AdmiralsREVIEW

March 05, 2020

Admiral Markets Forex Review

Admiral Markets was founded in 2001 and is regulated in two tier-1 jurisdictions and two tier-2 jurisdictions. The company is authorised by the Financial Conduct Authority (FCA), Australian Securities & Investment Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC).

Offering of Investments

- Forex: Spot Trading

- 47 currency pairs

- 3844 CFDs

- Social Trading / Copy-Trading

- Cryptocurrency traded as CFD

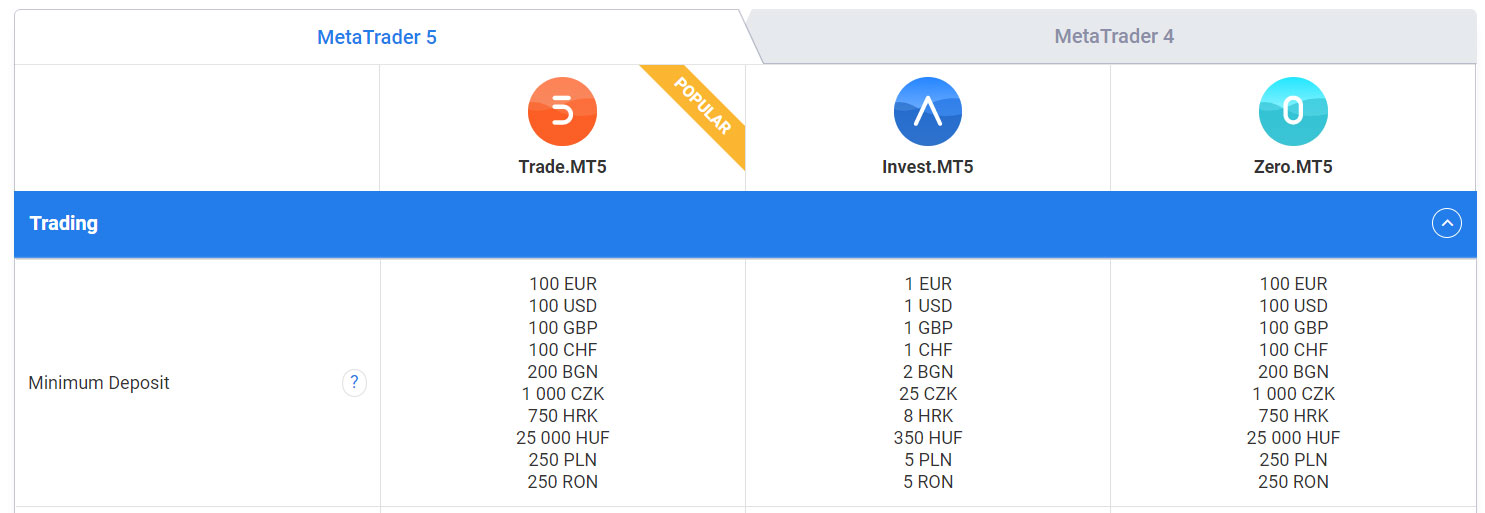

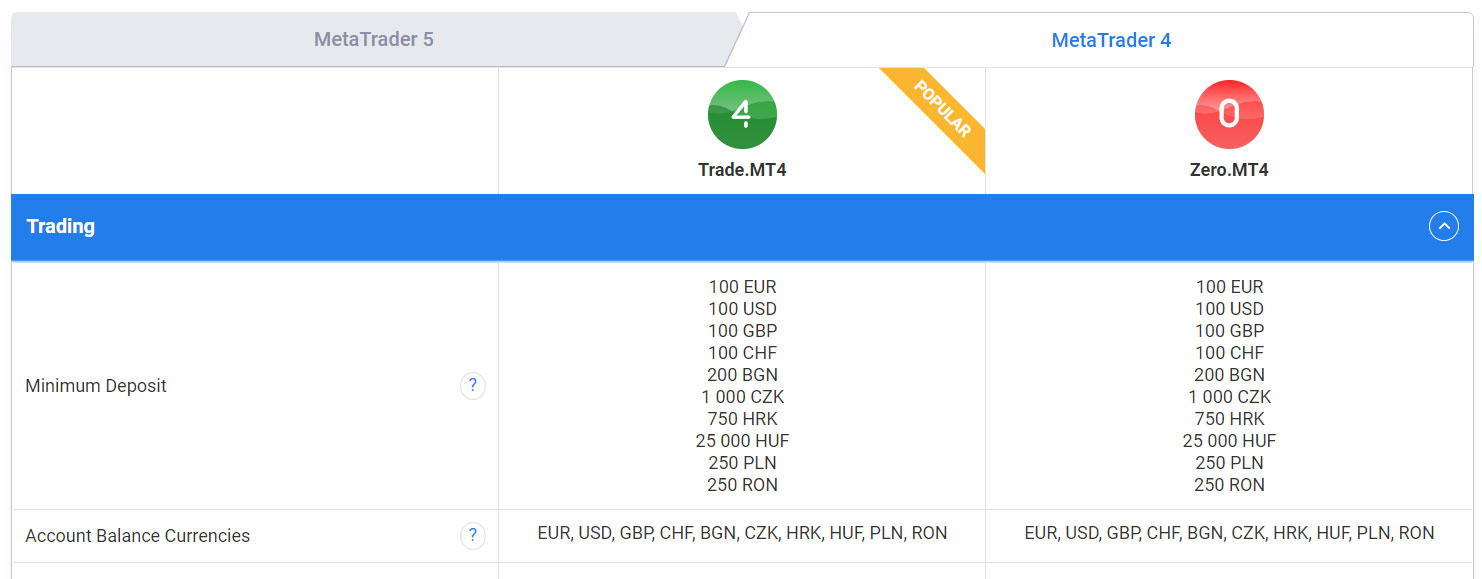

Admiral Markets Account types, Commissions & Fees

Admiral Markets offers four account types with a range of fees and products to trade on the market. When calculating the all-in cost to trade, including spreads plus any commission, pricing is similar across all account types, with ranges from 0.6 pips to 0.7 pips (referencing September 2019 data).

Account differences: The broker’s MT5 account (or MT5 Invest for exchange-traded stocks) provides the broadest number of symbols to trade, whereas those focused on just on forex may gravitate to the Admiral Prime MT4 account. The lowest all-in cost (spreads plus any commission) are found in the Admiral Prime account, which unfortunately has a drastically smaller range of tradeable symbols.

No dealing desk: The company provides agency execution across all account types and does not operate a dealing desk or take risk internally. Admiral Markets acts as an agency broker by routing client orders to its parent company, Admiral Markets AS, which is its sole liquidity provider for all its group companies.

Visit Broker SiteTrading Features

- Minimum Initial Deposit – 200

- Average Spread EUR/USD – Standard 0.6 (Aug 19)

- All-in Cost EUR/USD – Active 0.7 (Aug 19)

Admiral Markets Platforms & Trade Tools

Admiral Markets is a MetaTrader broker and stands out thanks to its MetaTrader Supreme offering (available for MT4 and MT5), which consists of a suite of 12 expert advisors and 20 custom indicators.

Some of the useful add-ons provided through the Supreme offering include showing news events plotted as small color-coded alarm bells on the chart. There are also other subtle tools, such as a candle countdown timer and a spread widget. Lastly, Trading Central is also available.

