Well it does look like Bitcoin continues to go more ‘mainstream’, with some of the world’s leading trading venues finally taking note of the large crypto trading volumes driving results at some of the leading online brokers.

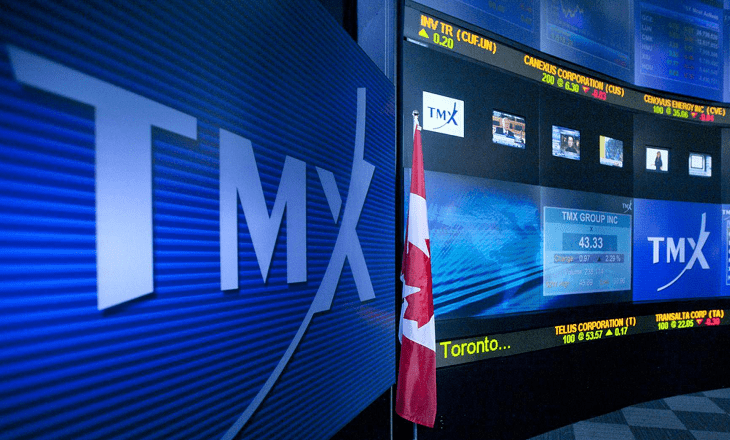

TMX Group, a Canadian financial services company that operates market exchanges including the Toronto Stock Exchange, and Paycase Financial, a value network and trustware provider for decentralized financial services, announces the first ever public cryptocurrency brokerage desk by a major exchange. The new brokerage service, Shorcan Digital Currency Network (Shorcan DCN), will first focus on bitcoin and ether. Full services will be available in Q2 2018.

Paycase Financial CEO Joseph Weinberg commented:

We are thrilled about this partnership between Paycase Financial and the TMX. As the first ever public crypto brokerage desk by an exchange, this deal represents the true institutionalization of cryptocurrencies as an asset class. This deal is significant in a number of ways. Firstly, it signifies what a flourishing startup community and a set of large institutions can do when they collaborate and work together to build the financial world of the future. Canada’s tight, cohesive startup scene, institutions and regulatory environment is a model for the world stage. And most importantly, it demonstrates that Canada is open for business.

Secondly, it shows how bitcoin and its counterparts are the bedrock of what markets, economies and the financial world in the not-too-distant future. This step further solidifies cryptoassets’ place in the modern economy. The world has barely begun seeing bitcoin’s utility. Bitcoin’s true utility will surface as institutional investors can truly incorporate the asset class in their strategies.

Paycase’s partnership with the TMX solved a major problem in the blockchain ecosystem. With this partnership, we have built the first major bridge between the crypto world and the traditional financial markets. This is just a taste of more things to come from the collaborative and tight-knit Canadian community as we build out more products for the world.

Across the Paycase group of companies, we focus on strategic projects in countries that require liquidity and critical market infrastructure. From identity and compliance standards, to liquidity, to consumer transaction infrastructure, Paycase builds and employs foundational frameworks that create global impact while maintaining market integrity.

We’re working with the best partners around the world to build technological innovations that are simple, affordable, flexible and secure, and will fulfill our vision for the new global economy.

Paycase and TMX’s partnership fulfills a global need for the ecosystem, providing liquidity and market infrastructure for the emerging asset class.