Equiti BrokerREVIEW

May 05, 2021

Equiti is an international, fully regulated, trusted forex broker based in Amman, Jordan, and operating across the Middle East, Europe, the Americas, Africa, and the Asia Pacific region. Founded in 2008, the firm is regulated and licensed by various regulatory bodies across the jurisdictions in which it operates, including the Financial Conduct Authority (FCA) in the UK. Equiti, which is under the leadership of CEO Iskandar Najjar, provides individual and institutional clients worldwide with easy access to equity global markets, with over 300 specialists around the world and an excellent customer support service, offered in nine languages. The firm is well-known as a reputable forex online broker, but is in fact a multi-asset brokerage with various financial instruments on offer.

Visit Broker SiteOffering of financial investments

Equiti offers a wide range of tradeable instruments, including more than 60 currency pairs, with a choice of major, minor and exotic pairs. Commodities, single shares and indices are also available. Some instruments are available to trade as CFDs, and leverage of up to 1:500 is offered for forex and precious metals, dependent on the exact instrument being traded. All instruments can be traded from one convenient online trading account. At Equiti customers can trade:

- Forex

- Stocks

- Commodities

- Metals

- Indices

- CFDs

Equiti Trading Account Types

Equiti offers customers the choice of either an Executive Account or a Premiere Account. Most online traders will find that the Executive Account meets all their needs, offering direct market access, fast order execution, MetaTrader 4 trading, and access to a broad range of instruments and asset types. This account allows you to trade with micro or standard lots, and use the broker’s ECN technology to access top liquidity providers and competitive spreads on every instrument. This account comes with a minimum deposit requirement of $500, and typical forex spreads from 1.6 pips.

The Executive Account is suitable for both novice and more advanced traders. However, if you are a professional trader, you may have specific requirements that are better met by the higher-level Premiere Account. This offers more competitive trading terms and deep liquidity, with institutional-level pricing available. The account comes with the MetaTrader 4 trading platform, Expert Advisors, access to No Dealing Desk execution, and a range of free research tools. The minimum deposit for this professional-level trading account is $20,000. Typical forex spreads on this account start at a very competitive 0.2 pips. Equiti also provides a risk-free demo account to allow new customers to familiarise themselves with the platform and try out new trading strategies.

Equiti Commission and Fees

At Equiti, the commissions and fees charged will depend on the type of account you hold, and, of course, the instrument you are trading. With an Executive Account, there are no commission charges, meaning that the broker profits come from the spreads. At Equiti, floating spreads are used, which means that they change frequently depending on market conditions. On the Executive Account, spreads start at 1.6 pips. Spreads vary greatly across forex pairs, and are, of course, different for each asset class. On the Premiere Account, the spreads are even tighter, starting at just 0.2 pips, but there is a small commission charge levied on some instruments. This charge is based on the nominal currency amount, and is $70 per $1m on forex trades. You can use the Equiti forex pip calculator over at the website to help you estimate the potential profit and loss on each trade, which will help you employ good risk management techniques. As with most brokers, swap fees are charged on positions held open overnight.

There are also a few extra fees to be aware of at this broker. For example, a monthly inactivity fee may be charged on any online trading account that has not been used for a period of 180 days. Inactivity can also result in the account being automatically closed, though Equiti notifies clients in advance before charging an inactivity fee or closing an account. All fees and charges are laid out clearly in the Client Agreement, which can be found on the website. Be aware that fees at any brokerage are subject to change, sometimes at short notice, so check the Client Agreement carefully before you register for your new account.

