Retail forex broker FXCM, and its parent company Global Brokerage Inc (NASDAQ:GLBR) each posted their most recent results yesterday, with both entities reporting what we consider to be decent performance, especially given the difficult conditions under which the companies have been operating.

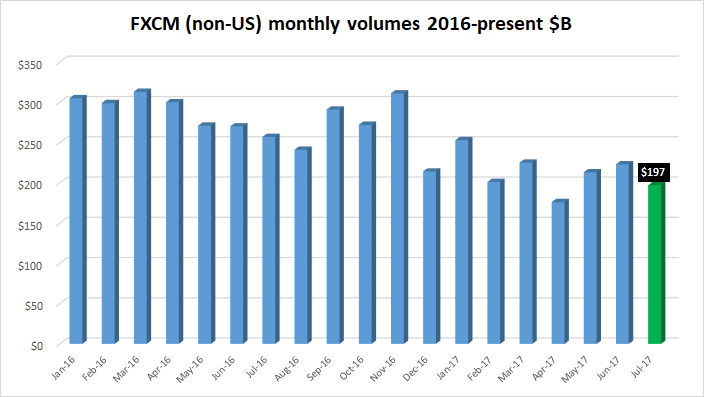

FXCM posted July FX trading volumes of $197 billion, 12% down from June but in line with other leading online Forex brokers, in what is a typical summer slowdown. Many Forex brokers would love to be doing nearly $200 billion of volume in a seasonally slow month.

The publicly traded company Global Brokerage Inc, which owns a 74.5% interest in Global Brokerage Holdings which in turn owns a 50.1% interest in the FXCM operating company, reported its Q2 and first half 2017 results showing an increase in Revenues during Q2 to $49.4 million, up from $45.9 million in Q1. EBITDA in Q2 was up to $8.5 million, from $5.6 million in Q1. (GLBR’s Revenue and EBITDA numbers basically mirror those of FXCM).

Again, decent performance under trying circumstances in which there was an unplanned turnover in management, while the company focuses mainly on selling assets to repay its high-interest loan from Leucadia National Corp (NYSE:LUK).

And, GLBR / FXCM is in big trouble. More GLBR than FXCM, however.

As we wrote in early May, the continued decline in GLBR’s share price led to the company receiving a Nasdaq delisting notice. Beyond presenting a problem for GLBR shareholders if that situation doesn’t remedy itself soon, the delisting is going to cause an issue with its $172 million of outstanding convertible debt, as well as its loan from Leucadia.

To avoid the Nasdaq delsting of its shares, the market value of GLBR’s publicly held shares must exceed $15 million for ten consecutive business days between May 2, 2017 and October 30, 2017. To achieve that, GLBR shares would need to trade up to about $2.45 per share from its current price of $1.95, and stay there for ten consecutive trading sessions. GLBR shares haven’t traded that high since early April.

If that doesn’t happen by October 30 (still two and a half months away), and GLBR gets delisted as expected, then that triggers a “Fundamental Change” as defined by the indenture governing GLBR’s Convertible Notes, which could require the company to repurchase all its outstanding $172 million of Convertible Notes for cash. Cash, which it doesn’t have. We’d also note that a default on the Convertible Notes (at the GLBR company) could also lead to an “event of default” under the Leucadia loan (which is at the operating company level, with FXCM).

And, even if the delisting issue somehow goes away, those Convertible Notes in any event come due in less than a year, in June 2018. That doesn’t exactly give the company a lot of time to come up with that sizable sum, especially since all cash coming to GLBR from its FXCM subsidiary is earmarked for repaying its other big debt, to Leucadia.

As such, GLBR stated that the potential delisting and the upcoming maturity of the Convertible Notes within less than 12 months raises substantial doubt about its ability to continue as a going concern. And, that the company is actively working with financial and legal advisers to explore a potential restructuring.

Now most of this really pertains to the publicly traded company Global Brokerage Inc (or as we’ve called it here for short by its ticker symbol, GLBR). The FXCM operating company, which is partly owned by GLBR and partly by Leucadia, is another matter. Were GLBR not able to deal with all its myriad issues – Nasdaq delisting, repayment of its Convertible Notes – then most likely its creditors would just step into its shoes and share ownership of the operating company FXCM with Leucadia.

But things are more complicated than that, beyond the fact that an event of default of the Convertible Notes at GLBR cold trigger a similar event of default for the Leucadia loan at FXCM.

The story described above is indeed a complicated one, with a number of different stakeholders – Leucadia, Convertible Note holders, GLBR shareholders, and also GLBR and FXCM management – each having a lot at stake, a lot to lose, and divergent goals. The continued drama is clearly taking its toll on the company and its management. Running an FX brokerage in what is an increasingly competitive and complex regulatory environment is difficult even in the best of circumstances.

Global Brokerage’s full Q2 report (10-Q filing) can be seen here.