Market Overview

Markets are taking on a phase of consolidation as the week draws to a close. There is little real direction to speak of throughout major forex and equity markets. There may be a slight positive bias for equities this morning in the wake of some strong after hours numbers from the tech giants in the US (Amazon and Alphabet), but if the Asian markets are anything to go by then there will be limited follow through. Japanese CPI came in with a slight miss at +0.2% (+0.3% exp) which reflected the concerns of the Bank of Japan after it revised lower its inflation forecast yesterday. The euro is starting to find its feet again after a mildly negative market reaction to the ECB leaving rates and forward guidance unchanged. Yesterday’s meeting of the Governing Council was more of a holding response but a slight improvement in the language of the statement could be interpreted as setting up for a less dovish outlook next month.

Wall Street closed almost flat again with the S&P 500 +0.1%. Losses across Asian markets followed with the Nikkei -0.3% but European markets are mixed to slightly lower in early moves. Forex majors show little direction, whilst gold is mildly supported. Oil has though managed to bounce further this morning after yesterday’s rebound into the close.

GDP is in focus today with both the UK and US taking a first look at first quarter economic growth numbers, with flash Eurozone inflation also on the calendar. Preliminary Q1 2017 UK GDP growth is announced at 0930BST and is expected to come in at +0.4% which would be down from the final reading of Q4 2016 which was +0.6%. Flash Eurozone CPI is announced at 1000BST which is expected to improve to +1.8% on the headline CPI (up from +1.5%, with the core CPI expected to increase to +1.0% (from +0.7%). However, in the wake of the higher than expected German inflation yesterday, there is a certainly the chance of an upside surprise. Then Advance US GDP is at 1330GMT which is expected to come in at an annualised +1.3% (down from +2.1% of Q4 2016). However, looking at the uninspiring +0.2% forecast of the Atlanta Fed GDPNow forecast, this could see a downward surprise. Revised University of Michigan Sentiment is at 1500BST and is expected to be revised mildly higher to 98.1 (up from 98.0 in the prelim).

Chart of the Day – AUD/USD

The outlook for the Aussie dollar has deteriorated over the past few weeks. I focused on the key breakout of GBP/AUD yesterday but now we also see the confirmation of a key breakdown in support on AUD/USD. For over a year now there has been a key pivot around $0.7500 and in the past few months this has been supportive for the corrections. However, as the Aussie has deteriorated in recent weeks a series of lower highs has formed (latest at $0.7590) and with three bear candles in a row the market has now completed two decisive closes below $0.7500 for the first time since early January. The concern is that the market is now pulling below all the moving averages, whilst momentum indicators are now bearishly configured. The RSI is failing around 50 and has downside potential in the mid-30s, the MACD lines are turning lower in negative territory again and the Stochastics have also just crossed lower once more. The implications of the move below $0.7500 is a completed three month top pattern that implies 250 pips of subsequent downside in the coming months. Look to sell into strength now with the neckline of $0.7500 now a basis of resistance. The hourly chart shows a band of resistance now $0.7490/$0.7510 which can now be considered to be a near term sell zone.

EUR/USD

In the wake of the ECB meeting the euro has just lost some of its upside impetus. The market has taken the Governing Council’s insistence on continued loose monetary policy stance with a mild negative and the EUR/USD pair has dropped back slightly. It is interesting to see that the $1.0850 support continues to hold, even though it has been used as the support for the market in each of the past three completed sessions. However the pressure is mounting as the closing levels are falling and once more today the early move is lower. The market beginning to fall below $1.0850 would likely begin the correction, with the daily chart showing support from Mondays traded low at $1.0820 below which would confirm a loss of momentum. The daily technicals are beginning to roll over too, with the RSI backing away from 70 again and a move below 60 would confirm the near term correction, whilst the Stochastics are also threatening to cross back lower. The hourly chart shows the sequence of lower highs whilst testing $1.0850 as the momentum has become neutral at best. Yesterday’s high at $1.0932 during the ECB press conference is now key near term resistance, with $1.0885 a minor barrier this morning. Below $1.0820 opens the previous resistance at $1.0777.

GBP/USD

Sterling has begun to pull higher as a six day consolidation looks to be continuing to the upside. The move yesterday above $1.0905 has not yet been decisive but a strong bull candle yesterday is again around the resistance and threatening to the upside again today. Daily momentum is strong with the RSI pulling above 70, whilst MACD and Stochastics are also positively configured. Not meaning to overplay this move, but the RSI has not been above 70 since May 2015 which was before the big bear market on Cable began. This all adds confidence to the outlook for the bulls. Holding above $1.2905 would open the psychological resistance of $1.3000 with the next meaningful resistance at $1.3120. The hourly chart shows positive near term momentum configuration and corrections being bought into. There is support now between $1.2845/$1.2870 to buy into weakness. The breakout around $1.2775 remains key.

USD/JPY

The recovery continues, however the bulls are not having it all their own way. Dollar/Yen is testing the resistance at of the pivot at 111.60 but as yet, the resistance is standing firm. The last two candles have shown attempted upside breaks but moves that have fallen over into the close. That is beginning to impact on the momentum which is losing its impetus now with the RSI stalling around the mid-50s and the Stochastics faltering. The confluence of the pivot at 111.60, the 38.2% Fib at 111.55 and the underside of the old seven month downtrend are all holding back the bulls. Between 111.60 and 112.20 means a more neutral outlook, with a move above 112.20 turning more positive in the recovery. This is an important crossroads for the pair. The hourly chart reflects a consolidation now with the support at 110.85 becoming important on the near term outlook. Below 110.85 is 110.60 breakout support with 110.09 the old pivot support.

