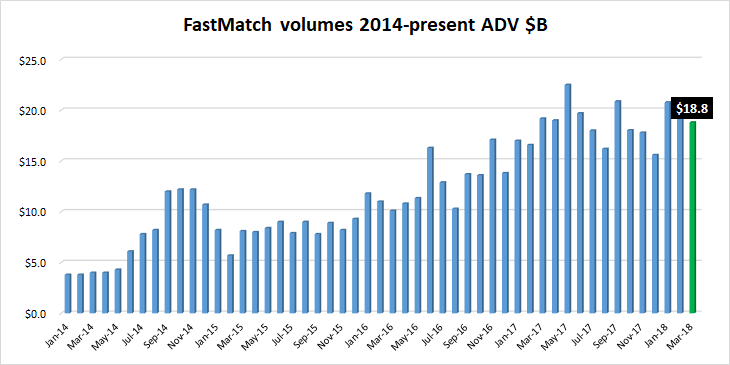

After a stellar start to 2018 trading, Forex ECN FastMatch has reported a somewhat expected decline in activity during the month of March.

After seeing two of its best months ever in January and February, FastMatch FX trading volumes declined by 11% MoM in March 2018, coming in at $18.8 billion ADV.

FX trading volumes at FastMatch averaged $21.1 billion daily in February 2018, up 1.6% from January’s $20.8 billion. Although March volumes weren’t quite that good, they still topped the daily average of $17.1 billion seen at FastMatch during all of Q4-2017.

As noted above February 2018 was FastMatch’s second best month ever, slightly behind a record $22.5 billion ADV set in May 2017.

As was exclusively reported at LeapRate last month, FastMatch saw fairly weak Revenues of just €1.57 million monthly in the last few months of 2017. However, given the uptick in trading volumes, it looks like those figures will improve in Q1-2018.

FastMatch has been very active the past few months, outside of the FX volumes count. Last month the company named Alain Courbebaisse as its new Chairman, replacing Lee Hodgkinson. FastMatch announced the opening of a new sales office in Greenwich CT late last year, located near some of its major customers. FastMatch also recently stated that it was opening up its FX tape data to the general public.

FastMatch also got a new look and logo (see above) in December from new owner Euronext NV (EPA:ENX). FastMatch’s three shareholders – Global Brokerage Inc (NASDAQ:GLBR), Credit Suisse and BNY Mellon Corp – announced in May 2017 that they were selling 90% of the company to Euronext for $153 million. The transaction closed in mid August.