Background

The main event on the calendar today is the US Federal Reserve Open Market Committee’s monetary policy review meeting. There is only a 5% chance of any movement in the policy rate so attention will focus on the short post-meeting statement. Little change to the previous outlook is expected, although, on balance, the data flow in between has disappointed on the downside.

In the Eurozone we get the first estimate of first-quarter GDP, which is likely to show economic activity running ahead of potential but not by enough to generate much wage pressure and therefore core inflation.

Attention will then turn to Friday’s US jobs report.

Management and risk description

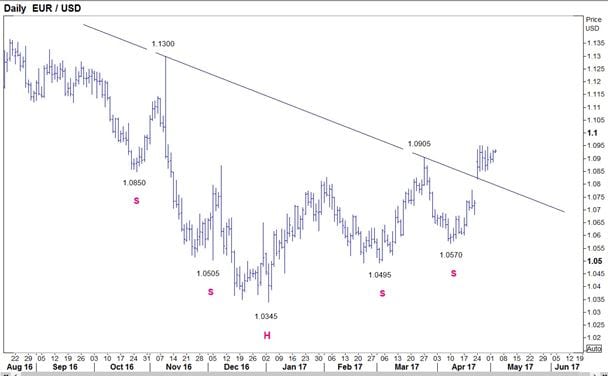

The euro displays a seven-month complex Inverse Head and Shoulders Reversal with an upside objective of 1.1620 (refer daily chart below), almost exactly the same as its Falling Wedge pattern target, if successfully completed, upon a sustained break above key 1.1005 resistance (refer weekly chart below).

Short-term support is now at 1.0915/1.0890 to yield rally above 1.0950 onto key 1.1005, then the 1.1060 level.

Parameters

Entry: today: EURUSD is seen as a buy at about 1.0915 (until 1.0950 resistance cleared).

Stop: just below 1.0890, initially.

Target: 50% at 1.0998 and 50% at 1.1057.

Time horizon: allow a few days for both targets to be met.

Source: ThomsonReuters. Create your own charts with SaxoTrader; click here to learn more

For more on forex click here.

Non-independent investment research disclaimer applies. Read more

A compiled overview of Trade Views provided on TradingFloor.com is found here.