BDSwissREVIEW

July 14, 2020

Trading in Forex/ CFDs and Other Derivatives is highly speculative and carries a high level of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent advice if necessary. Speculate only with funds that you can afford to lose.

BDSwiss Forex Broker Review

What is BDSwiss?

BDSwiss was founded in 2012. The broker is regulated under Financial Services Commission (FSC), Mauritius and the Financial Services Authority (FSA), Seychelles.

BDSwiss offers trading under FSA (and more than 1000+ CFDs under FSC) covering Forex, Commodities, Cryptocurrencies, Indices, ETFs and Equities.

Clients can also access AutoChartist and live trading alerts via Telegram, depending on account type. Customer service is offered 24/5.

Education

BDSwiss offers educational events via live analysis and educational webinars and seminars. The broker also offers a beginner to advanced courses in its Trading Academy.

Trading platforms

The broker offers trading via MetaTrader 4 and MetaTrader 5 trading platforms, as well as its own BDSwiss Web Trader and BDSwiss Mobile App.

Visit Broker SiteThe BDSwiss Forex MT4 platform offer includes:

- An easy to use interface

- The ability to overlay analytical studies

- Daily account statements

- Compatibility with BDSwiss Web Trader and mobile apps

- Regularly updated news feeds directly on the platform

- Multiple charting and analysis options

- Real time client account summary

- Free preprogrammed analytical tools

- Multi-language features

- Including account equity, floating profit and loss etc.

The BDSwiss Forex MT5 platform offer includes:

- Multi-Asset trading on +1000 CFDs

- Daily account statements

- Automated trading with Expert Advisors

- Ability to display 100 charts simultaneously

- Supports advanced order types, including pending, stop orders and trailing stop

- Full access to your account and history

- Internal mailing system

- The ability to overlay analytical studies

- Over 80 Technical Indicators and over 40 Analytical Objects

- Multi-language features

- Set Stop Loss and Take Profit levels

- Multiple charting and analysis options

- Built-in MQL5 development environment

BDSwiss WebTrader Platform does not require downloading and it is fully synchronised to the downloadable versions of the MT4, allowing for live price monitoring via an advanced market watch. The trading platform is translated in more than 24 languages and also features:

