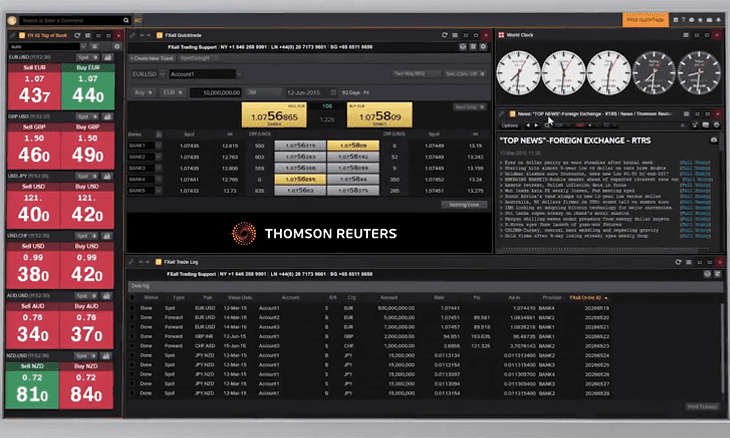

Thomson Reuters enhances FXall and FX Trading desktops for MiFID II execution

Thomson Reuters Corp (NYSE:TRI) just announced completed enhancements to its FXall and FX Trading desktops to ensure clients trading on Thomson Reuters Multilateral Trading Facility (MTF) remain fully compliant with the new MiFID II execution requirements for FX derivatives that will take effect in January 2018. The enhancements enable Thomson Reuters to add MTF-support for…

Read more