Gold

Both safe haven plays are hanging on to their key levels, for now, with gold also still holding on to the support at $1261. A bear candle from yesterday’s session shows further downside pressure on $1261 but for now the support is holding. As with the yen, gold is at a crossroads and a closing breach of $1261 would open further downside towards $1240. Again, as with the yen, there is a confluence of support with the $1261 but also old primary downtrend which is today also around $1261. The momentum indicators are near term corrective but the RSI is settling around 50 and if this can continue to hold the outlook will begin to improve again. The hourly chart shows a series of lower highs but interestingly there is a slightly more positive configuration on hourly MACD and RSI which would suggest that the bulls are fighting hard. A move above $1270.70 would signal a near term recovery, with $1278 now key.

WTI Oil

WTI broke lower again after a short period of consolidation, but the market bounced into the close of yesterday’s session to reclaim the $48.90 resistance. Furthermore, the market has sustained that bounce into today and is again looking at the $49.60 old neckline resistance. That means that once more there is a look at overhead supply between $49.60/$50.20. This attempted rally now becomes a key moment. A failure here would heap the pressure on once more to the downside. However the momentum indicators are showing signs of ticking higher and this could also be a recovery play. A close above $49.60 would be a six day high, whilst key near term resistance is $50.20. The hourly chart shows the hourly RSI is at a level where previous technical rallies have fallen over, so once more we see a market at a key near term crossroads.

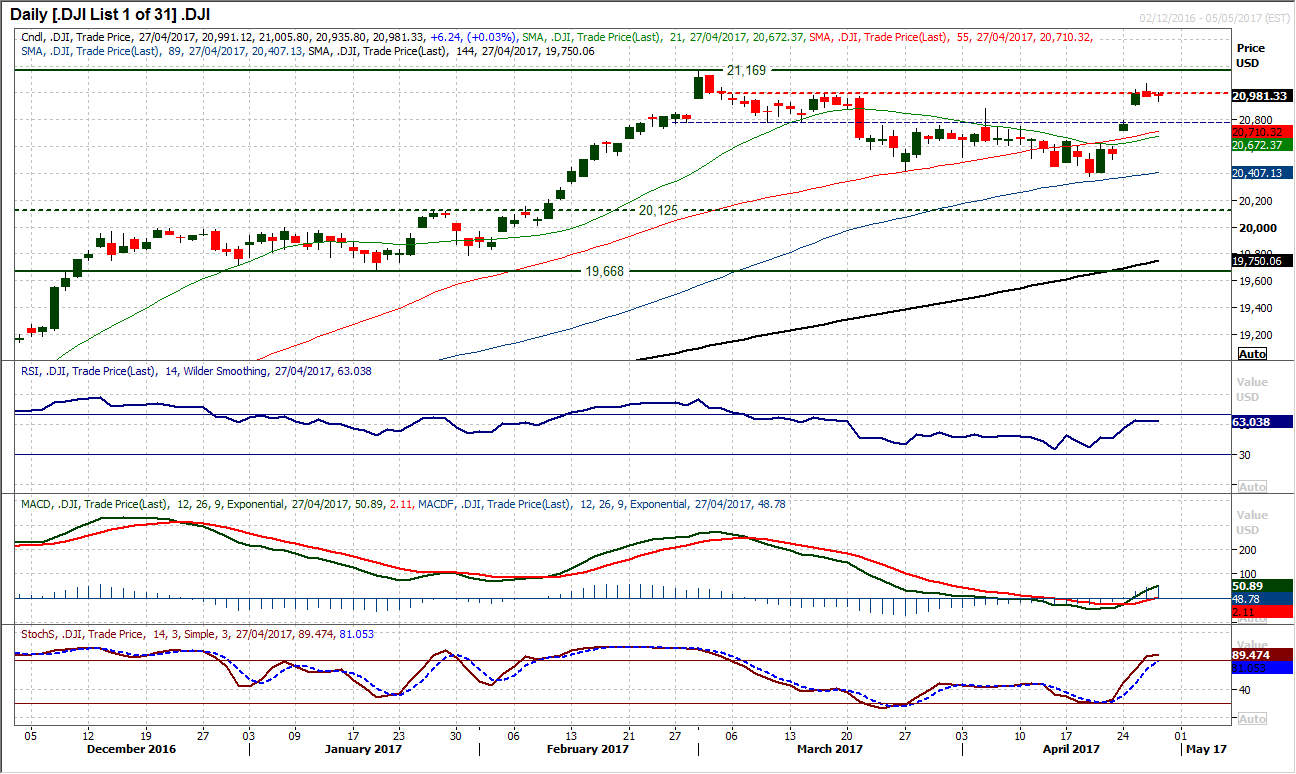

Dow Jones Industrial Average

It was interesting to see that the Dow spent the session yesterday in consolidation mode. The corrective implications from Wednesday’s bearish candle have done little to impact the direction yet, but once more the market failing to close above the resistance at 21,000 is a concern for the bulls. Momentum indicators on the daily chart remain positively configured but are showing signs of rolling over. The hourly chart suggests the potential for a correction as hourly momentum indicators look to reverse. An unwind into the support band 20,780/20,887 should not be ruled out. The intraday resistance is growing at 21,070 under the all-time high of 21,169.