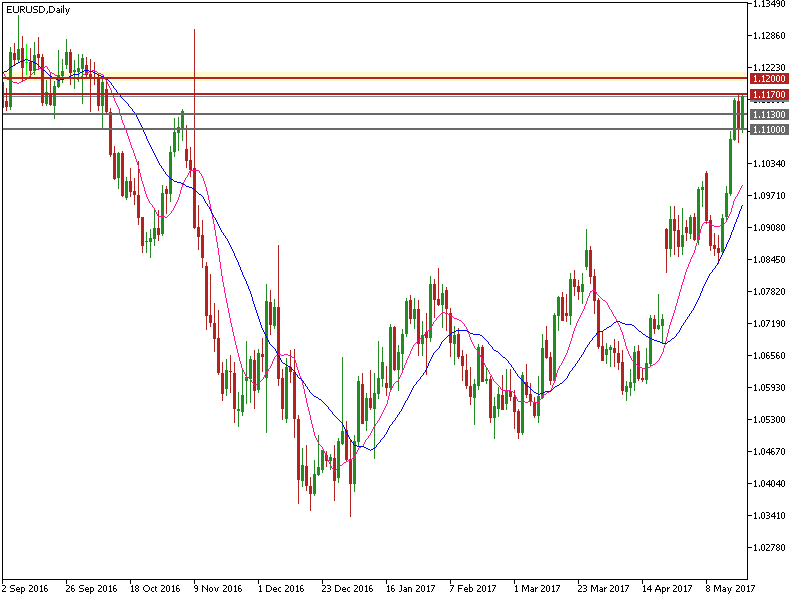

Could USD Rebound After FOMC Less Hawkish Stance?

The FOMC released its May meeting minutes last evening stating that the overall economic assessment was little changed. The Fed sees to raise rates once again is ‘soon be appropriate’. Markets assume that it signals a rate hike in June. The minutes also signals further tightening is expected if the incoming economic data shows improved…

Read more