LeapRate Exclusive… LeapRate has learned that CySEC regulated Retail Forex broker Icetrader.com has shut its (virtual) doors.

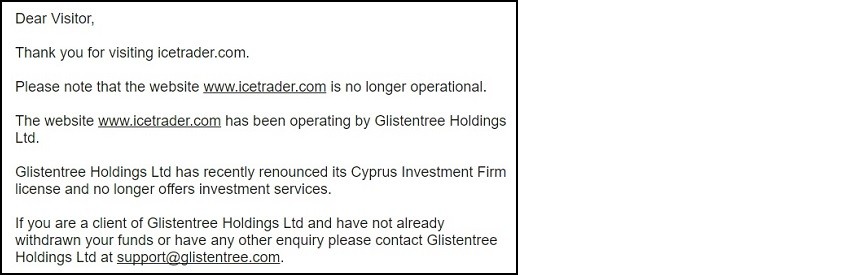

The company’s website icetrader.com, which as recently as Monday morning was operational and appearing as normal, now shows the following message:

In a related development, Cyprus financial regulator CySEC has posted a note on its website that regulated entity Glistentree Holdings Ltd which owned and operated the Icetrader.com website had renounced its CySEC license effective October 10, 2016.

Interestingly, LeapRate had reported about two years ago that Glistentree was related to failed Russia-based retail forex broker FOREX MMCIS.

CySEC also noted that there was a failed attempt to acquire Icetrader.com before the shutdown / renouncing decisions were taken. CySEC reported that a new proposed new shareholder named Mr. Danny Rothman

(or Mr. Daniel Rubinstein) was floated with the regulator.

However CySEC had recently taken administrative measures against Mr. Rothman / Rubinstein, including the imposition of a €100,000 fine against him.

While applying to be approved as the shareholder of a regulated entity, Mr. Rothman / Rubinstein apparently submitted to CySEC documents which were false and which provided misleading information in relation to to his academic qualifications and economic soundness. In particularly, Mr. Daniel Rothman /or Mr. Daniel Rubinstein does not possess the academic titles that he claimed to CySEC, and the relevant documents submitted were counterfeit.

He also submitted tax statements for the years 2013 and 2014 to CySEC which were falsified.

Back to Icetrader.com, the Company has been given three months by CySEC to settle its obligations arising from the investment services/activities that lapsed.

CySEC stated that it considers the protection of clients’ interests to be of the utmost importance, and therefore it will closely monitor the Company’s actions as it acts to return all outstanding balances to its clients, and handles all complaints received by its clients.

As of April 2016, there were four directors listed for Glistentree based on the company’s Pillar III disclosure document:

- Mr. Michael Michael, Managing Director

- Mr. Andreas Nicolaou, General Manager

- Mr. Petros Hadjikyriacos, Independent Non-Executive Director

- Mr. Georgios Panagidis, Independent Non-Executive Director

The complete CySEC announcement regarding Icetrader follows, and can also be seen here:

ANNOUNCEMENT

The Cyprus Securities and Exchange Commission (‘CySEC’) announces that, on 10

October 2016, the CIF Glistentree Holdings Ltd (the ‘Company’), which provided

investment services via the domain www.icetrader.com, renounced its authorisation

pursuant to section 24(1)(b) of the Investment Services and Activities and Regulated

Markets Law of 2007, as in force (the ‘Law’). Therefore, the CIF authorization Number

257/14 lapsed as from the abovementioned date.

It is noted that, the Company’s proposed new shareholder was Mr. Danny Rothman

(or Mr. Daniel Rubinstein), against whom CySEC took administrative measures

pursuant to its Board Decision dated 05 September 2016.

The Company is obliged to settle within a period of three (3) months, pursuant to

section 24(3) of the Law, its obligations arising from the investment services/activities

that lapsed.

It is noted that, in accordance with section 25(4) of the Law, the Company remains

under the supervision of the CySEC until it settles its obligations arising from the

investment services/activities that lapsed.

The CySEC considers the protection of clients’ interests to be of the utmost

importance and therefore will closely monitor the Company’s actions in relation to

this issue. Specifically:

1. The Company must return all outstanding balances to its clients and handle all

complaints received by its clients.

2. When all necessary actions are taken, the Company must provide CySEC with a

confirmation/letter from its external auditor that it does not have any pending

obligations in relation to the provision of any investment and/or ancillary services

and that the Company has settled all obligations due.

3. The external auditor’s confirmation/letter must include details on each of the

Company’s clients in relation to the issues of paragraph 1 above.