The following article is courtesy of Retail FX broker Aetos Capital Group.

Part I

The dominoes in history

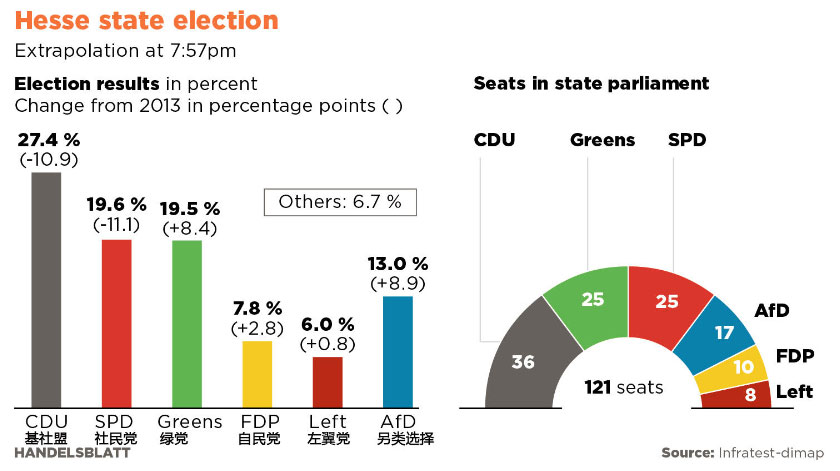

On October 14, 2018, the state election was held in Bavaria, Germany’s economic powerhouse and conservative stronghold, but it looked more like an “open execution” for the conservative governing coalition than a state campaign. The CSU, the sister party of the CDU led by German Chancellor Angela Merkel, suffered its bitterest defeat since 1950. While SPD, another major party in the coalition, lost half its support from the state. On October 28, the CDU and SPD suffered another setback in a state election hosted in Hesse, which is home to Frankfurt, the Eurozone’s financial center, as large numbers of voters turned to support the pro-left Greens and the far-right populist AFD.

The electoral defeat suffered by the conservative coalition in Bavaria and Hesse was by no means the first, and certainly not the last domino resulting in the fall of European politics. The rout in two key state elections led to the announcement by Merkel, Germany’s contemporary “iron lady” and a legendary leader for 13 years, that she would not seek political office upon the end of her term as chancellor in 2021. Such a decision will have a profound impact on the political ideas, fiscal plans, the Franco-German axis and the Eurozone reform process in Europe.

Europe feels the bite of populism

So far, no one can say for sure whether Merkel’s refugee policy in 2015 is a historical mistake. The fact is that the rapid increase of refugees has had a huge impact on the current social stability, social security and welfare, cultural system and political structure in Europe, as witnessed by an unprecedented clash of political views within Germany’s ruling coalition, Britain’s decision to exit the European Union in pursuit of independent immigration and fiscal policies, Italy’s ‘loss’ in the populist wave, the rise of far-right populism across Europe, and the split political positions of eastern and western European countries.

All this seems to stem from Merkel’s exciting vision of “saving the refugees” in the summer of 2015.

Since 2015, national populist parties in Europe, one after another, have been on the rise. The AFD in Germany, the National Front in France, the Five Star Movement in Italy, the Freedom Party in Austria, the Congress of the New Right in Poland, the Dutch Freedom Party and the Sweden Democrats are thriving on increasing numbers of votes won in elections at all levels.

The surging momentum of populism in Europe can be seen in the growing left-wing populist movements in the debtor countries of southern Europe, the continued rightward shift of traditionally moderate parties in Austria and France, the ascendancy of Italy’s far-right populist party, and the entry of the AFD into the Federation Council for the first time in history. Though each country’s populist parties has their own ideas, they are common in that they want to recover more power back from the EU to protect their own interests, which, together with the anti-EU, anti-immigrant, anti-refugee movements, all run counter to Merkel’s ideas.

There can be no doubt that Merkel, like Emmanuel Macron-who has defeated his far-right rivals in previous elections-has become Europe’s flagship leader in anti-populism, enjoying a reputation within the party, at home and abroad that surpasses those of other conservative candidates. Merkel’s departure could add momentum to AFD that is already on the rise.

The information contained in this website is of general nature only and does not take into account your objectives, financial situation or needs. Please ensure that you read the Financial Services Guide (FSG) , Product Disclosure Statement (PDS) , and Terms and Conditions which can be obtained on our website https://www.aetoscg.com.au, and fully understand the risks involved before deciding to acquire any of the financial products listed on this website.

AETOS Capital Group Pty Ltd is registered in Australia (ACN 125 113 117; AFSL No. 313016) since 2007 and is a wholly owned subsidiary of AETOS Capital Group Holdings Ltd, carrying on a financial services business in Australia, limited to providing the financial services covered by the Australian financial services licence.

Trading margin FX and CFDs carries a high level of risk and may not be suitable for all investors. You are strongly recommended to seek independent financial advice before making any investment decisions.

This commentary is owned by AETOS, and copying, reproduction, redistribution and/publishing of this material for any purpose in whole or in part without the prior written consent of AETOS is prohibited.