Equiti Platforms and Tools

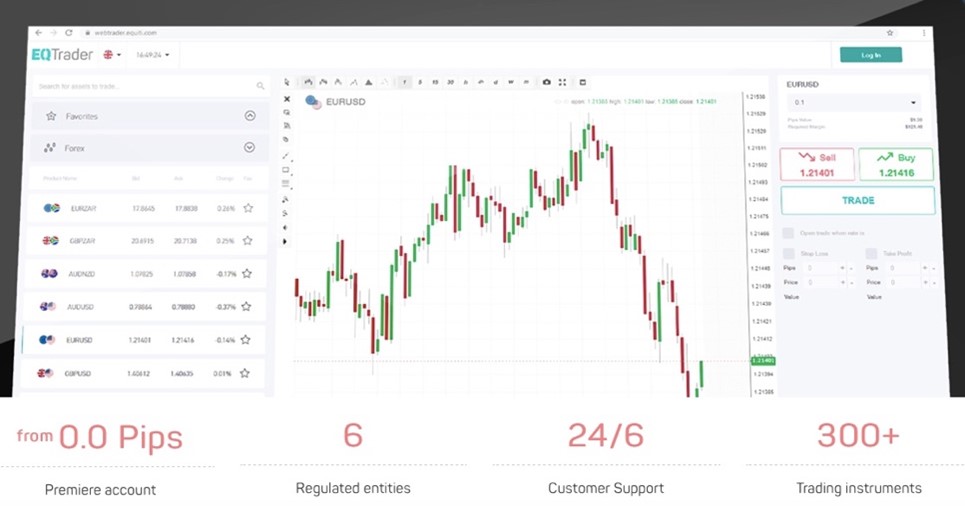

Equiti offers trading via the MetaTrader 4 platform or via EQ Trader, which is its browser-based Web Trader platform. If you have previously used a MetaTrader 4 broker and are familiar with the platform, then you will no doubt be happy to use MT4 software at Equiti, gaining access to the variety of trading tools, technical indicators, and third-party applications you are used to. The MetaTrader 4 platform is highly versatile, offering advanced charting tools, automated trading, and multiple time frames, and is popular with forex and CFD traders worldwide. EQ Trader is a straightforward, web-enabled platform that can be used from almost any device, and also has plenty to offer, with six charting types, and around 50 indicators, along with nine different time frames. This platform also displays your trade value and margin requirement in the trading panel before a trade is placed. This enables efficient risk management on every trade.

Visit Broker SiteEquiti Research

Equiti provides an excellent range of research and education tools. Relevant market news, articles and technical views can be found under the ‘Insights’ tab over at the website, along with a daily market wrap-up, summing up what traders need to know on any given day. There is also a weekly market update, The Week Ahead, released each Monday, where a senior market analyst covers the main events and news that could impact the markets in the coming week. Additional free research tools are available to Premiere Account holders. In addition, there is a well-stocked education portal on the website, found under the ‘Academy’ tab. This is where you will find guides, workshops, video tutorials and webinars on all aspects of online trading, along with a useful and very comprehensive glossary of trading terms. The education section includes an in-depth beginner forex trading course, as well as information on trading strategies, CFDs, stocks, and how to get the most out of the trading tools that the broker provides.

Equiti Mobile Trading App

This broker offers a convenient mobile trading app, which can be downloaded free for both iOS and Android devices. The app can be found in both the Apple App Store and the Google Play store. Mobile trading allows access to all the same assets and most of the same features and functions as the desktop and web-based platforms. However, as is often the case, there is not quite the same level of customisation and functionality on the app as on the other platforms. The app allows for one-touch trading and can be set up to show market news, alerts and notifications. Remember that the EQ Trader platform is a web-based platform, so it can also potentially be used for mobile trading, as it can be accessed directly from your browser using almost any device.

Should I trade with Equiti?

As our Equiti broker review has shown, this is a reliable, regulated broker, and is well worth trying if you are a forex trader looking for a user-friendly trading platform with reasonable costs. Although the firm’s focus is forex trading, the platform also allows for easy trading of multiple assets, all from one account. With over 60 forex pairs, more than 240 shares, and a number of indices to choose from, there is a good choice of assets. Mobile trading, MetaTrader 4 trading, automated trading and CFD trading are also available, and while the broker’s services are not available in every country, there is fairly good global coverage for international clients. For those looking for a reliable online brokerage, Equiti is certainly one to consider.

Pros

- Fully regulated

- Choice of account types

- Over 60 forex pairs

- Mobile trading

Cons

- No bonus offered

- No cryptocurrencies

FAQs

What’s the minimum deposit to open an Equiti account?

There is a minimum deposit of $500 on the Executive Account and $20,000 on the Premiere Account. This deposit can be made as soon as your live online trading account is up and running, using a debit or credit card, Neteller or Skrill. Account currencies accepted are USD, EUR, GBP and AED.

Is Equiti a safe or scam broker?

Equiti is a safe and legitimate online broker. The broker is fully regulated in the UK by the Financial Conduct Authority (FCA) and is regulated by other relevant bodies in other jurisdictions. All of the required legal documentation, risk warnings, and terms of use can be found at the website.

Does Equiti offer a demo account?

Yes. Equiti offers a risk-free demo account that can be opened quickly and easily. You will just need to enter your name, email address, country of residence and phone number. You can then start trading with virtual money. When you are ready, you can upgrade from a demo to a live account.