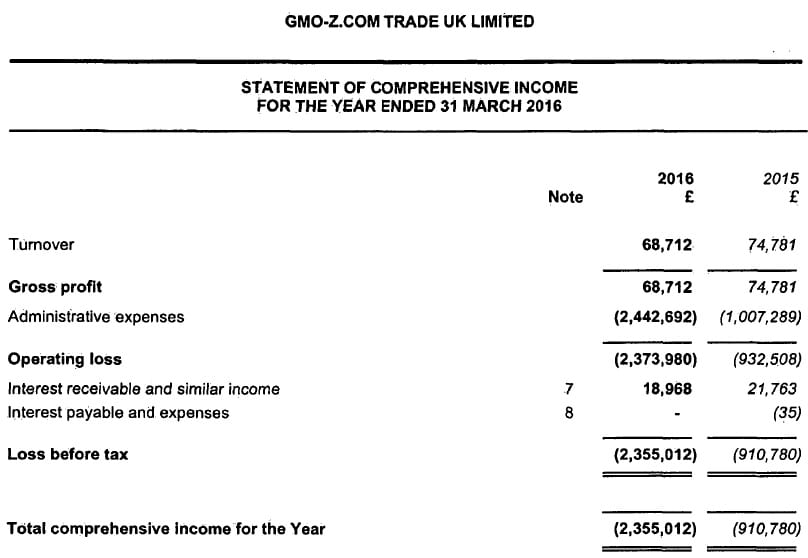

LeapRate Exclusive… LeapRate has learned via regulatory filings that GMO-Z.com Trade UK Limited, the FCA regulated brokerage arm of Japanese retail forex giant GMO Click Holdings Inc (TYO:7177), posted a £2.4 million (USD $3.0 million) net loss for Fiscal 2016. The company has a March 31 fiscal year end.

Tokyo-based GMO Click is, by volume, the world’s largest retail forex broker doing more than $1 trillion in OTC spot forex volumes per month, mainly in Japan. (By comparison, the largest ‘Western’ retail FX brokers do in the $200-400 billion range such as FXCM, Saxo Bank, and Exness). GMO Click paid $6.8 million to purchase the z.com domain name in 2014, rebranding its global retail forex operation to the rare one-letter domain while launching an FCA-regulated London-based operation at around the time.

Z.com UK, which operates under the Z.com Trade brand and offers the MT4 platform, reported just £69,000 of Revenues in 2016. The company, which averaged 12 employees during the year, paid out £692,000 in salaries.

GMO Click started off its Z.com Trade UK arm with £4 million in capital in 2013, and put in another £5 million in 2015. To date the company has accumulated £4.1 million in losses including the £2.4 million noted above in 2016, leaving it with a fairly healthy £4.9 million capital cushion. No new capital was put in during 2016.

We should note that as with similar subsidiary reports of global forex brokers, the financials don’t always tell the whole story. Z.com Trade UK matches all its trades back-to-back with its parent company in Japan, such that the ‘real’ profit and loss is recorded there. However we can still get a fairly good indication from the Z.com Trade UK books as to the general direction of the company, and its overall health. And, it looks like the company did not do much business in its first full year of operation in the UK.

Since fiscal year-end Z.com Trade has looked to grow its UK activities: launching an affiliate program, expanding funding options for clients by adding Visa and MasterCard, and introducing new CFDs to its offering.

Since fiscal year-end Z.com Trade has looked to grow its UK activities: launching an affiliate program, expanding funding options for clients by adding Visa and MasterCard, and introducing new CFDs to its offering.

Z.com Trade’s 2016 income statement reads as follows: