It has been a wild day of trading in the currency markets, particularly in the benchmark EURUSD.

After dropping about 1% in value to 21 month lows near the 1.05 level in early Asia trading this morning following the Italy referendum ‘No’ result and Prime Minister Matteo Renzi’s resignation (amid whispers of impending Euro-Dollar parity), the EURUSD has made a remarkable recovery, trading above 1.07 and sitting at about 1.0705 as of the time of writing.

So what’s going on? Why are Euro traders bullish after what was predicted to be a negative event?

John Hardy, Head of FX Strategy at Saxo Bank explains. More of John’s research can be seen at Saxo Bank’s TradingFloor.com.

FX Update: Market absorbs Renzi rejection

- Italy votes ‘No’, common currency plunges

- Over 66% of Italians want the euro

- EURUSD may post recovery bounce

John Hardy, Saxo Bank

The market easily absorbed the resounding rejection of Italian prime minister Matteo Renzi’s constitutional reform proposals at the weekend’s referendum. The ‘No’ vote was never much in doubt, though some were perhaps surprised by the strength of the turnout and the margin of victory, which at 59 to 41 showed nearly three voting against for every two in favour.

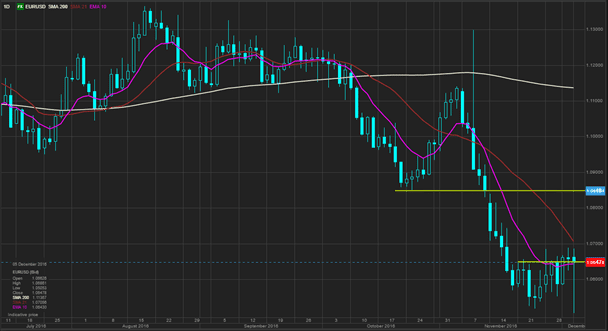

EURUSD dropped toward 1.0500, narrowly edging to new lows since the absolute low in early 2015, but bouncing strongly into early European hours. Italian 10-year BTPs opened some 10-12 basis points higher this morning, though still within the middle of the last couple of weeks’ trading range.

All in all, it appears the market had mostly discounted this vote, and the key question for the first couple of sessions this week will be whether the euro follows through lower. If it fails to, we have the significant risk of a consolidation into the European Central Bank meeting on Thursday, which could contain the odd mix of near-term dovishness (extension of the QE programme) together with a longer-term commitment to unwind that programme, if we’re to believe the recent Reuters story quoting ECB sources.

What comes next is by no means certain, whether for Italy specifically or for the EU more generally. Domestically, we’re not likely to see any drama for now as a caretaker government will likely be appointed until regularly scheduled elections for 2018.

For everyone harping on the risk of an Italian exit, let’s not jump the gun. More than two-thirds surveyed in Italy want to keep the euro. The latter fact of course doesn’t prevent a banking crisis and new political crisis in the EU as well over what to do about Italy’s two critical and inter-related issues: creaking banks and an unbearable sovereign debt burden.

EURUSD

The euro took a tumble overnight, but was well bid in early trading this morning – particularly against a Japanese yen that can’t find any friends. A failure to keep lower below the 1.0650 area today looks like a big setback for fresh shorts and there is some risk that the market focuses on a possible longer-term ECB intent to taper purchases at the Thursday meeting.

Risk toward 1.0800/50 zone tactically if local resistance can’t hold and even if we prefer the eventual continuation of the bear market.

Source: Saxo Bank

This week is a busy one, with three central bank meetings on the calendar, with the ECB meeting on Thursday the most anticipated of these. Tonight’s Reserve Bank of Australia meeting could see a cautious message, though we’re not expecting fireworks. Note in our G10 comments below that New Zealand prime minister John Key has stepped down – with little fanfare and apparently for personal reasons.

More important is an announced speech from the Reserve Bank of New Zealand’s Graeme Wheeler set for Thursday.

Another red flag over the weekend is President-elect Trump’s quite aggressive comments on China and its currency, trade and military posturing in the South China sea. This is incendiary stuff and we shouldn’t take it lightly that we face the risk of heightened tensions between the US and China under a Trump presidency.

The G-10 rundown

USD – The strong US dollar story isn’t really there at the moment, as we have more of a weak JPY and wobbly euro story. The greenback needs to pull something together by the end of the week or we may be facing a more profound setback rather than a sprint higher into year-end.

EUR – We believe in the weak EURUSD trend, but the near-term visibility is poor, as the ECB’s possibly mixed message this week could look relatively hawkish and leave the market in a quandary. Tactically, let’s continue to focus lower as long as we remain below 1.0625/50, with a risk toward 1.0800 if the reaction to the referendum is erases and we threaten higher again.

JPY – The yen remains under pressure as yields have failed to correct meaningfully and higher commodity prices threaten Japan’s real rates as cost push inflation and zero/negative rates out to ten years make Japanese fixed income look worse than ever. 115.00/50 looks like a possible major objective for USDJPY.

GBP – The sterling rally looks very much alive as EURGBP is down to new local lows and is even challenging the lowest levels since the initial Brexit reaction. Potential toward 0.8115 if the pressure keeps up on the euro and the pair can work down through the 0.8300 area. GBPUSD is running out of room to the next key resistance up at the initial post-Brexit low of 1.2800.

CHF – EURCHF bounced back from a test lower – likely on Swiss National Bank intervention and its tough to glean a reliable signal from CHF when EURCHF Is near the bottom of a range. USDCHF has shied away from a test of the top.

AUD – RBA up tomorrow with little anticipation going into this meeting, with perhaps some risk of dovishness at the margin on signs of a housing slowdown and a few data points that have disappointed recently. Watching the GDP data Thursday as well.

CAD – Strong oil prices have USDCAD pressing on the key 1.3250 area support recently. If this can’t hold the action and oil continues to rally, the pair could slip lower toward 1.3000. Bank of Canada meeting Wednesday is seeing little anticipation.

NZD – Key’s resignation was absorbed with little fuss as it was for non-political reasons. The RBNZ speech later this week is more pivotal and the stubborn kiwi has failed to fall recently as milk prices have recovered and the housing market remains on fire – could there be hawkish risks from this?

SEK – We constantly struggle for a reason to focus attention here – the 9.75 area in EURSEK now established as the important support/pivot level.

NOK – breaking the 8.90 support in EURNOK will likely require new cycle highs in crude oil as the correlation between crude and NOK has been very close.

Upcoming Economic Calendar Highlights (all times GMT)

- 0830 – Sweden Oct. Industrial Production/Orders

- 0930 – UK Nov. Services PMI

- 1000 – Euro Zone Oct. Retail Sales

- 1330 – US Fed’s Dudley to Speak

- 1500 – US Nov. ISM Non-manufacturing