Copenhagen based multi asset brokerage Saxo Bank has issued its financial results for 2016, indicating a return to profitability and healthy overall growth in the business.

Comparing Saxo Bank’s results to 2015 should be taken with a grain of salt, however. The firm’s 2015 results were hurt on both the top and bottom lines quite severely by the January 2015 Swiss Franc spike.

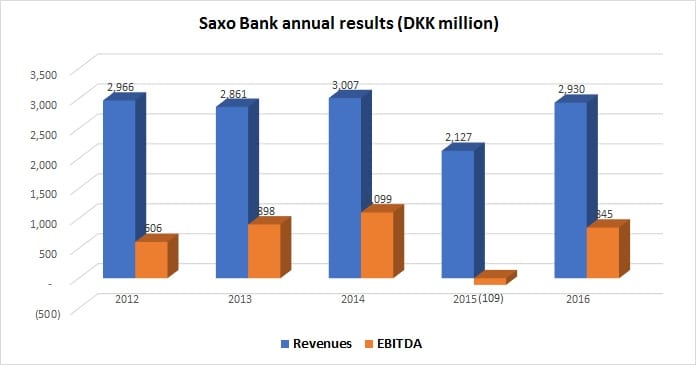

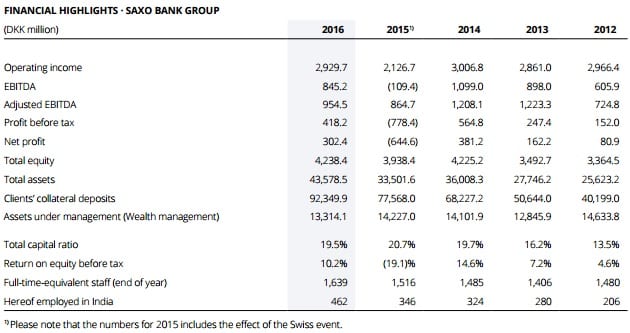

Overall, Revenues for the Saxo Bank Group in 2016 were DKK 2.9 billion (USD $425 million), up from DKK 2.1 billion in 2015. Clients’ collateral deposits grew to new highs with an increase of almost DKK 15 billion to DKK 92.3 billion by the end of 2016. Net profit was DKK 302 million (USD $44 million) for 2016 compared to a net loss of DKK 645 million for 2015.

Key figures for 2016 at Saxo Bank compared to previous years:

Saxo Bank stated that its strategic focus for 2016 has been on driving profitable growth and broadening Saxo’s client base through continued investments in and development of the multi-asset product offering.

2016 was marked by high profile political events, namely the UK EU referendum on 23 June 2016 and the US election on 8 November 2016. With a total of 490,000 client trades on 9 November 2016, the day after the US election, Saxo Bank reached a new record in trading activity.

Cost cutting continued to be a main focus area in 2016 for Saxo Bank. Staff costs and administrative expenses amounted to DKK 2.1 billion, a decrease of 9% compared to 2015, mainly due to lower spend on marketing, sponsorships and legal expenses. We also recently reported that Saxo Bank closed its Cyprus office in early 2017, as part of the continued cost cutting moves.

Kim Fournais, Saxo Bank

Kim Fournais, CEO and co-founder of Saxo Bank, said:

We are satisfied with the result for 2016 which reflects our commitment to democratize trading and investment to enable our clients to take part in global capital markets. We expect to grow the business further in 2017. Our investments in technology and products in 2016 complement our existing strong offering and allow us to cater to new client segments, such as the launch of the market’s first fully digital bond trading solution and SaxoSelect, our digital and automated investment service, aimed at clients looking for a discretionary way of participating in global financial markets.

Multiple regulators have issued proposals on how to better guide and protect clients trading with leverage. In many ways, we have been ahead of this regulatory curve and have made a clear strategic decision not to compete on high leverage. Some of the suggested changes are likely to lead to a more level playing field by placing greater focus on services, platform and depth of product offering in focus for clients. We welcome these proposals and expect them to be positive for the clients and Saxo Bank.

Saxo Bank’s complete 2016 annual report can be downloaded here (pdf).