This morning, the Reserve Bank of Australia (RBA) kept interest rates on hold at 1.5% which was in line with market expectations.

The RBA sees an upswing in the global economy and foresees Australian economic growth to increase gradually at around 3% over the next couple of years, helped by rising in mining investment and higher exports of resources.

In terms of the labour market the unemployment rate is expected to drop over time, but wage growth remains slow.

Overall, the economic outlook is sound, nevertheless, the bullish momentum of the Aussie will likely be restrained due to the concern over the slow wage growth.

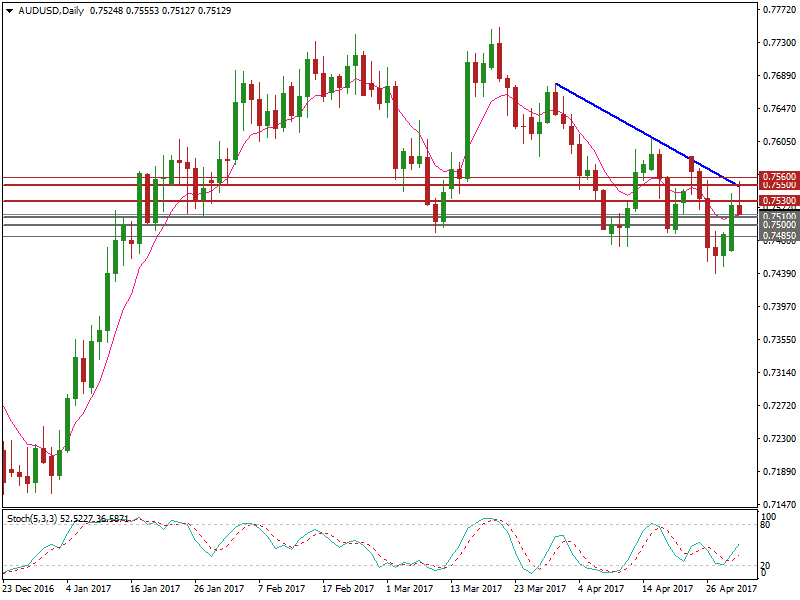

AUD/USD has rebounded after hitting a low of 0.7439 on April 27, last seen on January 12.

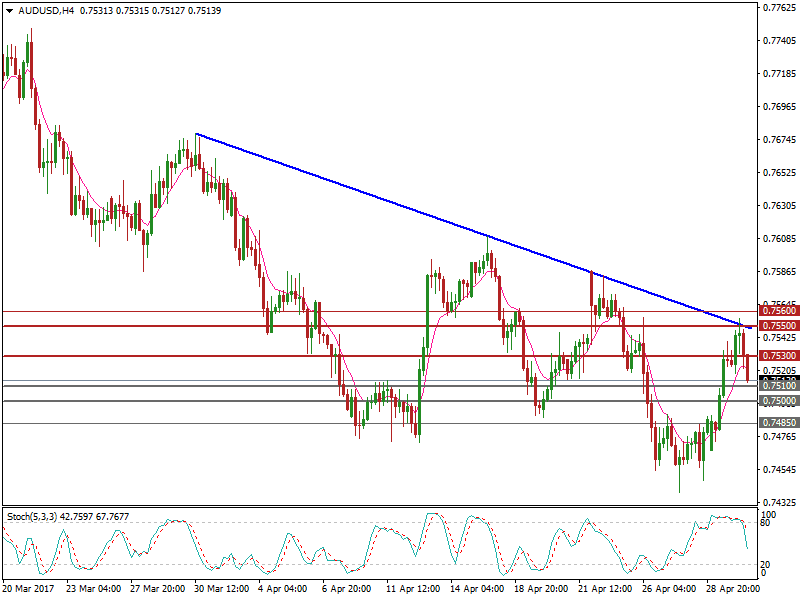

The RBA’s sound economic outlook lifted AUD/USD touching a 1-week high of 0.7555 in early hours of this morning, testing the near-term major downtrend line resistance.

That said, the price has retraced as the pressure at these levels is heavy.

The 4-hourly Stochastic Oscillator Is heading downward, suggesting further retracement.

The resistance level is at 0.7530, followed by 0.7550 and 0.7560.

The support line is at 0.7510, followed by the psychological level at 0.7500 and 0.7485.

The FOMC meeting will be held on Wednesday May 3. Markets expect the Fed to raise rates in June instead of May. Nevertheless, we might get further clues about the probability of a rate hike in June from Fed Chair Yellen’s tone of her speech. The recent weak US economic data might make Yellen’s speech less hawkish. Per the CME’s FedWach tool, the probability for a rate hike in June is 67.4%.