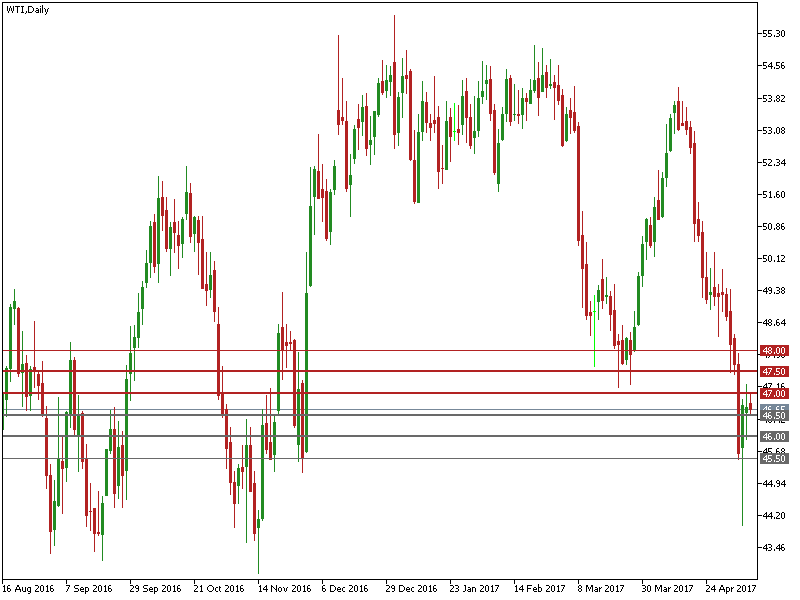

WTI Tests Major Support Zone Ahead of OPEC Meeting

The US shale oil industry has seen a marked recovery since February last year because of higher oil prices. The US Baker Hughes data, that records the number of new Oil Rigs, is showing additional Rigs added every week. The increase in shale oil supply has offset OPEC’s recent output cut effort to an extent.…

Read more