LeapRate Exclusive: The start of 2020 has been rough for many because of the Coronavirus crisis, but for the online broker ActivTrades this has been the best start of the year in its history. So far, it seems that 2020 is going to be the broker’s most profitable year yet with first half profit surging to £18 million.

Commenting to LeapRate, ActivTrades’ CEO Alex Pusco, stated:

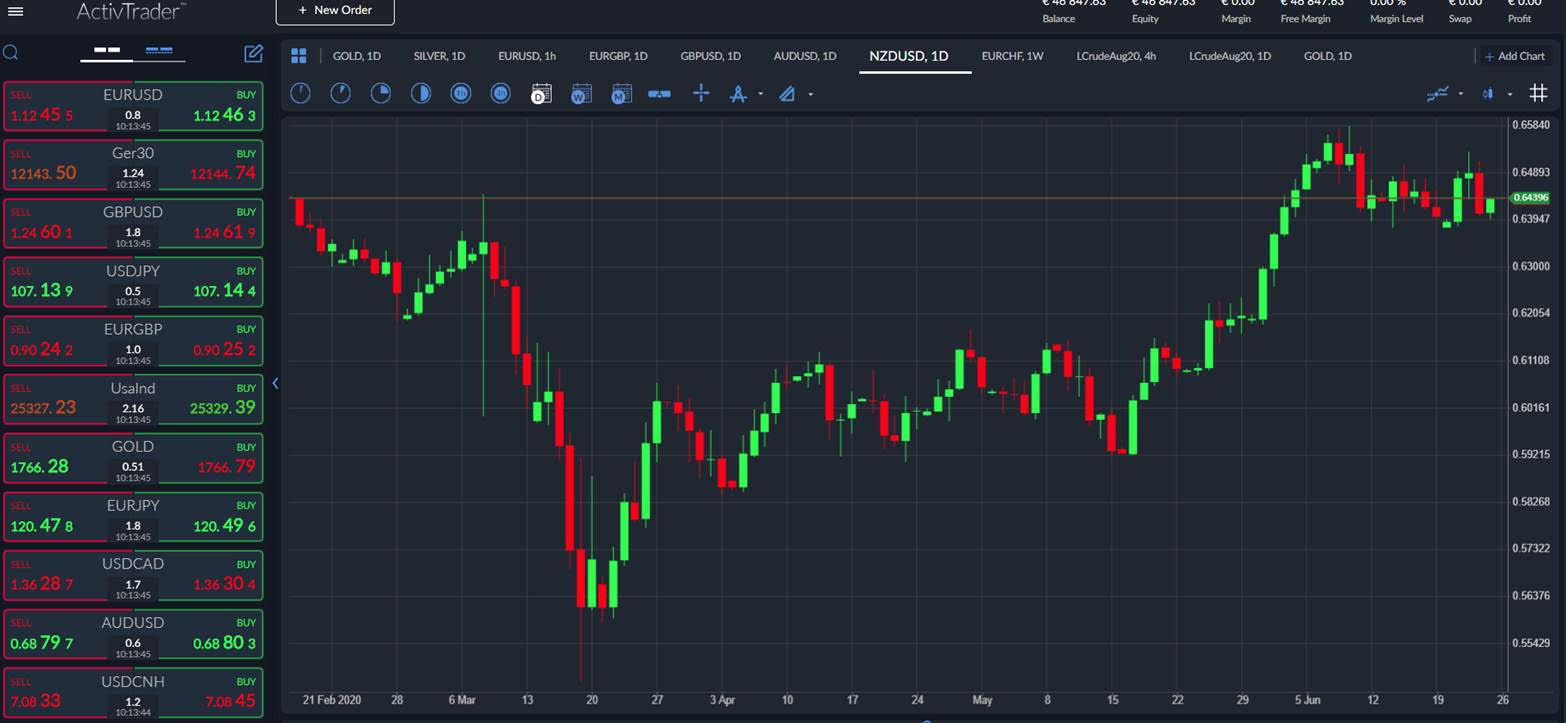

2020 has exceeded our expectations with ActivTrades having its best start to the year in our history. We have seen a jump in the number of clients and the successful launch of the ActivTrader platform, which is now widely used by our traders.

Moreover, volatility’s dramatic return to markets as a result of the coronavirus pandemic has helped boost revenue to £30 million, more than three times the £8 million recorded in the same period last year and already well ahead of the £20.6 million we recorded in the whole of 2019. Similarly, 2020 is on track to be our most profitable year yet with first half profit surging to £18 million.

LR: Have you done anything differently to last year to explain such a dramatic rise in both top and bottom lines?

Yes, these excellent figures bear testimony to the success of our ActivTrader platform, which is both easy to use as well as providing fast execution of orders. We’ve been continuously adding products to the platform, most notably two innovative CFDs tied to the spot price of the world’s two largest oil benchmarks, WTI and Brent.

LR: How did these new products perform given the plummet in oil prices seen earlier in the year, with WTI even seeing negative prices?

These products were quickly developed in response to previously unforeseen prices on oil contracts nearing expiry. We wanted to offer our clients an alternative solution to traditional products that would enable them to gain exposure to oil prices without having to worry about rolling over their positions. With no commission on CFDs, these products have proven very popular and we expect to see their popularity continue to grow. Equally, we are always looking to innovate and offer our clients smart solutions to new problems as markets continually evolve.

LR: What have been your most popular products so far this year?

Currency trading is very popular among our investors, not just the euro/dollar, but also pairs including the Aussie and New Zealand dollars, where there’s been a huge amount of volatility. We have also seen strong volumes on oil, both Brent and WTI, and with the dramatic movements of the last few months we have seen increasing interest for shares trading.

Although market conditions clearly have played a part in the growing popularity of shares, it also reflects the lower commissions we implemented a few months ago. We cut our commission on the majority of European markets to just 0.01%, meaning it costs only €5 to trade €50,000 worth of shares.

LR: What are the growth areas of the business?

As well as launching new products to tune in with subtle changes in demand, our main focus is expanding ActivTrades into a truly global business. London will always remain the headquarters but with the UK facing an uncertain future post-Brexit, our office in Luxembourg is likely to become increasingly important in providing a crucial base in the heart of both Europe and the European Union. Further afield, we are growing our presence in South America, Africa and Asia, most notably in Malaysia, with our site now also available in Malay.