nearly flat, up just 0.8%, while the Bats Brexit Low 50 Index is up over 23%. The performance of the indices suggest that UK companies that generate a large portion of their revenues from outside the UK have fared better than those that generate a greater portion of their revenues from the UK.

Jeremy Zhou, head of indexing at FactSet, commented:

For more than five years, we’ve been providing an innovative solution for estimating geographic exposure to help investors solve the geographic revenue puzzle. As markets become more integrated and companies expand operations beyond their domestic markets, GeoRev provides a valuable and standardised factor for analysing companies’ revenues by geography, creating a consistent, accurate and normalised dataset ideally suited for alpha discovery, risk management, and performance analysis.

Bats’ Brexit 50/50 Indices are managed under the same rules and methodologies used for other Bats benchmark indices so they can be compared accurately with other Bats national market and sector indices.