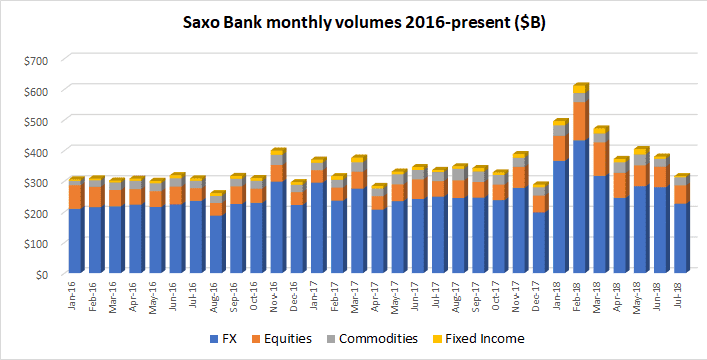

Continuing a somewhat troubling downward trend (see chart below), Copenhagen based Retail FX broker Saxo Bank has released data indicating that client FX and multi asset trading volumes in its system decreased by 17% during July, totaling $316 billion versus $380 billion in June. Within that total FX trading volumes were down 19%, to $226 billion, Saxo’s lowest result so far this year.

By contrast, Saxo Bank averaged volumes of $527 billion monthly in the first three months of 2018.

In the breakdown of volumes, FX trading as noted totaled $226 billion (72% of total volumes in July at Saxo Bank), Equities $60 billion, Commodities $26 billion, and Fixed Income products $4 billion.

Outside the volumes arena Saxo Bank has had a very busy start to the year. Saxo Bank made the interesting move of transferring its entire banking platform and technology stack to Microsoft Cloud. And the new China-based ownership group at Saxo Bank – while yet to formally take over, as final regulatory approvals are received – is already making its mark on the company by paring assets such as an exit from the South Africa FX market, while expanding further in China by partnering with SINA Corp’s Valuable Capital, and in Italy via a joint venture with Banca Generali.

And during July, Saxo Bank continued its streamlining and sold its Banking Circle payments unit to Swedish private equity firm EQT partners.

Saxo Bank has also been busy rebuilding its management team. During June the company added former Barclays executive Eric Krueger to head Client Services, and Nordea veteran Oliver Zecevic as Head of Operations, as was exclusively reported at LeapRate.