The following article was written by Samantha Robb, Creative Copywriter at FXTM.

Samantha Robb, FXTM

Opening a trading account and getting started as a trader in the markets has never been easier. Forex trading education has become so accessible and abundant, that it’s become difficult to recognise which tools can actually help you in the forex trading world. The term ‘spoilt for choice’ may come to mind when you are trying to decide which tools to deploy in your trading strategy. Amongst the hundreds of tools available, Forex Trading Signals has been widely developed and it is one of the preferred tools used by traders.

Trading signals are designed to project the market’s future movements and indicate the levels that prices are expected to reach, based on current trajectory. Signals are largely based on technical indicators that suggest it may be good time to buy or sell a currency. Trade signals come in a variety of forms, including pennants, rectangles, triangles and wedges, and they can also flag abnormal volumes. They are often combined with fundamental analysis to give traders another tool in their arsenal.

Signals can be a great tool for traders who are just starting out and getting to grips with the financial markets. They reveal insights into price movements that can, in turn, show the trader what could potentially be in store for the financial instrument he’s trading. They can also be very useful for maintaining good risk management practices, as they encourage the proper utilisation of take-profit levels and placement of protective stop-loss.

The challenge for many beginners however, is to be able to navigate the fickleness that can exist when trading the markets. A novice may assume that by using signals as their sole trading strategy, they will land the ‘Holy Grail’ of trades, which – as the experienced traders know – does not happen very often. If not approached with proper caution, trading signals can have a negative effect on a trader’s account. Those traders who use signals as their entire strategy on the projections that the signals reveal, without taking into account any other technical or fundamental factors, run the risk of being on the losing side of a trade. Over-eagerness and a lack of discipline can also cause the trader to over-estimate the signals and put more faith in the indicated positions than they normally would, and this behaviour rarely results in favourable results.

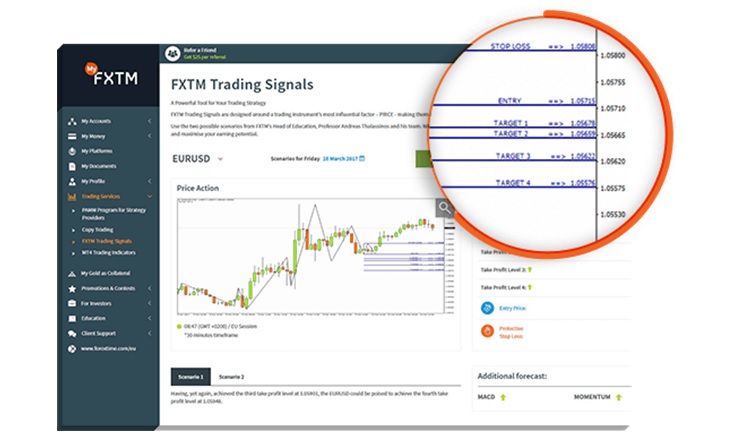

FXTM’s Head of Education, Andreas Thalassinos, is fully aware of placing too much emphasis on signals. In response to this, he has built an in-house tool that finds the middle ground for forex signals. FXTM Trading Signals provides traders with two plausible scenarios for projected price movements – the most probable and the likeliest alternative. Forex signals also provides an outline for take-profit levels, along with a protective stop-loss recommendation. This, combined with additional outlooks from three popular indicators (MACD, Momentum and the Weighted Moving Average), provides a more comprehensive picture of market trajectory and shows the trader that forex signals, by themselves, should not be taken at face value. The aim behind FXTM’s educative tool is to potentially strengthen a trader’s strategy through a combination of commentary, price action and additional forecasts.

When trading forex, it is imperative to remember that no indicator, oscillator or single tool can predict price movements with 100% accuracy, and this of course applies to FXTM Trading Signals as well. It’s vital to maintain proper risk management practices, which FXTM continuously encourages through its education centre and regular offerings of webinars, seminars, articles and videos. With that said, in a world that’s seeing more and more forex brokers and educational tools popping up, a tool like FXTM Trading Signals is an example of how a popular technique can be enhanced to provide beginners and advanced traders alike with a more comprehensive overview of the market.

Disclaimer: The content in this article comprises personal opinions and ideas and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Risk Warning: There is a high level of risk involved with trading leveraged products such as forex and CFDs. You should not risk more than you can afford to lose, it is possible that you may lose more than your initial investment. You should not trade unless you fully understand the true extent of your exposure to the risk of loss. When trading, you must always take into consideration your level of experience. If the risks involved seem unclear to you, please seek independent financial advice.

NOTES TO EDITORS

The FXTM brand provides international brokerage services and gives access to the global currency markets, offering trading in forex, precious metals, Share CFDs, ETF CFDs and CFDs on Commodity Futures. Trading is available via the MT4 and MT5 platforms with spreads starting from just 1.3 on Standard trading accounts and from 0.1 on ECN trading accounts. Bespoke trading support and services are provided based on each client’s needs and ambitions – from novices, to experienced traders and institutional investors. ForexTime Limited is regulated by the Cyprus Securities and Exchange Commission (CySEC), with license number 185/12, licensed by South Africa’s FSB with FSP number 46614, and registered with the UK FCA under reference number 600475. FT Global Limited is regulated by the International Financial Services Commission (IFSC) with license numbers IFSC/60/345/TS and IFSC/60/345/APM.