StoneX is making a bold move to solidify its position with a recently announced private offering of $625 million in Senior Secured Notes due 2032, a move directly tied to its planned acquisition of R.J. O’Brien & Associates (RJO), the oldest and one of the largest independent futures brokerage firms in the United States.

StoneX To Raise $625million in Senior Secured Notes

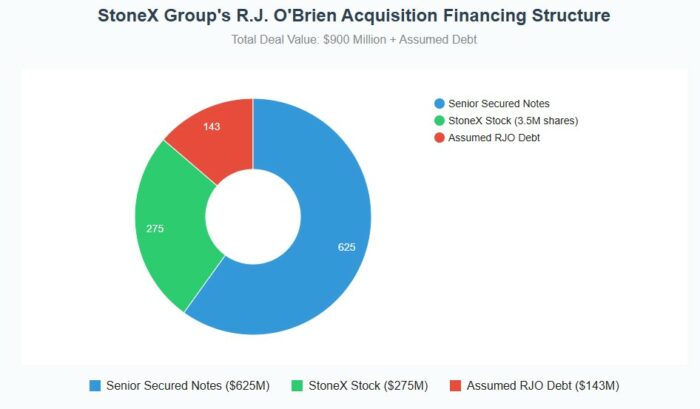

The notes, to be issued by StoneX Escrow Issuer, a wholly-owned subsidiary created specifically for this purpose, will be offered to qualified institutional buyers under Rule 144A and to certain non-U.S. persons under Regulation S. The proceeds will be held in escrow until the RJO acquisition closes, at which point StoneX will assume the obligations under the notes and use the funds, along with existing cash reserves, to finance the purchase and related expenses. The acquisition, valued at approximately $900 million (including cash, stock, and assumed debt), represents a significant expansion for StoneX.

This move is not without precedent. In March 2024, StoneX successfully closed a $550 million Senior Secured Notes offering due 2031, demonstrating its ability to access debt markets. The current offering, however, is larger and directly linked to a transformational acquisition, amplifying the stakes.

The acquisition of RJO is expected to bring significant benefits to StoneX. It will add over 75,000 client accounts and nearly 300 introducing brokers to its network, boosting its client float by nearly $6 billion. More importantly, the consolidation is projected to generate more than $50 million in expense synergies and unlock at least $50 million in capital synergies, according to StoneX. This positions StoneX as a dominant global derivatives clearing firm, enhancing its role across various asset classes.

However, the $625 million debt offering also introduces risks. The increased debt burden will increase StoneX’s financial leverage, making it more vulnerable to economic downturns and interest rate fluctuations. Successfully integrating RJO’s operations and realizing the projected synergies is crucial, but not guaranteed. The market’s reaction to the debt offering and acquisition will likely depend on several factors, including the final terms of the notes, the pace of regulatory approvals for the RJO deal, and StoneX’s ability to demonstrate progress in integrating the two businesses. While the acquisition holds significant promise, investors should carefully consider the associated risks before making any investment decisions.