Trade360 Forex BrokerREVIEW

November 25, 2020

Trade360 is an online CFD and forex broker that is based in Cyprus. It is owned by the Cypriot investment firm Crowd Tech Ltd and is regulated by the Cyprus Securities and Exchange Commission (CySEC).

Offering of Financial Investments

The brokerage offers a wide range of instruments available to trade as CFDs, including a variety of forex currency pairs and zero commission stocks. Leverage is between 1:5 and 1:20. At Trade360 bitcoin trading is also offered, alongside other major digital currencies. Instruments offered include:

- Forex

- Stocks

- Indices

- Commodities

- ETFs

- Cryptocurrencies

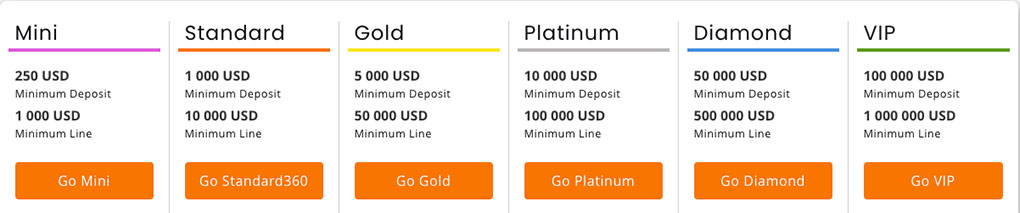

Trade360 Trading Account Types

Trade360 offers a range of account types to cater for traders at all levels, from a Mini account, which can be opened with a $250 deposit, up to a VIP account, which requires a minimum deposit of $100,000. Features vary between accounts, but all accounts allow access to Trading Signals and a live CrowdTrading feed, as well as 24/7 support. Unauthorised activity, such as scalping, can lead to immediate account suspension.

Trade360 Commission and Fees

This brokerage offers competitive spreads and reasonable fees, with very few hidden extras. Zero commission stocks trading is available. At Trade360 withdrawal and deposit are free of charge, though fees may be levied by your bank or other payment processor. Hedging positions may incur an administration fee of 0.1%. Spreads vary according to the account type and instrument being traded, but are clearly displayed within the platform.

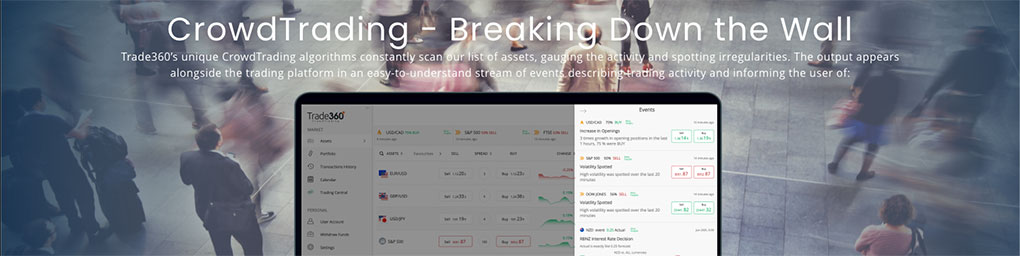

Trade360 Platforms and Tools

Trade360 offers a variety of platforms, including its own proprietary WebTrader and the ever-popular MetaTrader 5. There is an award-winning mobile trading app available, and Trade360 also provides clients with its unique CrowdTrading platform, allowing traders to easily monitor trends and market events, and how other online traders are reacting to them. Trading Signals are also provided free, three times a day, via Trading Central.

Trade360 Research

The broker provides research and analysis for its clients in the form of a daily market report covering market events, daily news and announcements that may have an impact on trading. This provides a review of the market, suggests targets to aim for, and identifies resistance and support levels, with regard to a range of assets.

Trade360 Mobile Trading App

The mobile trading app is available free for both iOS and Android devices, and provides all the same features and functions as the other trading platforms, albeit with a slightly different interface. CrowdTrading is available via the mobile apps, as is the Trade360 position simulator, allowing you to test positions before committing to them.

Should I trade with Trade360?

It is vital to check that any broker you invest with has all the features you need to meet your own individual requirements. However, our Trade360 forex broker review has shown that this brokerage has many features that make it an option worth considering for traders at all levels.

Pros

- Fully regulated

- Variety of instruments

- Good choice of account types

- Several platforms to choose from

Cons

- No bonus available (not permitted by CySEC)

- Does not cater to US clients

FAQs

How do you sign up with Trade360?

Simply go to the Trade360 login area of its website and click on ‘Register Now’. Opening an account is quick and easy and can be done entirely online. You will need to provide a government-issued ID as proof of identity and also proof of your address to verify your account.

Is Trade360 safe?

It is natural to worry that an online broker could turn out to be a scam, but Trade360 is a genuine broker with all the required regulation and authorisation in place. All legal documentation, terms and conditions, and risk warnings can be accessed from the footer of the website’s homepage.

What are Trade360’s platforms?

The broker provides a proprietary WebTrader platform, Trade360 MT4 and MT5, and a mobile trading platform, accessed via apps. These apps are free to download. It is also possible to access the broker’s CrowdTrading software and Trading Central, which is the leading provider of trading signals for retail traders.