- Intuitive Order Window

- Transparent & Secure Trading on any Device

- Fully synced with the BDSwiss App & MT4

- Fast Order Execution, no Requotes

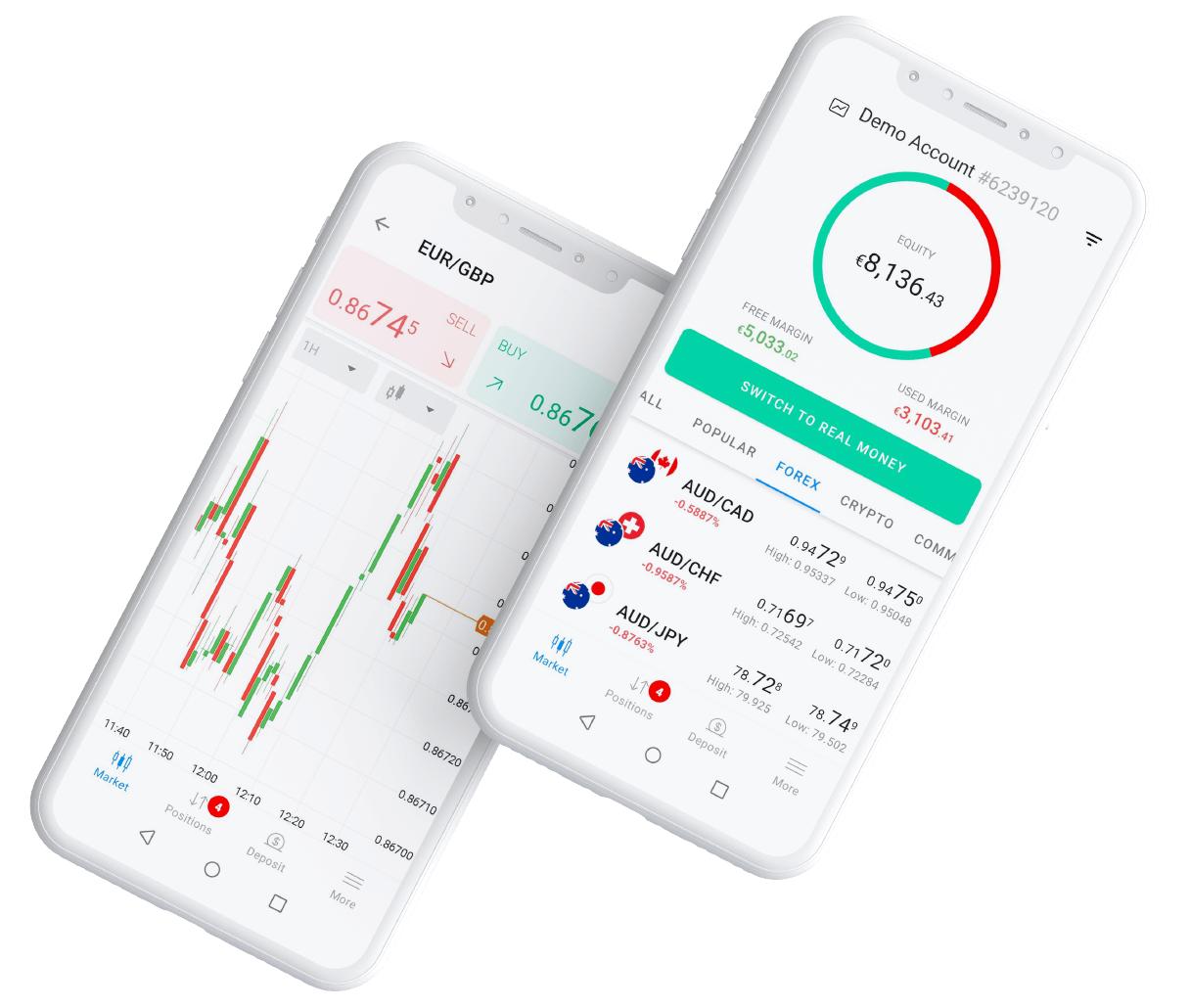

BDSwiss Mobile App provides traders with:

BDSwiss Mobile App

- Real-time Quotes

- Interactive Charts

- Clean, User-Friendly Interface

- Full Trading & Transactions History

- Deposit and Withdraw Functionalities

- Account Set Up & KYC Verification

- 24/7 Cryptocurrency Pairs Trading

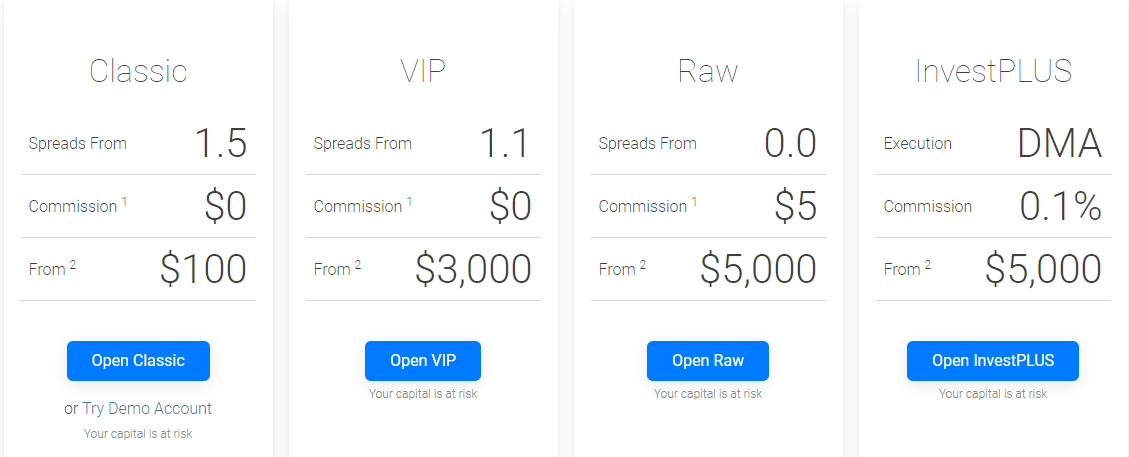

Account types

BDSwiss offers three main types of trading accounts which includes:

- Cent

- Classic

- Premium

- VIP

- Raw

- StockPlus

All accounts can be opened at the click of the button or using the Sign-Up button on the broker’s website.

Leverage

Leverage is offered up to 1:500 depending on the jurisdiction of account opening.

Deposit & Withdrawal Methods

BDSwiss’ clients can easily deposit and withdraw funds by using a variety of methods such as credit and debit cards, bank wire transfers, Skrill and Neteller. More detailed information can be found in the Payments section of the BDSwiss client portal area.

The broker offers zero fees on deposits and withdrawals processed via credit card. Keep in mind that withdrawals below 20 EUR will be charged a fixed fee of 10 EUR. Withdrawal via bank wire under 100 EUR will also be charged a fixed fee of 10 EUR.

There are also inactivity fees for inactive and dormant accounts.

Conclusion

BDS Markets (www.bdswiss.com) is authorised and regulated by the Financial Services Commission (FSC), Mauritius and the Financial Services Authority (FSA), Seychelles.

BDSwiss’ clients can trade on more than 1,000+ CFDs under FSA covering Forex, Commodities, Cryptocurrencies, Commodities, Indices, ETFs and Equities. Clients can choose from 4 account types and can trade on the MetaTrader 4 and MetaTrader 5 trading platforms, as well as the brokers own BDSwiss Web Trader and BDSwiss Mobile App.

BDSwiss clients have access to AutoChartist and live trading alerts via Telegram, depending on account type. Customer service is offered 24/5.

- Multiple regulations.

- Commission-free trading accounts and markets available.

- Access to raw spread trading available.

- Can trade on MT4 and MT5, as well as own BDSwiss web and mobile trading platform