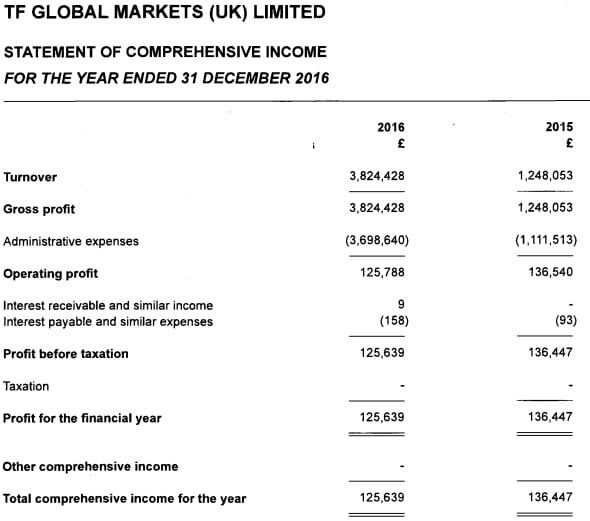

LeapRate Exclusive… LeapRate has learned via filings made in the UK and Australia that ThinkMarkets UK more than tripled its Revenues in 2016 to £3.8 million (USD $5 million).

ThinkMarkets UK, via FCA regulated holding company TF Global Markets (UK) Limited, is the UK arm of Australia-based retail forex broker ThinkMarkets. ThinkMarkets set up its UK arm in mid 2014 following the receipt of an FCA license.

The company remained fairly quiet in the UK after launch, building up its office and management team, until the company globally rebranded from ThinkForex to ThinkMarkets in mid 2016, including the launch of its proprietary trading platform ThinkTrader. (The company also offers MT4). So, most of the $5 million in revenues were actually earned in the second half of 2016, after the rebrand and as the company began a concerted marketing effort around the new brand and platform.

On the bottom line, ThinkMarkets UK turned a modest profit of £125,000 in 2016.

Client assets held by ThinkMarkets UK amounted to £3.8 million at December 31, 2016, up from just £937,000 in 2015.

As with a number of the FCA-licensed subsidiaries of brokers with global operations, we’d note that ThinkMarkets UK clears its trades with the parent company in Australia, so that its revenues are really reported on a cost-plus basis based on its formal agreement with the parent company. However the company’s Revenues do give a very good view into the overall level of activity during the year.

Launched originally in New Zealand in 2010 by brothers Nauman and Faizan Anees, ThinkMarkets relocated its headquarters to Australia in 2012 receiving ASIC licensing. The company expanded to the UK in 2014, as noted above, receiving FCA regulation.

Nauman Anees, ThinkMarkets

LeapRate spoke about the results with ThinkMarkets co-founder Nauman Anees, who had the following to say:

ThinkMarkets latest earnings data shows that the global brokerage firm continues to achieve its corporate objectives.

Since establishing the group’s UK entity we have seen continued growth across all segments, with client recruitment, trading activity & volumes and revenues, trading all in the green.

The firm has seen significant growth on the back of its rebrand last year and has seen a massive uptake of users on its proprietary trading platform, ThinkTrader. Coupled with, stronger than expected volatility with Brexit and the US elections.

ThinkMarkets has a strong sales and business development pipeline going into 2017-2018 and this strengthens the firm’s European presence. The firm is positioning itself as the preferred provider for traders in a number of key growth markets including, the UK, Greece and Germany. Additionally, the firm has a number of strategic partnerships (soon to be announced) in southern and Eastern Europe that will extend its regional footprint.

ThinkMarkets UK 2016 income statement follows: