Holding Firm

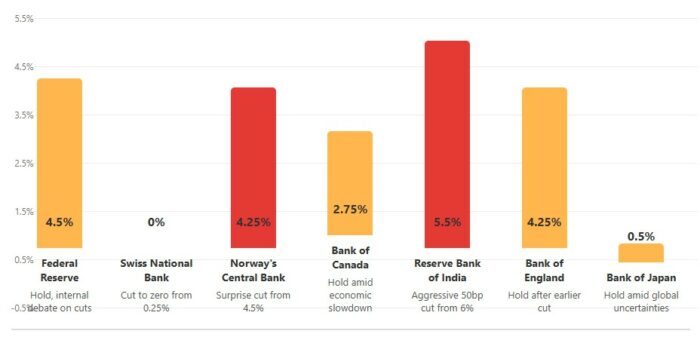

Across the Atlantic, the U.S. Fed finds itself in a more precarious position. While rate cuts are widely expected by the end of 2025, the timing remains highly uncertain. Persistent inflation, stubbornly above target, coupled with looming trade tariffs, has created a significant policy dilemma.

Internal divisions within the Fed are intensifying, with some governors advocating for immediate rate cuts to mitigate the impact of tariffs and support economic growth, while others, including Chair Jerome Powell, emphasize the need for more concrete economic data before making any adjustments. President Trump’s vocal criticism of the Fed for not cutting rates more aggressively further complicates the situation, adding a layer of political pressure to an already challenging economic environment.

Also holding firm were the Bank of England (BOE), BOJ, and BOC.

The Bank of Canada (BOC) held after a series of cuts earlier in the year. The BOC cited signs of a slowing economy and the potential impact of U.S. tariffs on Canadian goods as reasons for maintaining the current rate.

The BOE cited similar concerns regarding economic slowdown and trade tensions. The Bank of Japan (BOJ) also held steady, focusing on supporting domestic economic activity and achieving its inflation target.

In contrast, the Reserve Bank of India (RBI) has pursued a more aggressive easing strategy, implementing a significant 50-basis point cut to its benchmark repo rate. This move, exceeding market expectations, aims to stimulate credit growth and support economic activity in the face of slowing domestic demand and rising external uncertainties.

Norway’s central bank also surprised markets with an unexpected rate cut, driven by concerns over the depreciation of the Norwegian krone.