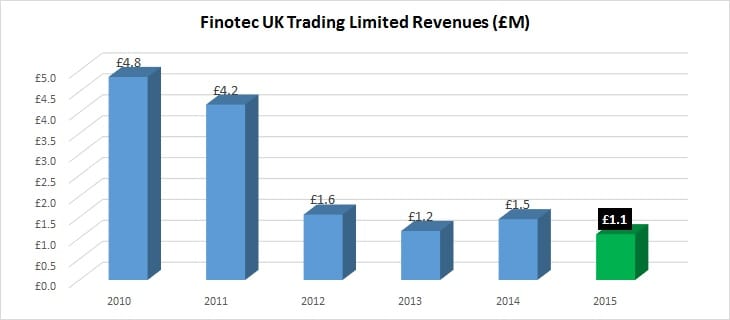

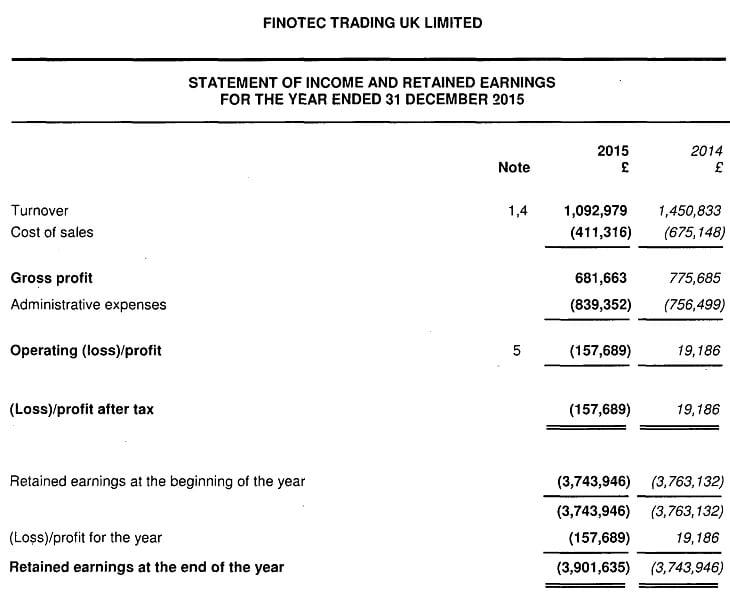

LeapRate Exclusive… LeapRate has learned that FX Prime Brokerage solutions provider Finotec brought in just £1.1 million (USD $1.6 million) of Revenues in 2015, reporting a net loss of £158,000 ($230,000). The Revenue figure was Finotec’s lowest result in several years.

Finotec Trading UK Limited, the FCA regulated UK arm of Finotec Group Inc, underwent a change a few years ago from being a market making firm for institutional and retail Forex and CFD traders, to a matched principal agency model serving mainly retail forex brokers and white label operators.

More recently, Finotec has been focusing on selling what it calls a ‘Trading Name Package’ full broker solution. For what we understand is a $20,000 setup fee plus a volume based monthly license fee, Finotec is now offering those wanting to start a forex brokerage (or those already running one) the ability to piggyback off of Finotec’s FCA license and serve up an FCA regulated offering, with Finotec taking care of compliance and back office and regulatory functions including online KYC and AML verification, an MT4 trading platform, pre-aggregated data feed and execution, and A/B book flow management.

Finotec’s business model is fairly simple. It purchases net open position lines from prime brokers at $5-6 per million, while aggregating and reselling them to their own clients at prices varying from $10-15 per million. However that business model relies on large volumes, which Finotec has not yet built up (or at least hadn’t by the end of 2015). Finotec cleared $65 billion of client transactions during the year, or $5.42 billion per month.

Given the company’s financial condition, Finotec’s directors stated that ‘circumstances represent a material uncertainty that casts significant doubt upon the company’s ability to continue as a going concern‘. The directors’ concern was also noted by Finotec’s auditors Berg Kaprow Lewis LLP. The company’s directors also stated that (as of the beginning of 2016) Finotec was in advanced talks to get a significant injection of capital in the ‘near future’. However there has been no news of an outside (or insider) fundraising since then.

Finotec’s 2015 income statement follows: