Dollar under corrective pressure again amid further Trump concerns

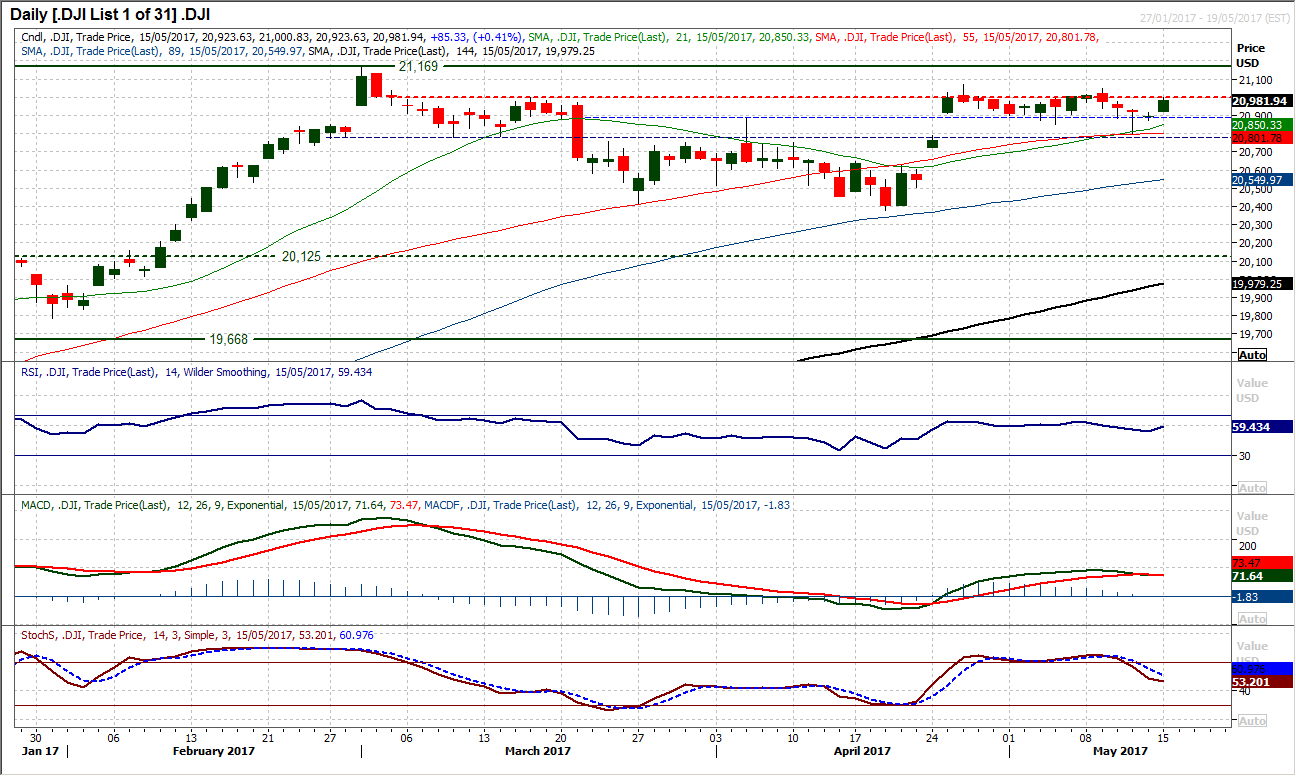

Market Overview The recovery in the price of oil in the last week has been a boost to market sentiment and this has come with the dollar coming under increasing corrective pressure amidst data disappointment and more concern over Trump. Weaker US data is gradually becoming a trend, as the New York Fed manufacturing dropped…

Read more