LeapRate Exclusive… LeapRate has learned that FCA regulated Retail FX and CFDs broker Valutrades will soon be posting its financial statements with regulatory authorities, indicating that the company continued to grow its revenue base in 2016. However, the growth has come at the cost of increased losses at Valutrades, leading the company’s shareholders to put more capital into the company.

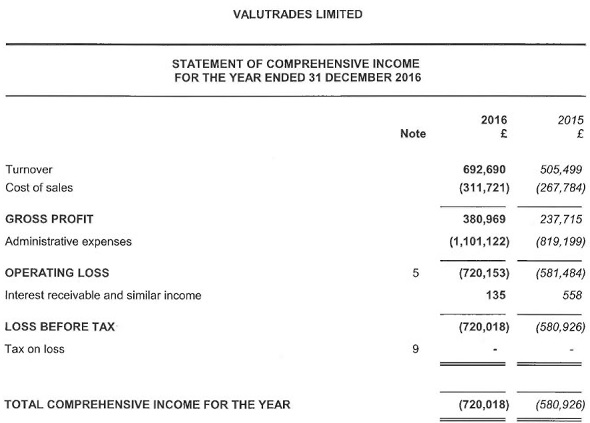

Overall, Valutrades grew its Revenue from £505,000 in 2015 to £693,000 in 2016 – growth of 37%. However admin and marketing expenses also grew during the year as the company continued to build systems, added a new payment solution, revamped its CRM system and launched a new website, resulting in a £720,000 net loss in 2016, versus £581,000 the prior year.

To cover the losses, Valutrades shareholders put in an additional £1.2 million of capital into the company during 2016, which was previously exclusively reported by LeapRate.

Valutrades was originally set up about four and a half years ago as the FCA-regulated UK arm of Indonesia-based retail forex broker Monex Investindo Futures, that country’s leading online broker. (Not to be confused with Monex Group of Japan, an unrelated company). At the time, Anil Bahirwani was CEO of Monex. However Bahirwani left active management of Monex and took direct control (along with business partner Mohandas Lakhiani) of Monex UK, renaming it Valutrades in early 2014.

During the year, as part of its recapitalization and restructuring noted above, Valutrades changed its MT4 white label to AMB Prime, a Cyprus-based CySEC licensed company which is also owned by Anil Bahirwani. (With the “AMB” of AMB Prime standing for Anil M. Bahirwani).

Graeme Watkins, Valutrades

LeapRate spoke with Valutrades CEO Graeme Watkins about the results, and how the company is doing so far in 2017. He had the following to say:

2016 represented both a difficult but yet really exciting year for Valutrades. While the bottom line numbers were disappointing we were able to raise more capital than we lost ending the year in a much stronger position than we started. At the same time we remained 100% committed to our goals of excellent customer experience and growth above profits which we believe will deliver a solid foundation for the long term.

We were also able to pivot our strategy to focus on content and inbound marketing. This is already showing a sharp increase in our performance for 2017 with highlights so far a 100% increase in the average number of accounts opened each monthly and record high volumes.

Valutrades 2016 income statement follows: