IC MarketsREVIEW

November 27, 2020

IC Markets Forex Broker Review

Introduction

IC Markets is a True ECN broker with two separate arms: IC Markets AU covers the Australian market and is regulated by the Australian Securities and Investments Commission (ASIC), while IC Markets Global covers many other jurisdictions around the world and carries approval from both the Cyprus Securities and Exchange Commission (CySEC) and the Financial Services Authority of Seychelles (FSA).

The broker was founded in 2007 and provides trading solutions for active day traders and scalpers, as well as traders that are relatively new to the forex market.

Offering of Financial Investments

IC Markets is a forex and CFDs trading broker.

IC Markets offers a variety of CFD and crypto products, but its forex product offering is relatively smaller than other brokers.

The default leverage size of the products can be changed when trading, which is quite useful for traders.

IC Markets Trading Account Types

The account opening process at IC Markets is fast, fully digital, and usually approved within a day. The broker offers low minimum deposit.

IC Markets accepts customers from many countries. Exceptions include the US, Canada and Israel.

The minimum deposit is as low as $200, compared to other CFD brokers, which usually require a minimum of $2,000 or more.

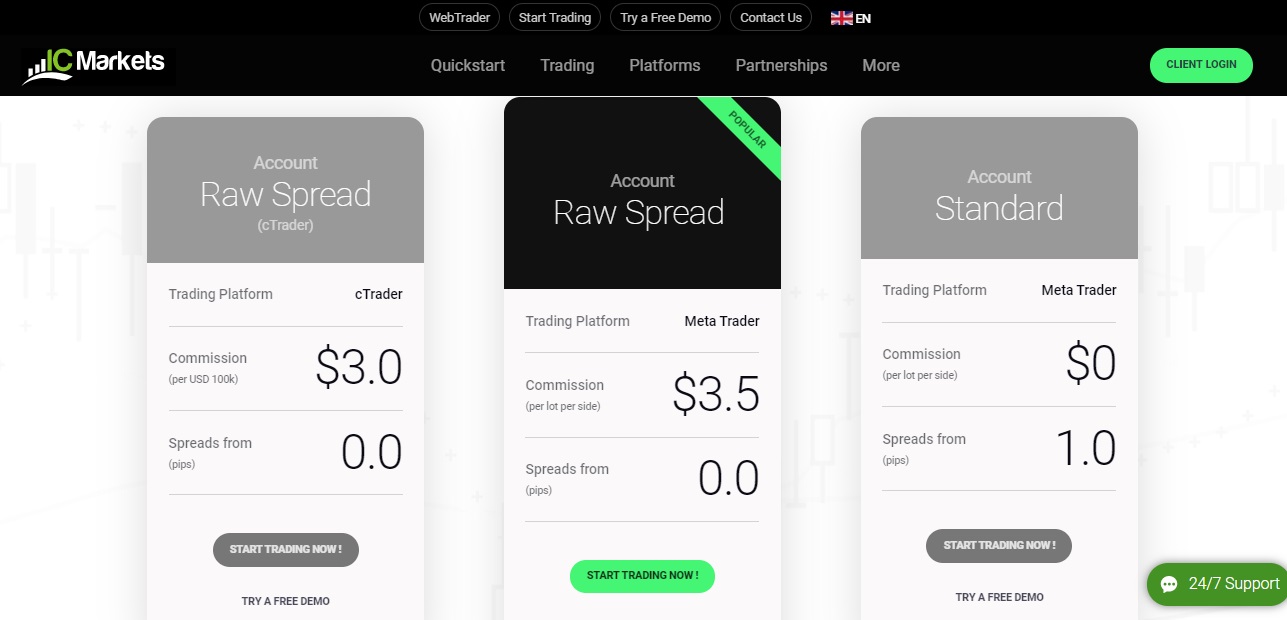

The broker offers three account types – “Raw Spread”, “Raw Spread” (cTrader), and “Standard”.

IC Markets Commission and Fees

IC Markets offers low and no trading fees. There are no inactivity fees nor are there charges for making an IC Markets withdrawal or deposit. However, financing rates for CFDs are relatively high.

IC Markets Platforms and Tools

IC Markets doesn’t have its own self-developed trading platform, therefore it provides trading by the widely known MetaTrader trading platform. MetaTrader platform is available in numerous languages, however, it lacks a two-step login, price alerts, and the design is completely outdated.

The IC Markets WebTrader platform is supplemented by MT4 and MT5 access, while there are further options for both desktop and mobile traders.

IC Markets’ most used trading platform is MT4, although the IC Markets MT5 option continues to gain traction with its greater array of trading options. The broker also offers trading on the cTrader platform.

IC Markets Research

IC Markets offers a great variety of research tools, technical tools, quality news, and charting tools. However, there’s a lack of fundamental data.

IC Markets Mobile Trading App

While there isn’t a dedicated mobile app from IC Markets, traders can still access its key software platforms on iOS and Android mobiles and tablets. Both MetaTrader and cTrader have mobile apps that can be downloaded to devices.

Should I trade with IC Markets?

IC Markets is regulated by several financial authorities globally, including ASIC, CySEC and the FSA of Seychelles. That helps traders to have the confidence that this is a highly regulated broker that must act in the best interests of its clients at all times.

IC Markets provides negative balance protection for EU retail customers, which means that if an account balance goes into negative, the trader will be protected. However, the broker provides only forex and CFDs products for trading. All client funds are held in segregated accounts with major financial institutions too.

Pros

- Well established, licensed and regulated broker

- Comprehensive suite of Forex, CFDs and crypto to trade

- Rapid account opening

- No fees or charges

Cons

- Lack of educational content

- No dedicated app

FAQs

Is IC Markets a True ECN Broker?

Yes, IC Markets is a true ECN broker across Forex CFDs, offering trading on more than 236+ financial instruments across forex, commodities, indices, bonds, cryptocurrency, stocks and futures on the MT4, MT5 and cTrader trading platforms.

Does IC Markets Offer an Islamic Account?

Traders at IC Markets can apply for their Islamic account, which does not charge interest and instead offers raw pricing on a trade. The IC Markets Islamic account is available swap free across the broker’s platforms, with low charges for positions held overnight in a number of Forex pairs.

How Do I Open an IC Markets Account?

Click the ‘start trading’ button and you will be taken to the account registration page. Fill in your details, and once verification has been confirmed the account will be live and you can login. You can opt for a demo account or trade for real money straight away.