Advanced tools: Admiral Markets offers a unique set of volatility protection tools, helping you control inherent risks associated with agency execution, including slippage and market gap scenarios.

Research Tools Offered to Traders

Admiral Markets provides a good range of research tools to catch up with the market, as well as resources across its website and trading platforms.

Premium Analytics: Through Admiral Markets Premium Analytics (free for customers), traders gain access to a Dow Jones News calendar, Trading Central signals, and sentiment widgets from Acuity Trading. Other tools include heat maps, fundamental and technical analysis content, and Elliot Wave Analysis.

Admiral Markets Mobile App Trading

Depending on the account type you open at Admiral Markets, either the MT4 or MT5 app comes standard, available for both Android and iOS. Unfortunately, the unique add ons provided with the desktop platform do not translate to mobile. As a result, scoring for this category matches that of other MetaTrader-only brokers.

Should I trade with Admiral Markets?

Admiral Markets offers the entire MetaTrader platform suite, as well as a variety of add-ons and trading tools. A competitive range of tradeable products for trading and research not often found in MetaTrader-only brokers are also available for MetaTrader enthusiasts.

Visit Broker SiteFAQs

Is Admiral Markets safe?

Admiral Markets is a legit broker with a high trust score and good reputation. It has been operating since 2001 without any scandals. It is regulated by the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC). Client funds are held in segregated bank accounts with tier-1 banks.

Is Admiral Markets an ECN broker?

Admiral Markets is an ECN broker. It offers ECN accounts with zero pip spreads and instant market execution. Commission is $3.00 per lot. Its high speed ECN technology comes from AMTS Solutions. It doesn’t provide the MT4 ECN bridge for network connection, however. It offers other account types alongside ECN.

Do Admiral Markets offer an Islamic Account?

Admiral Markets offers a swap free Islamic Account specially designed for Muslim traders. No interest is paid or received on the account for as long as it is held. There is no spread widening and there are no specific up-front commissions. The same trading conditions apply as on standard accounts.