It took only 869 days.

Nearly 29 months after the fateful Swiss Franc spike of January 15, 2015, Special administrator KPMG has announced that on Friday, June 2 they sent out notices to former Alpari UK clients, indicating that final distributions to account holders at the now-bankrupt Retail Forex broker have been made.

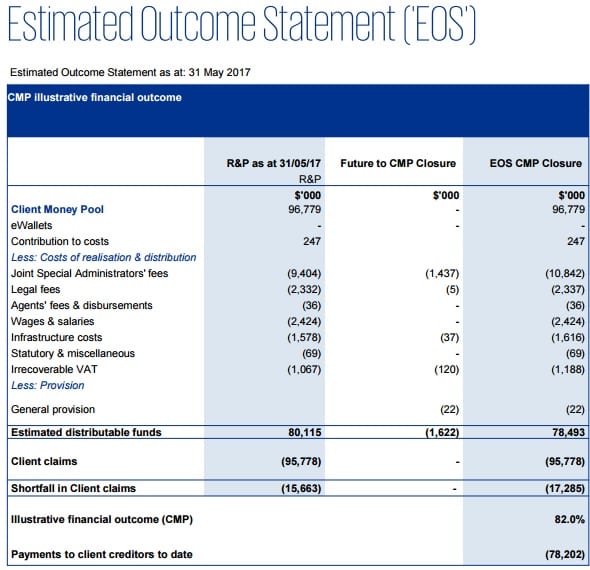

Overall, between KPMG as administrator and the UK’s Financial Services Compensation Scheme (FSCS) to which most clients assigned their claims, a total of $78.2 million of funds will have been paid out to ex Alpari UK clients, out of a total of $95.8 million in client claims – or about 82% of amounts owed. Most of the ‘shortfall’ of just over $17 million was eaten up by KPMG’s own fees of $10.8 million, legal fees of $2.3 million, and various other expenditures, as per the table below.

KPMG indicated that clients whose total distributable amount is less than $51.50 will not receive a payment, in accordance with a Court Order dated September 29, 2016. Such clients remain entitled to make a claim to the FSCS.

Clients who have requested to have distribution payments made to their account at ETX Capital, which won an auction held by KPMG to purchase the Alpari UK client list, will have the final distribution payment made as requested. Clients will be contacted by ETX once the funds have been received.

So what have we all learned from the Alpari UK bankruptcy?

Well, a few things.

First, the UK system for protecting and reimbursing clients at Regulated Retail Forex brokers seems to work. It takes time to sort out, but it works.

Second, when clients have a choice, they should opt for compensation from the UK’s FSCS. The FSCS took a lot less time to reimburse clients (up to £50,000 per client) than did the Special Administrator. There is no downside to assigning a claim to the FSCS.