ActivTrades’ Market Analysts prepared their daily commentary on traditional markets for February 26, 2020. This is not a trading advice. See details below:

FOREX

The Swiss franc has been the outstanding currency since the coronavirus crisis gathered momentum in Europe at the end of last week, perfectly incarnating its role as a safe haven as anxiety levels rise. The franc has gained more than 1% to the dollar over the last five trading sessions and, crucially, 4.5% against the Japanese yen, the other refuge asset currency par excellence. Japan is very close to the epicentre of the crisis in Asia and its currency is suffering the impact of investors’ concerns over the fallout for the region given the slowdown of the Chinese economy. As the coronavirus situation threatens to become a global pandemic, the Swiss franc is emerging as the ultimate safe-haven currency.

Ricardo Evangelista – Senior Analyst, ActivTrades

EUROPEAN SHARES

Share markets continued their slide in Europe on Wednesday, extending this week’s losses following another sell-off with significant volumes in Asia overnight. Victims of the coronavirus keep on climbing around the world and market participants are still struggling to evaluate both the commercial impact and the outlook of the situation. Uncertainty, the worst enemy of investors, still dominates markets worldwide, putting strong pressure on risk assets.

Despite the number of deaths slowing in China, sentiment is being weighed down by the growing number of cases around the world, leading to a loss of trust in the ability of governments to contain and control the epidemic. Investors are desperately looking for any sign of relief such as a new set of measures from nations and/or further accommodation from central banks.

Today is likely to be a volatile trading session as investors will cautiously be analysing ECB Chairman Christine Lagarde’s speech due later today as well as important data from the US in the afternoon.

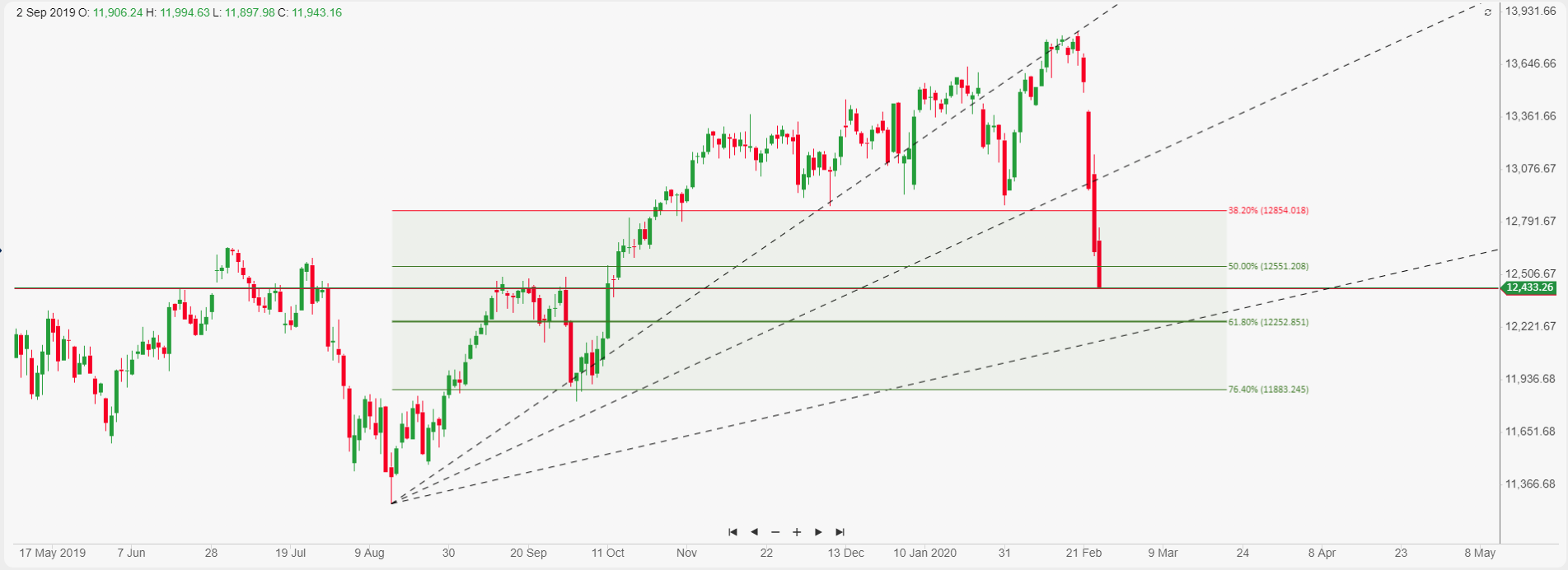

Travel and leisure shares are leading losses so far on the Stoxx-50 Index, with the DAX-30 the worst performer. The price has fallen through the previously solid 12,550pts level and is now heading very sharply towards 12,250pts, which is close to both the 61.8% retracement and the third speedline. A technical rebound may take place around this zone but the current trend won’t reverse unless the global context changes as well.

DAX index chart

Pierre Veyret– Technical analyst, ActivTrades