Shares of binary options platform provider TechFinancials Inc (LON:TECH) plunged by more than 30% on Tuesday, after the company disclosed that it was going to lose its largest client, binary options broker 24option.com.

The decline triggered two successive 5-minute Price Monitoring Extension periods in London Stock Exchange trading in the stock. A Price Monitoring Extension is activated when an LSE stock rises or falls by more a certain percentage in a short period of time.

TechFinancials shared the news as part of its 2016 results Trading Update, which otherwise was fairly upbeat. The company stated that it was going to beat market expectations, with 2016 Revenues to come in at about USD $21 million and EBITDA of not less than $2.8 million. In the first half of the year TechFinancials brought in $9.9 million of Revenues and EBITDA of $1.1 million, so the second half of the year nicely outpaced 1H.

However investors were clearly focused on the loss of 24option as a client, and punished the company’s shares accordingly.

At around the time of TechFinancials’ IPO in early 2015 we had reported that 24option made up about 30% of TechFinancials’ platform revenues, which comprise just over half of TechFinancials overall income. Meaning, 24option accounted for about 15% of overall TechFinancials revenues.

We believe that 24option’s relative importance in TechFinancials’ overall financial picture has become relatively less important since then, as the company has somewhat diversified by bringing in other brands and building its own OptionFair binary brand.

But even at about 10% of overall TechFinancials’ activity, that’s a big hit at a time when the Binary Options brokerage business globally is coming under pressure from regulators.

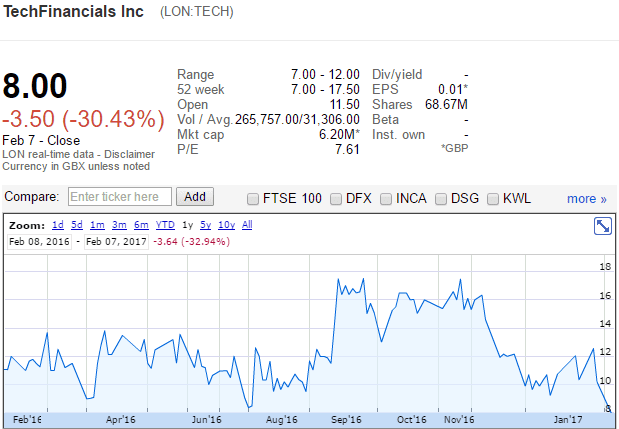

TechFinancials one-year share price graph. Source: Google Finance.